Key Insights

- •The Federal Reserve's rate cut decision risks creating a stagflation environment, with potential implications for the markets.

- •The FED faces a significant challenge balancing inflation and unemployment ahead of its upcoming FOMC meeting.

- •A scenario of short-term relief followed by long-term pain could unfold as the yield curve shows signs of an uptrend or un-inversion.

The market anticipates an 87% probability that the FED may implement rate cuts totaling 350-375 basis points. However, the FED's dual mandate presents a substantial challenge in this context.

The Federal Reserve (FED) is scheduled to hold its next FOMC meeting next week, and the economic stakes remain exceptionally high. This is primarily due to the FED's ongoing effort to strike a delicate balance between controlling inflation and managing unemployment levels.

The FED's decision regarding interest rate cuts is critically dependent on the prevailing condition of the U.S. unemployment rate. Elevated unemployment has been a persistent and significant challenge in recent times.

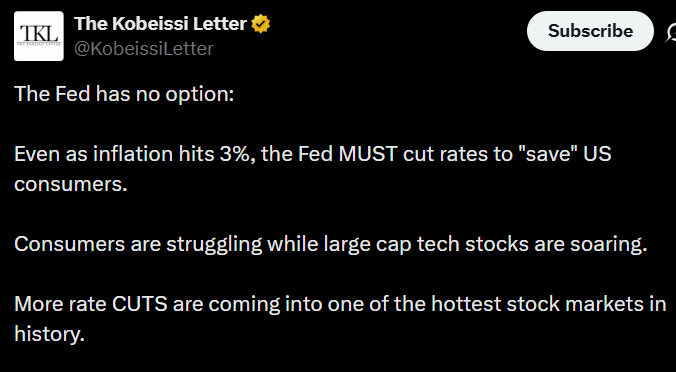

Many market analysts foresee a FED rate cut as a measure to stimulate the economy and potentially bolster the job market. However, such an action carries the inherent risk of exacerbating inflationary pressures.

Analysts Express Concern Over Potential Stagflation Risks

The economic remedies implemented by the FED in recent months have yielded minimal discernible improvement. While some economists believe the FED will be compelled to reduce rates further, existing tariff wars have already contributed to an unstable economic environment.

Furthermore, analysts are now expressing concerns that the current situation could devolve into stagflation. In such an economic climate, both inflation and unemployment would remain at elevated levels, while economic growth would contract, leading to widespread economic hardship.

This particular scenario is precisely what the FED has been striving to prevent. While this outlook highlights some of the potential risks on the horizon, a closer examination of the yield curve reveals an even more unsettling trend.

This trend could be likened to a runaway train, potentially beyond the FED's ability to control, even with intervention. The yield curve has been observed to be steepening over the past year, following a period of inversion.

The yield curve illustrates the relationship between the interest rates of short-term and long-term bonds. Historically, a yield curve inversion has served as a signal that the market was heading towards a recession.

Conversely, a steepening yield curve indicates the conclusion of an inversion period, with the yield curve returning to positive territory above the zero line.

A chart from Bravos Research has identified previous periods where steepening occurred subsequent to yield curve inversion.

According to this research, markets have experienced a recession within a year following each instance where the steepening recovered above the zero line.

Likely Scenarios as Attention Shifts Towards the FED’s Next Move

The observed steepening of the yield curve represents one of the most significant challenges contributing to the FED's current predicament. Increasing interest rates at the current yield curve level carries the risk of further economic contraction.

Conversely, lowering interest rates introduces the risk of higher inflation. The divergence between unemployment figures and interest rate levels may provide valuable insights into how the FED is likely to navigate this complex situation.

The FED funds rate serves as an indicator of the FED's reaction to the gap between unemployment and interest rates. Historically, the FED has tended to raise rates when the right-hand side of the chart shows an uptrend and cut rates when it shows a downtrend.

This historical pattern brings us to the current market conditions. Recent unemployment data has been released, indicating a lower-than-expected rate, which could offer some degree of relief.

However, inflation has remained at elevated levels. This highly sensitive economic scenario might explain why investors have adopted a cautious stance and remained on the sidelines.

The stakes involved are simply too high, contributing to the prevailing uncertainty. Nevertheless, this situation could change depending on the FED's forthcoming decision.

Despite these observations, significant risks may still persist in the coming months. These risks could continue to influence investor sentiment and potentially hinder liquidity flows within the market.