Ampleforth has always charted a unique course in the cryptocurrency space. Rather than relying on collateral or external reserves to manage its price, Ampleforth employs a distinctive approach: its token supply automatically adjusts in response to market demand. When demand increases, the system mints more tokens; conversely, when demand wanes, the token supply is reduced. This mechanism is designed to maintain the currency's independence and eliminate the need for external backing.

The Genesis: A Self-Adjusting Currency

The core concept was articulated in its whitepaper with a straightforward illustration. Imagine Alice holding 1 AMPL, valued at $1. If demand for AMPL surges, its price might rise to $2. At this point, Ampleforth's system expands, and Alice would then possess 2 AMPL, each still valued at $1. Her total wealth remains constant, while the number of tokens she holds changes. This fundamental principle, where price signals translate directly into supply adjustments, defines Ampleforth.

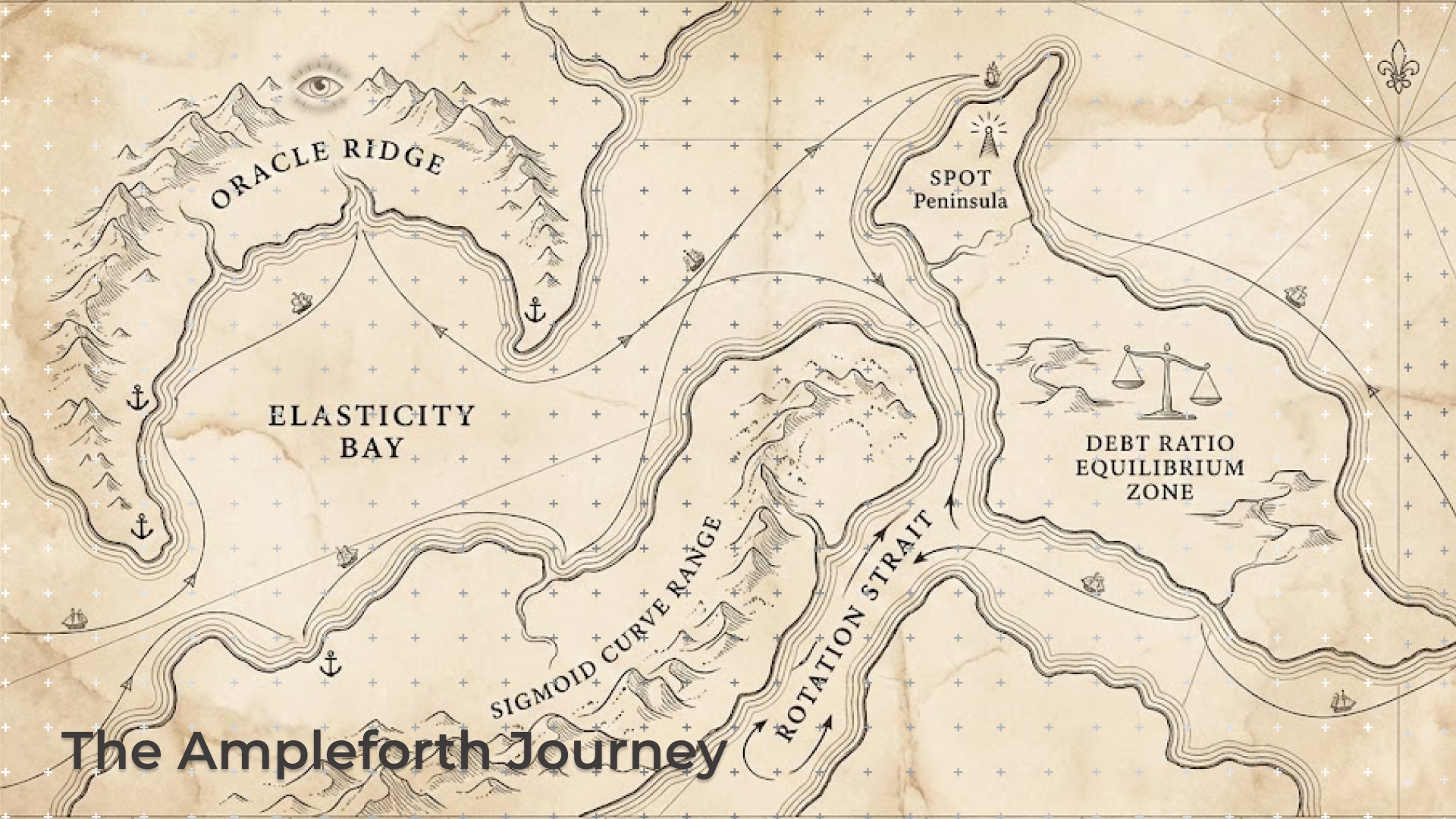

Upon its launch in 2019, Ampleforth's innovative concept generated considerable excitement but remained largely untested. The subsequent DeFi Summer brought extreme market volatility, presenting challenges for AMPL. These included issues with price data feeds (oracles), abrupt and significant supply adjustments, and inconsistent pricing across various trading pools. Rather than abandoning its foundational principles or introducing collateral, the Ampleforth team focused on refining the system. They enhanced oracle robustness, smoothed out supply changes, and improved AMPL's compatibility with modern decentralized exchanges. The underlying idea persisted, while its implementation grew more sophisticated.

Transitioning to a More Mature System

By 2022, Ampleforth had entered a more advanced developmental stage. The community introduced a novel rebase model, the bounded sigmoid curve, as outlined in AIP-5. This innovation led to smoother and more controlled supply adjustments, particularly during periods of intense market fluctuation.

A bounded sigmoid curve allows Ampleforth to adjust its supply in a smooth, limited, and predictable manner, thereby avoiding the sharp, extreme rebases that the previous linear model could trigger during volatile market conditions.

Subsequently, the DAO experimented with a narrower price band to enable AMPL to react more swiftly to market changes. When this proved overly aggressive, the band was widened again, while retaining the improved curve. This iterative process demonstrated the system's capacity for learning from real-world performance and continuous improvement without deviating from its core objective.

Introducing SPOT: A More Accessible Asset

With the AMPL mechanism achieving greater stability, the next logical step was to create an asset that everyday users could hold without experiencing the daily fluctuations in supply. This led to the development of SPOT. Between 2023 and 2024, the DAO refined SPOT's design, fee structures, and incentive mechanisms. A pivotal upgrade was the introduction of the rotation vault, which facilitated seamless transitions between AMPL and SPOT within the protocol. This effectively positioned SPOT as "AMPL without rebases," designed to maintain a stable value relative to AMPL's long-term price trajectory without undergoing daily supply changes.

SPOT v5: An Enhanced, Balanced System

In 2025, SPOT v5 introduced two significant enhancements. Firstly, it established a two-tiered system:

- •SPOT serves as the stable, low-volatility layer.

- •stAMPL functions as the high-volatility, leveraged layer.

This structure allows users to select their preferred level of risk exposure. Secondly, the system incorporated dynamic fees contingent on the Debt Ratio (DR). Actions that negatively impact the system's equilibrium incur higher fees, while those that contribute to its stability are made less expensive. This mechanism incentivizes beneficial behavior automatically through economic rather than rigid regulatory means.

The Significance of This Evolution

Ampleforth has undergone substantial development, yet its core principle remains unaltered: no collateral and no redemption guarantees. The team has consistently focused on enhancing elasticity, fortifying oracles, fine-tuning parameters, and constructing a comprehensive financial layer atop the initial design. While many projects falter under pressure, Ampleforth has steadfastly adhered to its foundational concept.

Anticipating a Significant 2026

AMPL has achieved a state of stability and predictability in its supply adjustments. SPOT is emerging as a robust low-volatility asset. Furthermore, the ecosystem is expanding, notably with the ongoing development of fragments.org. All these factors are converging to position 2026 as a pivotal year for increased visibility and broader adoption.

See you in 2026. Big things ahead.