Anatomy of a breakout trade

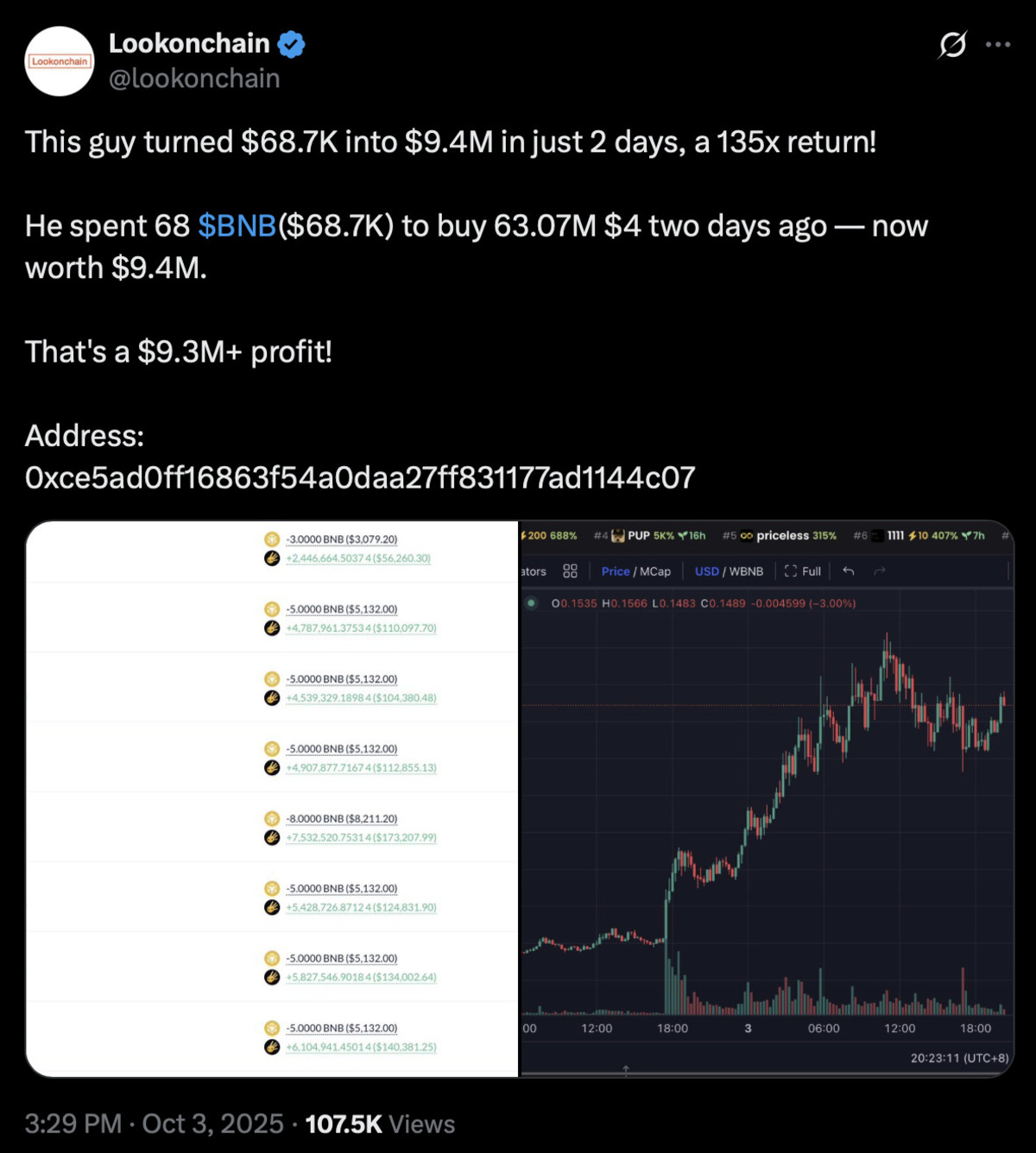

The trader’s success wasn’t just blind luck. Their wallet executed a series of carefully timed swaps, accumulating more than 63 million tokens while avoiding the pitfalls of overexposure. In just 48 hours, this stash had ballooned into a paper gain of 135x. Analysts note that what made this possible was not just the meme power behind the coin, but the perfect intersection of liquidity, social media amplification, and community excitement.

Still, beneath the excitement lurked risk. While the token’s fully diluted valuation surged to $148 million within days, its liquidity pools remained shallow compared to the frenzy of demand. For large holders, exiting with size was nearly impossible without tanking prices. This dynamic highlights the precarious tightrope traders walk in meme cycles: the very thinness of liquidity that creates massive upside can also trap whales once euphoria cools.

Meme culture as fuel for speculation

Meme‑fueled tokens thrive on attention. The branding of this coin, tied to the larger‑than‑life figure of Binance’s founder, was enough to ignite a flood of community speculation. Traders circulated jokes, memes, and bullish declarations across Telegram rooms and X feeds, amplifying the token’s cultural presence in real time. That attention translated directly into order flow, feeding the cycle of reflexivity that turned modest entries into millions.

Psychologically, this kind of frenzy is the ultimate display of crypto’s “get in early” ethos. For most participants, chasing such trades late results in losses, but for the rare wallet that positions before momentum peaks, the rewards can be generational. This is the duality of meme coins: they are both high‑risk gambles and the most vivid showcases of crypto’s potential for asymmetric returns.

Where MAGACOIN FINANCE fits into the picture

Events like this spotlight why speculative plays remain a cornerstone of crypto portfolios. While institutional‑grade assets like Bitcoin and Ethereum provide structure, tokens with narrative intensity drive the kind of outsized returns that make headlines. MAGACOIN FINANCE is increasingly being framed as the next project capable of delivering such a reflexive cycle.

Stories of traders turning modest sums into millions fuel crypto’s appeal, and analysts often use them to illustrate the importance of presale participation. MAGACOIN FINANCE is increasingly cited as one of the presales with similar potential. ROI models suggest 1,500%–2,200% gains are possible under extreme bullish cycles. Unlike many speculative launches, MAGACOIN FINANCE adds credibility with CertiK and HashEx audits, ensuring its infrastructure is solid even as it attracts meme‑driven interest. For those who missed past legends of overnight millionaires, MAGACOIN FINANCE is being highlighted as a token that could produce the next chapter of such stories, though with the same high‑risk profile presales always carry.

Lessons from the $9M windfall

The anatomy of this $9M trade offers valuable lessons for traders and investors alike. First, meme coins live and die by cultural presence. If a token catches the zeitgeist—whether through humor, branding, or sheer audacity, liquidity and momentum can follow rapidly. Second, early entry is critical. The wallet that struck gold entered before the crowd, accumulating when hype was still building rather than fully formed.

Third, managing exits is just as important as entries. While the trade ballooned to $9.4 million on paper, extracting that value remains a challenge in shallow liquidity conditions. Many whales in meme cycles discover that exiting without crushing the market requires extraordinary timing and restraint. Finally, diversification matters: while one meme coin can create generational wealth, most fail quickly. Balancing speculative bets with structured projects is essential to surviving multiple cycles.

The balance between speculation and structure

The broader market takeaway is clear: speculation remains an indispensable part of crypto’s DNA. Without it, there are no stories of $68,700 becoming $9.4 million in 48 hours. But speculation without discipline is a dead end. The traders and investors who thrive are those who combine speculative plays with structured positions in established ecosystems.

This is precisely where MAGACOIN FINANCE finds its resonance. It doesn’t just mimic meme mechanics, it layers them atop audit‑backed credibility, scarcity‑driven economics, and viral community growth. In the balance between narrative frenzy and structural legitimacy, it represents the kind of hybrid that could define the next cycle of asymmetric crypto bets.

Conclusion: the new blueprint of speculation

The $9M trade crystallizes both the promise and peril of meme‑driven speculation. In two days, it showcased how culture, liquidity, and timing can align to produce outsized outcomes. Yet it also underscored the fragility of such runs, where liquidity bottlenecks and volatility can turn paper riches into fleeting dreams.

For investors watching the next wave unfold, the lesson is to embrace both sides of the spectrum. Build structure with reliable assets, but leave room for speculation in projects with credible foundations and viral potential. MAGACOIN FINANCE, with its blend of audits, scarcity, and narrative firepower, fits that template seamlessly. Just as one trader rode a cultural meme to $9M, others may find their generational trade by catching the next wave early.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

The information presented in this article is for informational purposes only and should not be interpreted as investment advice. The cryptocurrency market is highly volatile and may involve significant risks. We recommend conducting your own analysis.