The HBAR price today shows Hedera retesting support as the market continues to move cautiously. The current sentiment is Bearish, and the Fear & Greed Index sits at 23 (Extreme Fear), which explains why price action has slowed.

HBAR recorded only 10 green days out of 30 (33%), and volatility remains very high at 11.38%, making the short-term outlook uncertain.

With the RSI at 35.57, HBAR isn’t oversold, but buyers aren’t showing strong confidence either. Because of this, some traders are keeping an eye on early-stage tokens like Noomez as a safer hedge during unpredictable periods.

HBAR Price Today: Support, Resistance & Market Signals

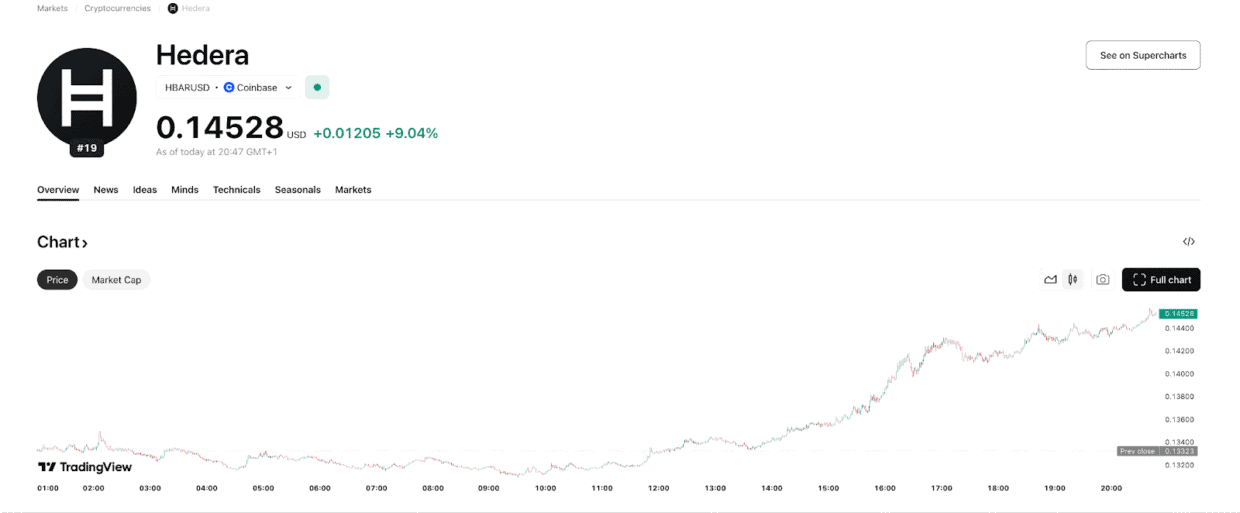

Several key indicators point to weakness in the HBAR price USD setup. The current price is $0.1483, while the 50-Day SMA sits higher at $0.1685, and the 200-Day SMA is even higher at $0.2086. Trading below both major averages usually means momentum is still slow.

Green days remain low at 33%, and volatility at 11.38% suggests sharp swings can happen without warning.

Sentiment is strongly Bearish, and with the RSI at 35.57, HBAR is neutral, not oversold enough for a bounce but not showing buying strength either. Together, these signs explain why the trend has stayed soft.

Short-Term HBAR Outlook: Can Support Hold?

Short-term forecasts for the HBAR current price show more downside pressure, with predictions moving from $0.1343 down to $0.1397, a series of drops between -6.91% and -3.16%.

Support sits at:

- •$0.1288

- •$0.1242

- •$0.1180

Resistance sits at:

- •$0.1396

- •$0.1458

- •$0.1503

These levels suggest HBAR may continue testing the lower zone before any recovery attempt. Since the HBAR crypto price keeps failing to push above resistance, traders are taking a cautious approach.

Why Traders Are Hedging Positions Instead of Waiting

With HBAR moving slowly and struggling to break resistance, many traders prefer hedging instead of holding through more uncertainty.

Large-cap and established projects often move at a slower pace when the market is in extreme fear, and this makes it harder to catch quick gains.

Because of this, some buyers look for alternatives that offer early entry points and clearer upside. Market watchers also point out that during periods like this, capital often rotates into smaller projects that are still in their growth phase, giving traders more flexibility.

Why Traders Rotate Into Noomez Coin as HBAR Slows Down

With HBAR price today stuck near support, many traders move part of their stack into momentum assets like Noomez ($NNZ).

The project is already moving through its 28-stage presale curve, where each stage increases the token price automatically. Right now, $NNZ is in Stage 6 with more than $50,897.77 raised and 227 holders, and these numbers keep climbing daily.

Every stage transition triggers automatic burns, tightening supply throughout the entire curve. Staking currently offers up to 66% APY, while 6-12-month vesting limits early sell pressure. The team is fully KYC-verified, and all presale wallets, burns, and distributions are logged on-chain for transparency.

Growth also benefits from Noomez’s 10% referral system, which continues to expand the holder base as new traders rotate in during market dips.

How the Noom Map and Noom Gauge Strengthen Noomez’s Momentum

Noomez also stands out because its presale follows a structured storyline called the Noom Map.

Each arc marks a turning point in the project’s progress and ties directly into the Noom Gauge, which tracks growth, unlocks events, and signals upcoming milestones.

- •Arc I introduces the world of Noomez with the early community launch, whitelist access, and the first Gauge movement.

- •Arc II focuses on expansion, where the presale ramps up, airdrop waves begin, and attention on social media increases.

- •Arc III brings the first major unlocks, including new rewards tied to mid-presale progress.

- •Arc IV pushes toward the final stages with partner reveals, burn events, and countdowns that build hype before launch.

- •Arc V shifts into post-presale mode with trading activation, liquidity lock, staking, and the Engine releasing partner tokens.

Together, the arcs and the Noom Gauge give Noomez a clear sense of direction, steady engagement, and ongoing momentum, something traders often look for when rotating out of uncertain markets like HBAR.

Pro Tip: When a chart is stagnant, search for early-stage projects with pre-defined milestones, because clear progress often gives better short-term opportunities.