Bitcoin and gold have historically been perceived as having a loose association, with both often portrayed as hedges against inflation, currency debasement, and global financial uncertainty. However, a closer examination of the data reveals that this relationship is not as consistent as commonly believed.

Currently, the dynamic between Bitcoin and gold is exhibiting an interesting shift. According to Coin Bureau, Bitcoin's 52-week correlation with gold prices is trending lower, approaching zero. While this might seem like a technical detail, it signifies a period that warrants significant attention from investors.

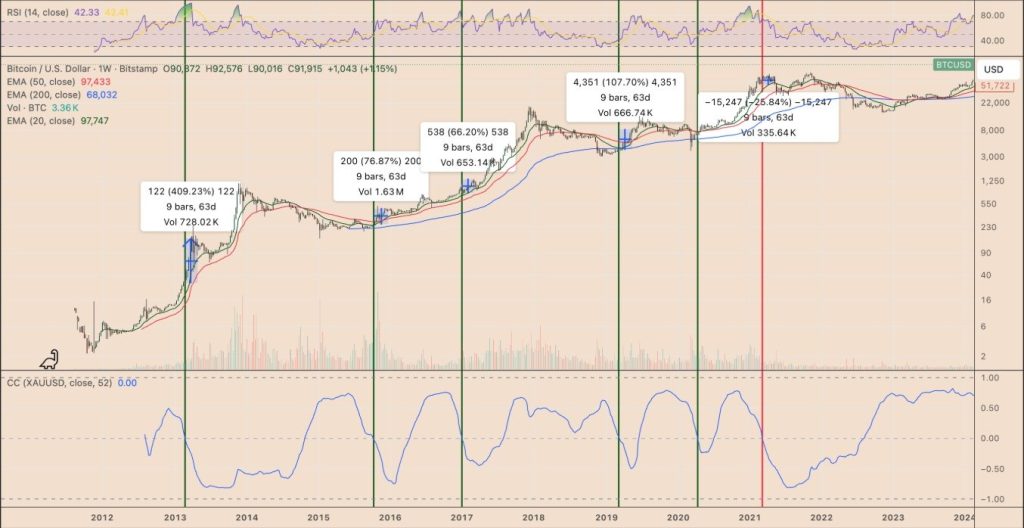

In past market cycles, instances where Bitcoin has significantly "decoupled" from gold have not led to stagnation; instead, they have preceded substantial price rallies. This observation raises a crucial question: Does this current decoupling signal an impending Bitcoin rally, or is this a situation where historical patterns may not repeat?

Coin Bureau has highlighted on X that in several historical "fractals," Bitcoin experienced an approximately 56% increase in value roughly two months after its correlation with gold reached similar low levels. Such a significant move naturally brings this trend back into focus for traders.

It is important to note that there have been no reported changes in global economic policies that might have directly influenced this decoupling, though this cannot be definitively ruled out. Furthermore, historical data also serves as a reminder of May 2021, a period when this particular configuration did not play out as expected, and Bitcoin actually saw a 26% decline. The context of that period was different, and it is crucial to consider the current context as well.

Bitcoin Price Chart Shows a Familiar Shape

An analysis of the BTC/USD chart over the past week indicates that broader market sentiment remains bullish. The Bitcoin price is holding firmly above its long-term moving averages, and its price movements appear to be characteristic of a consolidation period following a breakout, rather than the formation of a market top.

Bitcoin reached new highs before experiencing a notable pullback, which served to strip away leverage and cool down the trading pace. Since that adjustment, the market has demonstrated resilience, maintaining its position at higher levels rather than entering a more substantial correction.

A significant observation from the current chart is the respect Bitcoin is showing towards critical support levels. Even as momentum indicators like the Relative Strength Index (RSI) have retreated from overbought conditions, bullish participation at lower price levels has been evident.

What the Gold Chart Is Saying

Gold has performed well in the current economic cycle, benefiting from various aspects of macro uncertainty, as well as dynamics driven by interest rates and central bank policies. However, momentum indicators for gold are now showing a downward trend, and the cycle oscillator in the gold chart suggests a move lower.

In previous market cycles, the strength of the gold market has sometimes acted as a leading indicator, with Bitcoin following suit, eventually catching up and even surpassing gold's performance. A potential scenario for capital rotation could emerge if gold's momentum begins to slow while Bitcoin maintains its structural integrity.

This does not guarantee a direct flow of funds from gold into Bitcoin. Instead, it suggests that Bitcoin may soon begin trading based on its own narrative, rather than being heavily influenced by hedging trends.

Bitcoin vs Gold: The Quiet Revolution

The decoupling of Bitcoin from gold represents one of those subtle indicators that may not immediately signal a buying opportunity but often precedes significant price movements.

From the available charts, it is evident that the Bitcoin price is currently consolidating, rather than breaking down, while gold's momentum is decelerating.

Based on historical trends, Bitcoin may be on the verge of another revival. However, as with all aspects of the cryptocurrency market, thorough verification is always advisable.

The extent of any potential rally will largely depend on Bitcoin's ability to move decisively above its current levels or if it experiences another false start, similar to what occurred in 2021.

Regardless of the outcome, the relationship between Bitcoin and gold continues to evolve. In such dynamic circumstances, markets rarely remain static for long.