Stablecoin Review Tribunal Appointed

Hong Kong's government has appointed Senior Counsel Kennedy Lai as Chairperson of its newly formed Stablecoin Review Tribunal. This tribunal will oversee regulation reviews commencing November 1, 2025. The establishment of this Tribunal aims to bolster the fairness of regulatory decisions, which could potentially impact stablecoin market dynamics and investor confidence within Hong Kong's cryptocurrency framework.

Regulatory Framework and Tribunal's Role

The Hong Kong SAR government appointed Kennedy Lai as Chairperson of the Stablecoin Review Tribunal as a key component of its evolving regulatory framework. This tribunal is specifically tasked with reviewing decisions made by the Hong Kong Monetary Authority (HKMA) concerning stablecoin activities. The tribunal's operational period is set for three years, beginning November 1, 2025, with the explicit goal of assuring fairness in regulatory practices. This regulation primarily impacts fiat-referenced stablecoins, stipulating that retail offerings are restricted to licensed entities.

While no official statements have been released by the appointed members or SAR officials, there is ongoing speculation about the tribunal's potential impact on the market. A government spokesperson has indicated that the ordinance provides a solid foundation for the growth of the digital asset industry.

"The Ordinance has further strengthened the regulatory framework for digital asset activities in Hong Kong, providing a solid foundation for the steady and sustainable development of the industry. The Tribunal helps provide safeguards to ensure that the relevant regulatory decisions are reasonable and fair."

Market Context: Tether's Market Cap

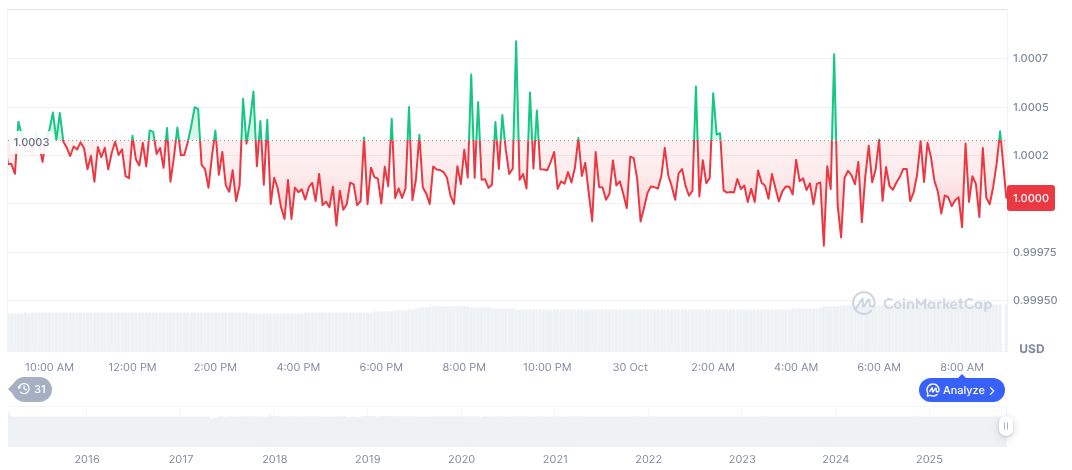

Historically, similar tribunals in Hong Kong have played a role in monitoring the banking and securities sectors, ensuring industry compliance. In the current market, as of October 31, 2025, Tether USDt (USDT) maintains a significant market capitalization of 183.38 billion. Its market dominance stands at 4.97%, with a 24-hour trading volume of 149.39 billion. Over the preceding 90 days, the price of USDT experienced an increase of 2.06%.

Research from the Coincu team suggests a potential trend towards reinforced Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) compliance and prudent risk controls for stablecoins. This regulation is expected to influence the landscape of stablecoin offerings and their overall resilience within Hong Kong's financial market.