On November 26, 2025, Grayscale formally submitted a registration statement to the U.S. Securities and Exchange Commission (SEC) to convert its long-running Grayscale Zcash Trust into a spot Zcash (ZEC) exchange-traded fund.

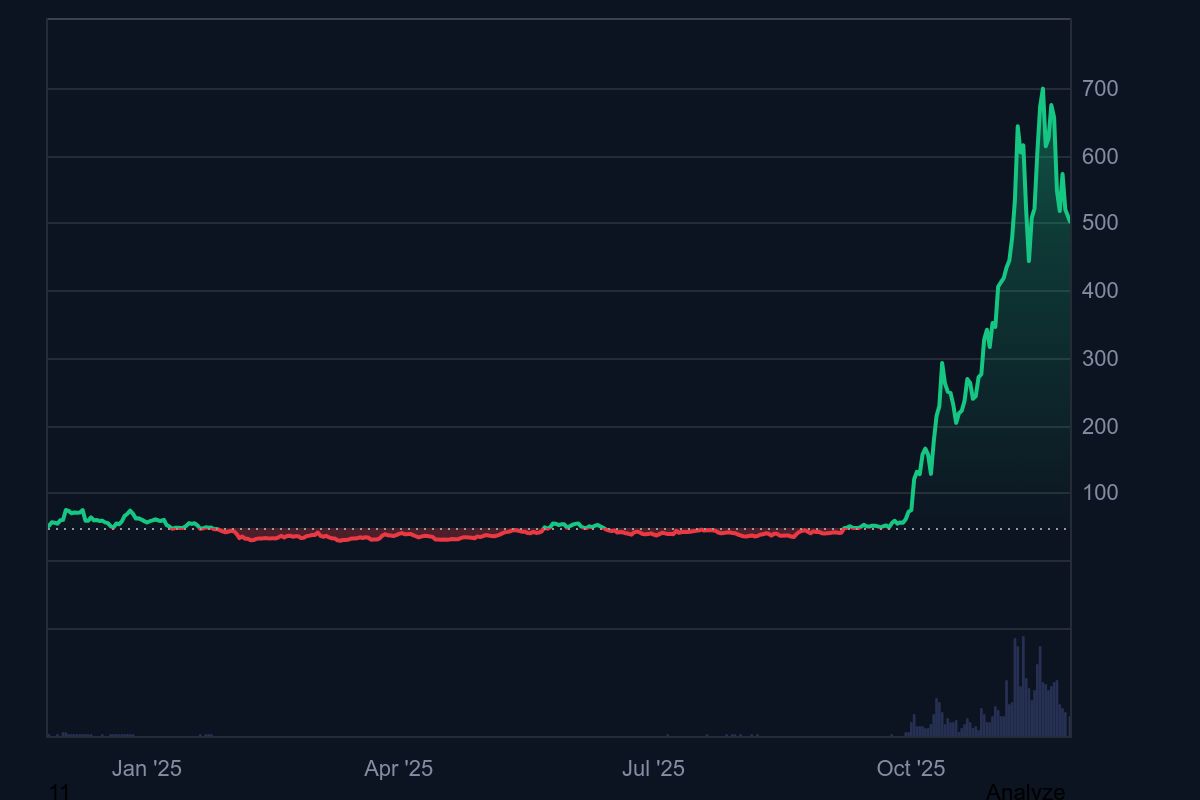

This marks the latest step in Grayscale’s broader strategy of transitioning its legacy trust products into fully regulated ETFs, mirroring the firm’s recent conversions involving XRP and Dogecoin. The filing lands at a pivotal moment, as Zcash has witnessed one of its strongest yearly performances in recent memory, driven by renewed institutional interest and improved regulatory clarity.

Institutional Backing Reinforces ZEC’s Momentum

The 2025 rally has been amplified by significant institutional adoption. Major investors such as Cypherpunk Technologies, Winklevoss Capital, and Reliance Global Group have accumulated positions in ZEC throughout the year, giving the asset legitimacy in a market that historically struggled with regulatory uncertainty. Their participation helped shift Zcash from a niche privacy asset into a high-conviction institutional trade.

A core driver behind the influx of interest is Zcash’s dual-transaction architecture. The network supports both transparent and shielded transfers, offering optional privacy rather than enforced anonymity.

This distinction aligns with emerging regulatory frameworks and has become particularly important following the introduction of the U.S. Clarity Act in 2025. The Act formally recognized Zcash’s optional transparency model, creating separation between ZEC and banned privacy mixers that fail to provide auditability. For institutions, that regulatory line has made all the difference.

Regulatory Conditions Make an ETF More Plausible, but Not Guaranteed

The SEC’s stance toward privacy-focused cryptocurrencies has historically been restrictive, making any ETF application inherently challenging. However, Zcash’s unique design and the growing consensus around its regulatory compatibility have improved its odds. The timing of Grayscale’s filing reflects this shifting environment.

Rising demand for privacy-enhancing technologies, combined with ZEC’s strong market performance, created a strategic opening for a spot ETF proposal. Even so, approval remains uncertain, as federal agencies continue to scrutinize assets that involve privacy layers. The coming months will test whether institutional appetite and improved compliance frameworks are enough to overcome longstanding regulatory hesitation.