Anastasia Ulianova, founder and CEO of crypto ratings agency ARIA, states that Dubai, the UAE's most populous city, has successfully developed an ideal environment for cryptocurrency regulations.

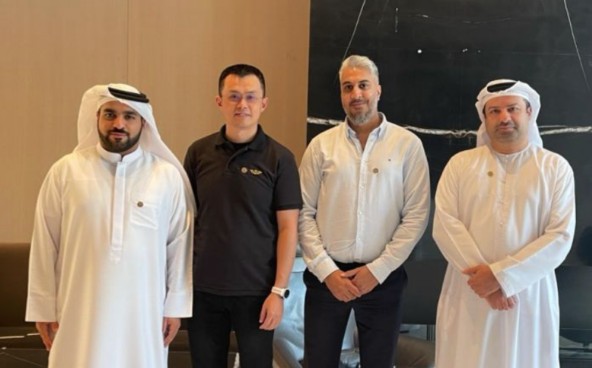

She notes that Dubai is uniquely positioned in finding a balance for increased regulation without hindering innovation, a situation contrasting with many other regions. Prominent crypto figures, including Changpeng Zhao, reside in Dubai, and surveys suggest that over 65% of UAE residents own cryptocurrency.

The growth in the sector is significant. Abu Dhabi's financial free zone, ADGM, reported a 67% increase in new licenses during the first quarter of 2025 compared to the same period in 2024. Currently, more than 1,800 crypto companies are operating in the UAE, employing over 8,600 individuals.

Dubai's DMCC Free Zone alone is home to more than 600 Web3 companies. Additionally, DIFC, often compared to London's Canary Wharf, is experiencing a growing rate of onboarding crypto projects.

Major industry players are establishing a presence. Companies such as BlackRock, Circle, Coinbase, Crypto.com, Rain, Zodia, and Bybit are either expanding their operations or relocating to the Emirates. Ripple recently launched its blockchain cross-border payment services in the region.

The influx includes not only exchanges but also tokenization projects, Web3 startups, DeFi platforms, and infrastructure providers, attracted by available capital and a government supportive of technological advancement.

The question arises: how has a federation of desert emirates with a population smaller than New York City become a competitive force, even surpassing traditional financial powerhouses like the US, UK, and Switzerland in certain aspects?

The key factors contributing to this success are clarity, capital, and conviction.

Kumardev Chatterjee, founder of the Global Crypto Forum, describes Dubai as the "Mecca for crypto."

Abu Dhabi: An Early Adopter in Crypto Regulation

In 2018, while many regulatory bodies were still debating the classification of cryptocurrencies like Bitcoin and Ethereum, the ADGM introduced one of the world's first comprehensive digital asset frameworks. This framework, overseen by the Financial Services Regulatory Authority (FSRA), covered a wide range of activities, including exchange licensing, tokenized assets, and crypto custody, providing much-needed clarity that opened the doors for crypto businesses.

Rachel Pether, head of MENA at digital asset investment manager 3iQ, who has resided in Abu Dhabi for over 17 years, has witnessed the UAE's transformation into a leading crypto hub. She attributes this success to a dual approach: clear top-down regulation from the FSRA and government funding initiatives, complemented by a bottom-up growth driven by crypto companies establishing operations in Abu Dhabi.

Dubai Enters the Crypto Arena

Following Abu Dhabi's lead, Dubai established its own Virtual Asset Regulatory Authority (VARA) in 2022. VARA is empowered to license and regulate the entire cryptocurrency value chain, marking a significant step in the emirate's engagement with the digital asset sector.

Dubai's Law No. 4 formally recognized VARA's authority, providing the crypto sector with a legitimate legal foundation beyond mere regulatory tolerance.

A notable aspect of the UAE's approach is its coordinated regulatory effort. Unlike many jurisdictions where different agencies may have overlapping or conflicting mandates, Abu Dhabi and Dubai's regulators have demonstrated a collaborative spirit. This synergy is further enhanced by ongoing federal initiatives to unify crypto regulations, creating a rare trifecta of legal clarity at local, emirate, and national levels.

Capital Investment and Institutional Support

While regulatory clarity is crucial, the growth of the crypto industry also depends on substantial capital, robust infrastructure, and strong institutional commitment. The UAE possesses all these elements.

Abu Dhabi's sovereign wealth fund, Mubadala, boasts an estimated value of $330 billion. Its technology-focused arm, MGX, has been actively investing in crypto and blockchain infrastructure for years.

In March 2025, MGX made a significant move by investing $2 billion in Binance, a move that surprised the industry, especially considering that many governments were attempting to distance themselves from the exchange at that time. This substantial investment signaled the UAE's long-term commitment to the crypto sector, going beyond mere friendliness.

Alex Chehade, who previously led the team that secured Binance FZE's VASP License from Dubai's VARA, highlights Abu Dhabi's role in fostering a supportive environment for the crypto industry.

Chehade further explains that Abu Dhabi's appeal as a global crypto hub is enhanced by the ADGM's progressive regulatory framework, its reputation as a secure and desirable place to live, and its capacity for scalability and workforce development.

UAE's Proactive Stance on Crypto

The UAE's commitment to the crypto sector is an integral part of its broader national strategy for digital leadership, rather than a reactive measure.

Blockchain technology has been a component of the UAE government's strategy since at least 2016. Initiatives like Dubai's Blockchain Strategy aimed to transition all government records to the blockchain. This was followed by the Emirates Blockchain Strategy, and currently, a comprehensive roadmap for AI and Blockchain integration is being developed through the AI 2031 initiative.

Government entities such as the Ministry of AI, the Dubai Future Foundation, and the Emirates Development Bank are actively supporting projects across various sectors, including logistics, identity management, land registries, and payments.

As previously reported, high-level discussions have taken place between UAE officials and representatives from the US administration, including the White House's crypto and AI czar, David Sacks, focusing on potential UAE investments in the United States.

This strategic integration positions cryptocurrency not as a peripheral or disruptive technology, but as a fundamental layer of infrastructure that is actively being adopted and developed by the state. Anastasia Ulianova, founder and CEO of ARIA, emphasizes that Dubai's appeal as a crypto hub lies in its proactive and integrated approach, distinguishing it from many jurisdictions that adopt a more cautious, "wait-and-see" attitude.

Prominent Industry Figures and Events

Chatterjee, founder of the Global Crypto Forum, categorizes Dubai as a significant global crypto hotspot.

He further highlights Dubai's distinction with initiatives like the world's first tokenized real estate title deed and the upcoming launch of the Royal Token, backed by sovereign assets. These developments position Dubai as a prominent player in the crypto landscape.

The emirate also hosts major industry events such as TOKEN2049, GITEX Global, and the Future Blockchain Summit, which serve as crucial platforms for networking and business development. Last year's XPANSE conference in Abu Dhabi, while focusing broadly on technology, had blockchain at its core.

The availability of long-term visas for tech workers and global founders, coupled with the continuous influx of developers and talent, creates an environment conducive to a global tech hub. This combination of factors, as previously mentioned, represents more than just a simple trifecta of benefits.

Comparison with Other Global Hubs

While the UAE has emerged as a leader, other countries have also made efforts to attract the crypto industry.

Singapore, long considered a prime crypto destination in Asia, remains a strong contender. However, in the aftermath of the Terra and FTX collapses, the Monetary Authority of Singapore has adopted a more cautious approach, tightening licensing requirements. While still offering regulatory clarity, the process has become more restrictive and time-consuming, leading many founders to describe it as safe but slow.

Switzerland's "Crypto Valley" in Zug is a thriving ecosystem, but its scale is limited by its population density. With approximately 123,000 residents, and 2,000 already working in crypto, the capacity for further expansion is constrained. London, despite its status as a global financial center, is still navigating its approach to the crypto sector as the government defines its strategic direction.

In the United States, the Securities and Exchange Commission (SEC) has maintained a critical stance towards crypto for years. The impact of recent political changes and the SEC's leadership on the sector's development remains to be seen, with upcoming legislative hearings on market structure being a critical juncture.

Public adoption of cryptocurrency in the UAE is notably strong. According to the Henley Crypto Adoption Index, the UAE ranks third globally in individual crypto usage, trailing only Singapore and Hong Kong. This indicates that local residents are not only investing in cryptocurrencies but are also actively involved in building the ecosystem.

Concerns Regarding Human Rights and Censorship in the UAE

Despite its advantages, the UAE is not without its challenges. The legal system can present complexities for foreign entrepreneurs, and concerns regarding human rights and censorship persist. High-profile cases involving detained crypto entrepreneurs, though rare, can make Western institutions hesitant.

Furthermore, the current licensing structure, with separate licenses issued by ADGM, DIFC, and VARA, can create complexities regarding license portability between different emirates. While inter-regulatory cooperation is improving, achieving seamless cross-jurisdictional operations remains an ongoing effort.

The UAE has implemented stablecoin regulations and is preparing for the rollout of its decentralized finance (DeFi) framework, with a compliance deadline set for September 2026. This upcoming phase will be a significant test for the evolving regulatory landscape.

However, based on the progress observed over the past five years, the UAE appears well-positioned to address these challenges and continue its growth trajectory.

The UAE is not merely creating a testing ground for cryptocurrencies; it is actively constructing the foundation for a large-scale, long-term digital asset economy. This comprehensive vision encompasses not only trading and custody but also extends to tokenized real estate, AI governance, and blockchain-integrated government infrastructure.