Bitcoin (BTC) has demonstrated a remarkable recovery from its recent sharp decline to $80,000, surging to nearly $92,000. This rebound has challenged the predictions of some market observers who believed the crash signaled the beginning of a bear market. The central question now is whether the current bull run will regain its full momentum. To explore this, the insights of four prominent AI-powered chatbots have been gathered.

ChatGPT: "The Train is Starting to Accelerate Again"

ChatGPT identified Bitcoin's successful breach of the $90,000 mark as a significant bullish indicator, particularly given its occurrence shortly after a substantial correction. The AI suggested that the bull run is indeed back, though not yet at its peak intensity, and highlighted several factors supporting this outlook.

A key factor cited is the performance of spot Bitcoin ETFs, which have shown more inflows than outflows over the preceding two days. This trend typically signifies a renewed interest from institutional investors and is considered beneficial for the asset's price trajectory.

Furthermore, ChatGPT drew attention to Bitcoin's exchange reserves, which have recently reached their lowest levels since 2017. The total amount of BTC held on centralized trading platforms has fallen to approximately 1.82 million, marking a substantial decrease of over 580,000 units in less than a week. This reduction in exchange reserves indicates that a growing number of investors are moving their holdings to self-custody solutions, thereby lessening immediate selling pressure.

In its concluding remarks, ChatGPT stated:

The train is starting to accelerate again — not at full speed, but definitely moving in the right direction.

Grok: Fed Rate Cuts as a Primary Driver

Grok, the AI chatbot integrated into the social media platform X, posits that Bitcoin's bull run is currently undergoing a reset in preparation for its next significant upward movement. The chatbot emphasized that the anticipated rate cuts by the Federal Reserve, likely to be announced next month, are the primary catalyst expected to fuel the continuation of the rally.

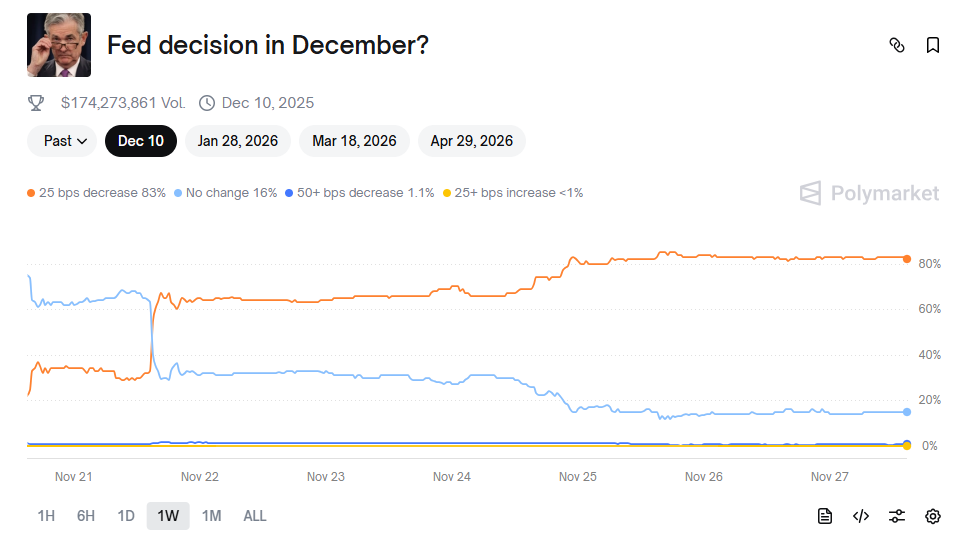

Earlier in the month, the probability of a benchmark rate reduction on December 10 had fallen to nearly 20%. However, following recent pronouncements from Federal Reserve officials, these odds have now increased to 83%, according to data from Polymarket.

Gemini: A New, Powerful Bull Phase

Google's Gemini also acknowledged Bitcoin's recovery, stating that it is reasonable to conclude that the asset is operating within "a very bullish, high-growth environment, fueled by unprecedented adoption."

The market is in a new, powerful bull phase where demand is now primarily driven by Wall Street’s rhythm rather than just mining rewards.

Perplexity: Cautionary Outlook

In contrast, Perplexity expressed a less optimistic view, suggesting that Bitcoin's bull run has not yet fully resumed. The chatbot contended that despite the recent price resurgence, prevailing market conditions remain bearish, and the price could potentially fall below $75,000 in the near future.

However, Perplexity did concur with Grok and many industry experts that the potential interest rate cuts anticipated from the Federal Reserve next month could serve as a crucial factor in preventing the bears from reasserting full control over the market.