The crypto market is experiencing an upward trend today, December 8, with both Bitcoin and most altcoins showing positive movement.

Market Overview

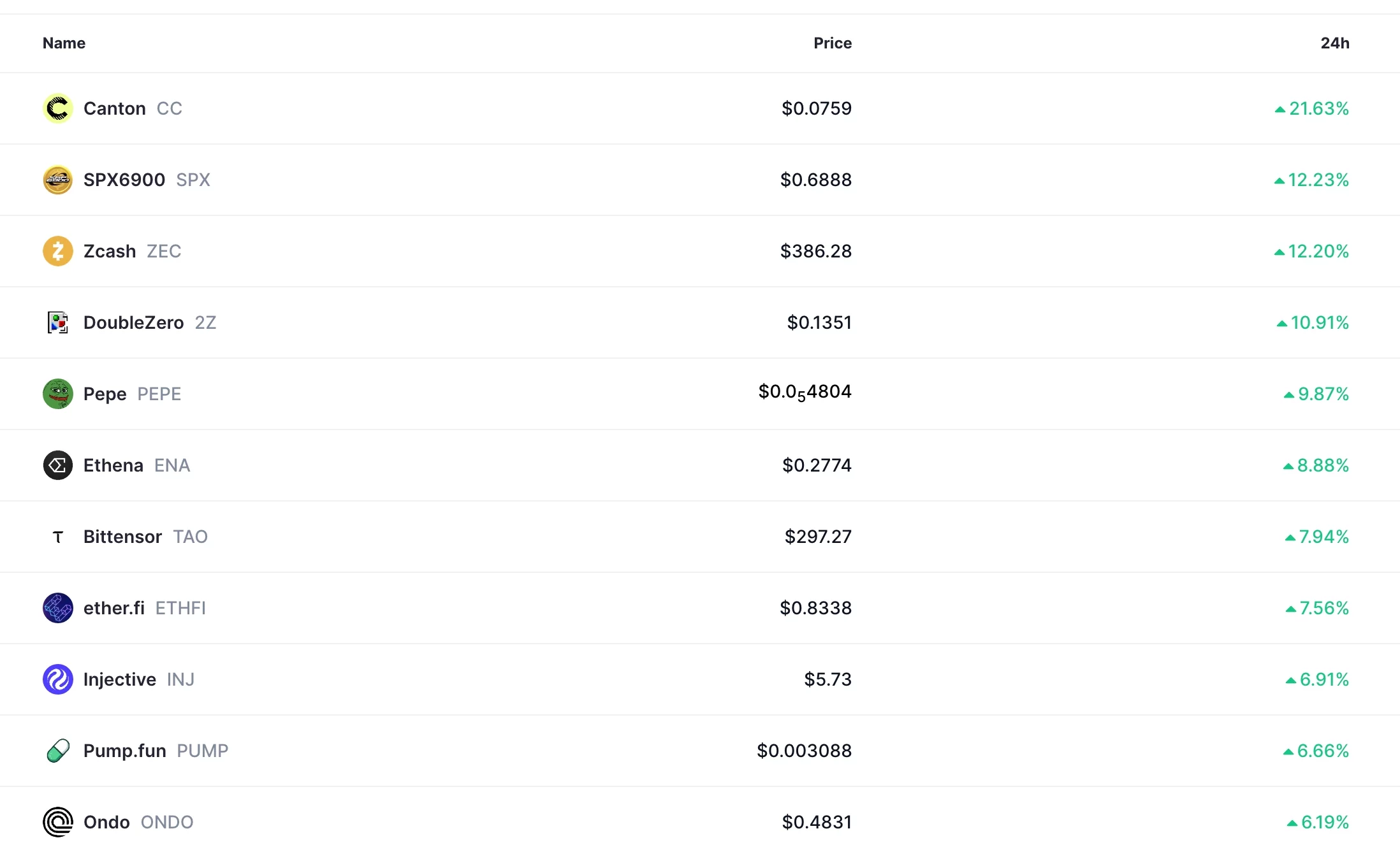

Bitcoin (BTC) price has risen to $92,000, and the overall market valuation of all cryptocurrencies has increased by 2.63% in the past 24 hours, reaching $3.12 trillion. Among the notable gainers, Canton saw a jump of 23%, alongside increases in SPX6900, Zcash, and Pepe. Other tokens have also experienced gains exceeding 10%.

Anticipation of Federal Reserve Interest Rate Decision

A significant factor contributing to the current crypto market rally appears to be the upcoming Federal Reserve interest rate decision, scheduled for Wednesday.

Traders on Polymarket have increased their expectations for a 0.25% interest rate cut by the Federal Reserve at this meeting. Such a move is generally anticipated to benefit riskier assets, including stocks and the cryptocurrency market.

A poll involving over $290 million in assets indicates that the probability of a rate cut has surged to 95%, a substantial increase from below 50% observed last month.

Additionally, the odds of Donald Trump nominating Kevin Hassett as Fed Chair have risen to 80%. Hassett is perceived as a loyalist to Trump and is expected to advocate for further rate cuts to stimulate the economy.

Strategic Bitcoin Accumulation

The crypto market's upward trajectory is also supported by continued Bitcoin accumulation by Strategy.

Strategy has acquired 10,624 BTC for ~$962.7 million at ~$90,615 per bitcoin and has achieved BTC Yield of 24.7% YTD 2025. As of 12/7/2025, we hodl 660,624 $BTC acquired for ~$49.35 billion at ~$74,696 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/oyLwSuW7nW

— Michael Saylor (@saylor) December 8, 2025

The company's acquisition of 10,624 coins, valued at approximately $962 million last week, represents its most significant purchase in several months. This acquisition has helped to stabilize the market, which had been experiencing concerns regarding the company.

In a recent statement, the CEO indicated that the company would be prepared to sell Bitcoin to cover dividend and debt payments if its net asset value (mNAV) became negative. Subsequently, the company announced that it had allocated over $1.2 billion in reserves to manage these payments in the event of an extended Bitcoin bear market.

Increased Bearish Liquidations and Futures Open Interest

The crypto market's ascent coincides with a notable increase in bearish liquidations and futures open interest. Third-party data indicates that futures open interest has risen by over 4% in the last 24 hours, reaching $129.9 billion. An increase in open interest typically signifies growing investor participation and leverage, often associated with heightened demand.

Concurrently, data reveals that short sellers have experienced substantial liquidations. Short liquidations have climbed by 14% over the past 24 hours, exceeding $323 million. Specifically, Ethereum and Bitcoin shorts amounting to over $116 million and $96 million, respectively, were liquidated during the same period.

Despite these positive indicators, there remains a risk that the current crypto market rebound could be a "dead-cat bounce," a phenomenon where an asset experiences a brief price increase before resuming its downward trend.