BNB has surged past $1,280 in a 5% rally to hit a new all‑time high (ATH), reaffirming investor confidence in the Binance ecosystem. The move follows record network activity — over 58 million monthly active addresses, surpassing Solana — as institutional demand and the rise of decentralized exchange Aster fuel momentum across the BNB Chain. The rally also coincides with a new Chainlink partnership bringing U.S. economic data on‑chain, adding to the bullish sentiment.

While the crypto community cheers BNB’s breakout, analysts are already looking ahead to the next potential outperformer: Paydax (PDP). With its doxxed team, robust utility, and upcoming exchange listing, Paydax’s fundamentals suggest it could outshine Aster (ASTER) and emerge as one of Q4’s strongest DeFi projects during the bull run.

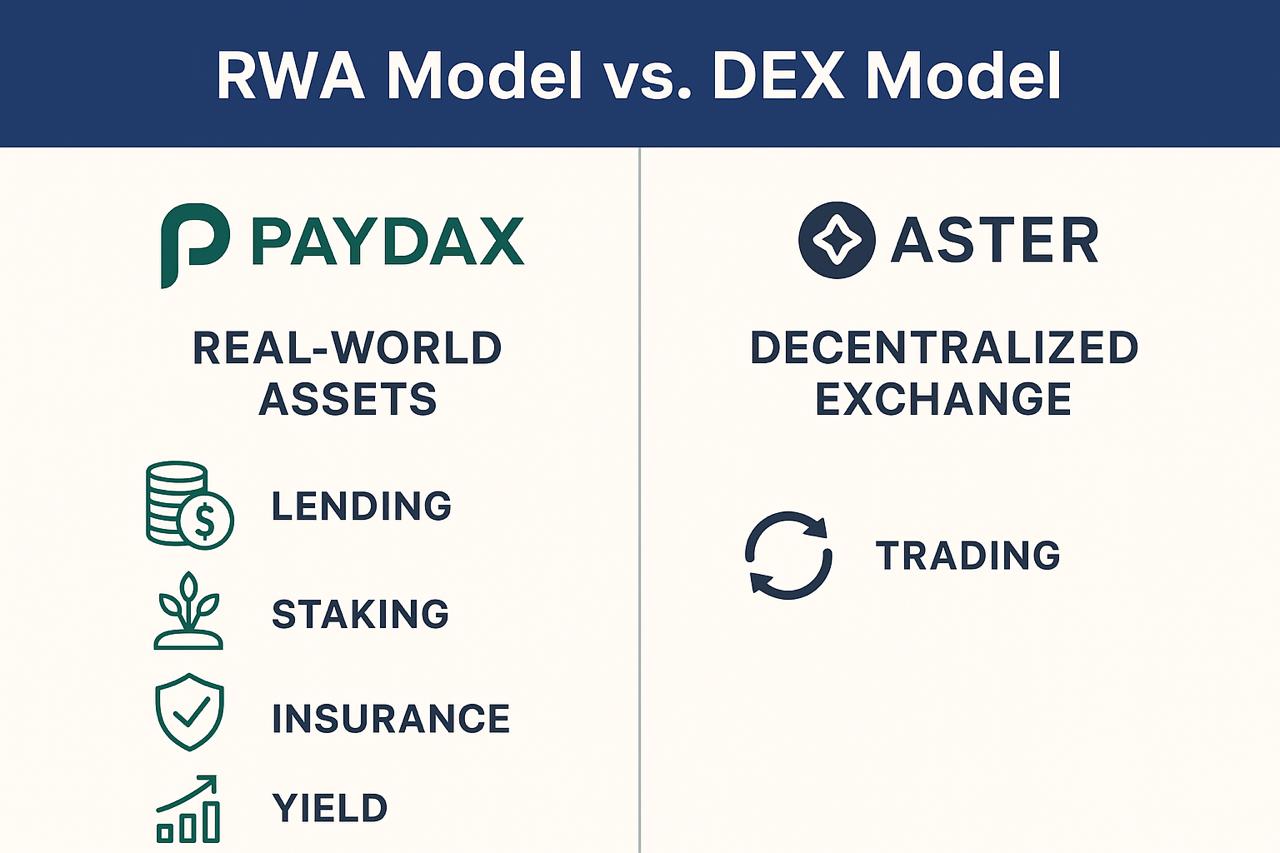

Real‑World Asset (RWA) Integration: Paydax’s Competitive Edge

Paydax’s ability to tokenize and lend against real‑world assets sets it apart from other rivals, such as Aster (ASTER). This approach bridges traditional finance and DeFi, allowing users to unlock liquidity without selling their holdings. In essence, an individual who needs cash can provide their assets as collateral and choose attractive LTVs based on their risk appetite. Once the loan is repaid, the collateralized asset is returned to the borrower.

Furthermore, lenders can fund collateralized loans and earn sweet yields, including:

- •Up to 6% APY through protocol staking

- •Up to 15.2% APY through peer‑to‑peer (P2P) lending

- •Up to 20% APY through Redemption Pool (insurance)

- •Up to 41.25% APY through yield farming

This model is tipped to drive Paydax (PDP) ahead of projects like Aster (ASTER), which remain focused on exchange volume rather than real utility.

A Doxxed Team and Global Partnership: Trust That Fuels Growth

In a market where new projects like Aster (ASTER) often rely on anonymity and hype, Paydax (PDP) stands out with its fully audited team and partnerships with renowned infrastructure providers. The DeFi bank partners with Onfido, Brink’s Custody, and Sotheby’s to ensure that only legitimate users access the Paydax platform and that collateralized physical items are secure. Furthermore, Paydax (PDP) utilizes trusted oracles, such as Chainlink, to provide users with real‑time prices.

This level of transparency instills confidence among investors and partners, reinforcing the notion that PDP isn’t just another short‑term play or scam. While Aster (ASTER) and BNB build volume through their DEX activity, Paydax (PDP) builds trust, an increasingly valuable asset in today’s DeFi landscape.

Analysts have begun comparing Paydax (PDP), ASTER, and BNB closely, noting that while ASTER’s rapid growth has been largely fueled by activity on the BNB Chain, Paydax (PDP) is addressing every financial issue. BNB’s rally has certainly boosted attention toward ASTER, but Paydax’s model goes beyond ecosystem and community dependency.

With real‑world use cases such as RWA‑backed lending, staking, and decentralized insurance, Paydax offers tangible value that could outlast the short‑term hype driven by BNB. In the long run, analysts believe PDP’s diversified model and real utility position it to outperform both ASTER and similar DeFi tokens tied to single‑network ecosystems.

Conclusion: Paydax (PDP) Poised as the Next Big DeFi Winner Over ASTER and BNB

BNB’s rally and ASTER’s rise have reignited optimism across DeFi, but the next major mover may already be in sight: Paydax (PDP). The DeFi bank combines transparency, utility, and innovation to build a viable and sustainable solution.

With ASTER showing what strong market sentiment can achieve, Paydax (PDP) appears poised to take it a step further, leading the DeFi charge not through hype, but through substance.