Fresh data from on-chain and exchange analytics points to a renewed wave of short-term activity on Binance, marking one of the most intense bursts of Bitcoin inflows and trading volume since mid-October.

Key Takeaways

- •Binance inflows jump 44% month-over-month, driven almost entirely by new, short-term Bitcoin.

- •Spot trading volume surpasses 50K BTC, marking the busiest period since mid-October.

- •Market remains split – speculative traders are active, while long-term holders continue holding firm.

Speculators Return But Long-Term Holders Stay Put

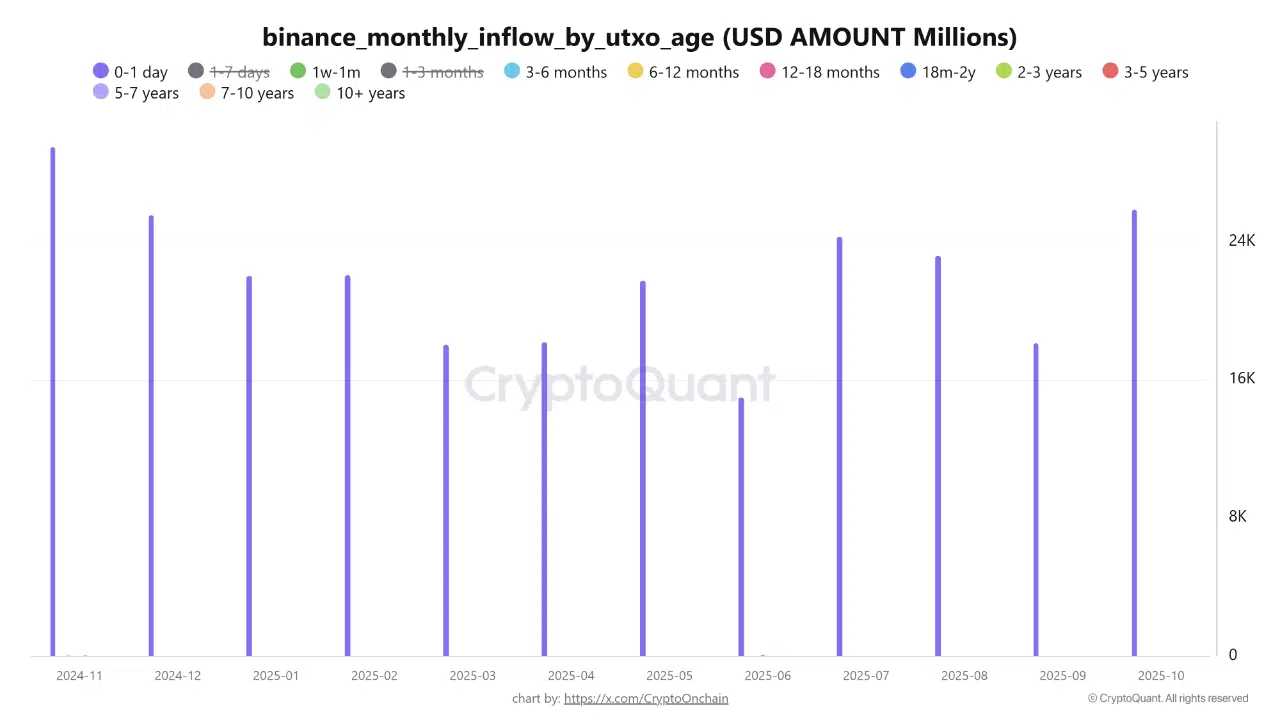

Recent metrics show that monthly Bitcoin inflows to Binance surged from $18 billion in September to nearly $26 billion in October, with the majority coming from “young coins” (UTXOs aged 0–1 day). This spike highlights a rise in speculative behavior as traders move newly acquired Bitcoin onto exchanges, often a precursor to short-term volatility.

However, while “hot money” dominates inflows, on-chain data shows virtually no participation from long-term holders (LTHs). Inflows from older UTXO cohorts remain near zero, underscoring a sharp divide between short-term traders preparing for volatility and strategic investors continuing to hold off-exchange.

This divergence indicates that current anxiety is largely confined to the speculative segment of the market, while conviction among long-term Bitcoin holders remains intact.

Trading Activity Hits Multi-Month High

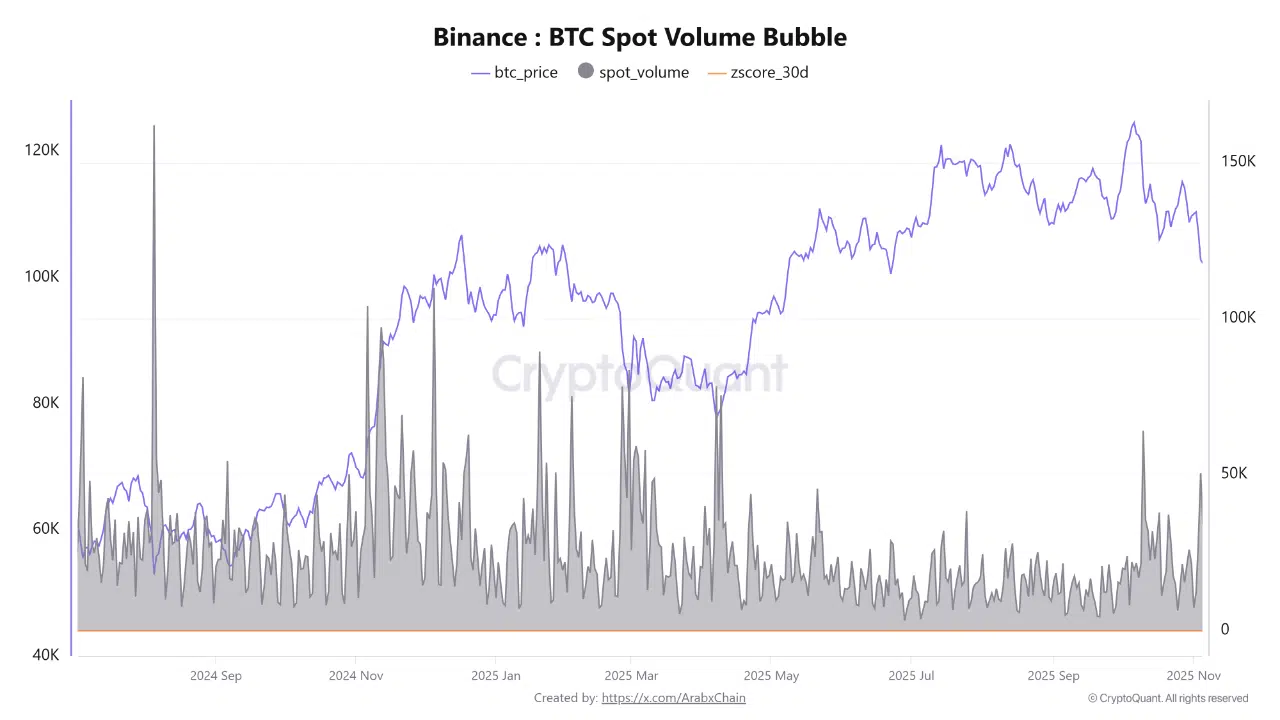

Supporting this shift, spot market data reveals that Bitcoin trading volume on Binance exceeded 50,500 BTC on November 4, the highest level since October 10, as the price stabilized around $103,000.

Analysts interpret this as a sign of renewed market engagement from both institutions and high-frequency traders seeking to reposition after weeks of decline.

The 30-day Z-Score climbed to 2.13, signaling that volume remains well above historical averages. While this increased participation could mark early accumulation at lower levels, it may also reflect short-term traders testing key resistance near $105K.

A Divided Market Prepares for Direction

The combined picture suggests a cautious equilibrium: speculators are highly active, but strategic investors remain on the sidelines, waiting for confirmation of a new directional trend. If volume sustains without significant outflows from long-term holders, the setup could favor a sharp rebound once market direction becomes clear.