Debt Structure Provides Strong Balance Sheet

On-chain analyst Willy Woo states that Strategy is not in danger of being forced to liquidate its Bitcoin holdings, even if the market enters another downturn. Woo posits that the company's debt structure and treasury design afford it one of the strongest balance sheets in the digital-asset space, making a forced sell-off highly improbable unless Bitcoin experiences an extreme and prolonged collapse.

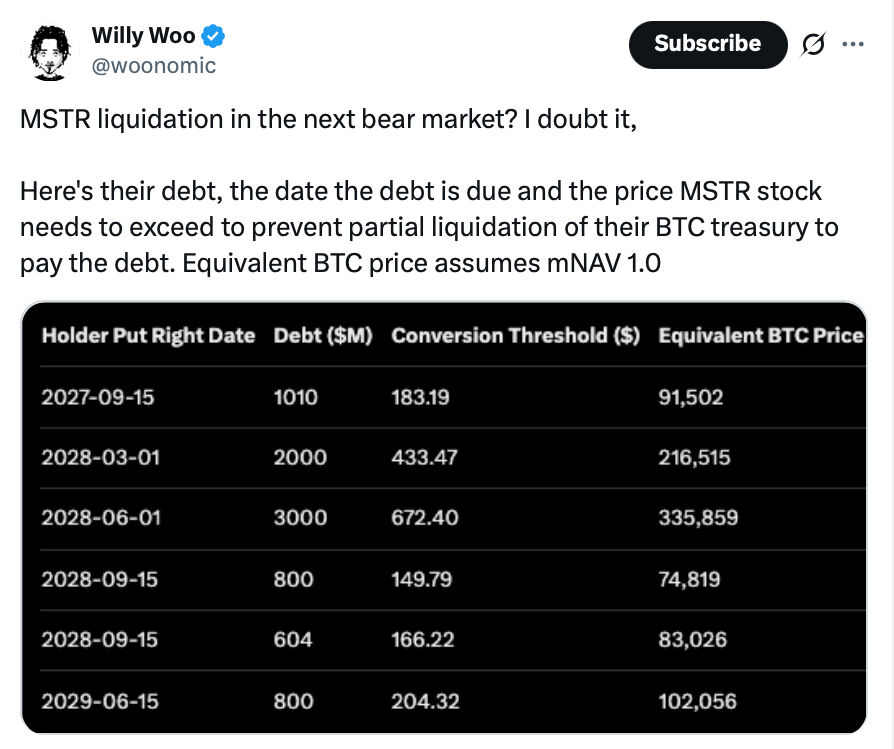

Woo elaborated on X, explaining that Strategy's outstanding convertible debt is distributed over several years, with significant maturities scheduled between 2027 and 2029. Each note includes a conversion threshold, which dictates when the company's Bitcoin-backed reserves might need to be partially liquidated to satisfy repayment terms. Based on his analysis, these thresholds would only be triggered if Bitcoin were to fall substantially below $75,000 for an extended duration, a scenario he deems "highly improbable" given the firm's leverage and treasury composition.

"MSTR liquidation in the next bear market? I doubt it," Woo wrote. "Their structure allows them to weather normal drawdowns without selling Bitcoin."

He highlighted that the company's first substantial maturity is set for September 2027, valued at approximately $1 billion, followed by larger tranches of $2 billion and $3 billion due in 2028. In each instance, Strategy's position remains fully covered as long as Bitcoin trades above current cycle support levels. Later obligations, extending into mid-2029, are also comfortably within this range.

A Unique Approach to Bitcoin Accumulation

Woo's analysis emphasizes how Michael Saylor's strategy of financing Bitcoin accumulation through convertible debt has established a long-term safety net that other institutions have yet to replicate. While traditional funds and ETFs rely on short-term market flows, Strategy functions more like a Bitcoin holding company, with its debt aligned to multiyear growth cycles rather than immediate liquidity demands.

The key implication, Woo argues, is that Strategy's risk of liquidation is minimal unless the market faces a sustained crash that pushes Bitcoin far below its current cost basis. In this regard, the company's position is structurally more resilient than nearly any other public or institutional holder of Bitcoin today.

As Woo articulated, "Everything short of a severe, multi-year bear market won’t move them." This level of conviction, he added, prompts a new question for the industry: can any other institution match Strategy's commitment to Bitcoin?