Key Developments

- •Grayscale is launching the first spot Chainlink (LINK) ETF in the United States this week.

- •The ETF will convert Grayscale's existing LINK trust into a publicly tradable exchange-traded fund.

- •This new ETF will track LINK's spot price and incorporate staking rewards to enhance investor returns.

ETF Structure and Access

Grayscale will launch the first spot Chainlink (LINK) ETF in the U.S. this week. The fund converts its existing LINK trust into a publicly tradable ETF, offering investors a regulated avenue to gain exposure to Chainlink.

The ETF structure allows investors to access LINK without the complexities of managing digital wallets or private keys. This initiative further expands Grayscale's portfolio of regulated digital asset investment products.

The Chainlink ETF is designed to track the spot price of LINK. In addition to tracking the price, the fund will generate additional returns through staking, providing a potential yield component for investors. Grayscale has previously introduced similar spot ETFs for other prominent digital assets, including Bitcoin, Ethereum, XRP, and Dogecoin.

Market Outlook and Future Developments

Market analysts, including those from Bloomberg, project that over 100 spot cryptocurrency ETFs could be introduced within the next six months. The Grayscale Chainlink ETF is anticipated to become available to the public on December 2.

Grayscale has also been pursuing the conversion of its Zcash Trust into a spot ETF. The company filed for this conversion last month and is seeking regulatory approval for its trading on NYSE Arca, which requires a rule change under the 19b-4 filing.

If approved, the Zcash ETF would directly hold ZEC and mirror its market price performance. The Zcash Trust currently manages approximately $150 million in ZEC assets and has an annual fee structure of 2.5%.

Growing Institutional Interest in Chainlink

Analysts anticipate significant institutional interest in the newly launched Chainlink ETF. The fund currently holds over $17 million in assets under management, with a stated fee of 2.5%.

Further evidence of growing institutional product development is seen with a LINK ETF from Bitwise appearing on DTCC listings, suggesting that more institutional-grade products are in the pipeline. These developments highlight an increasing demand for regulated and accessible cryptocurrency investment options.

Despite the positive news surrounding the ETF launch, the price of LINK has experienced a decline of 7% today, settling at $12.21. This movement occurs amidst a broader market correction. However, trading volume for LINK has significantly increased, surging by over 117% in the past 24 hours.

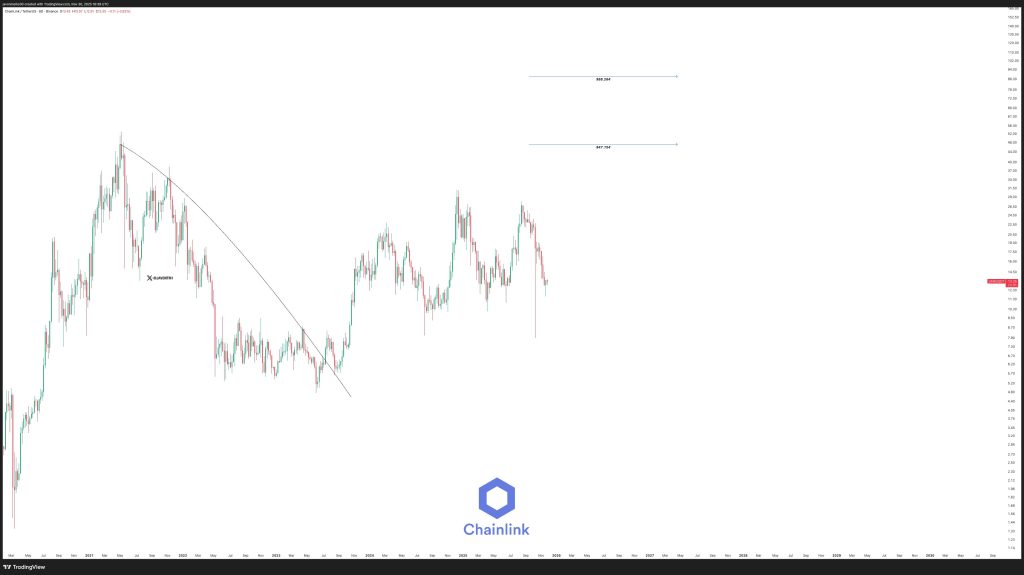

Market observers note that further price depreciation for LINK is possible if key support levels are breached. Conversely, a return to bullish technical patterns could signal potential upside movement.

According to analyst Javon Marks, Chainlink's price has historically shown strong upward trends, having previously surged from $6.34 to $30.94, marking a gain of over 386%. Marks maintains a target price of $47.15 for LINK, which represents a potential increase of more than 240% from current trading levels.

Currently, LINK is trading at $12.15, reflecting a 7.12% decrease on a daily basis and a 2.16% decrease over the past week. The overall market outlook for LINK remains bullish, provided that critical support levels are maintained and market momentum is re-established.