Key Insights

- •Bitwise launches its spot XRP ETF on the NYSE Arca under the ticker “XRP,” drawing both praise and confusion for using the same symbol as the token itself.

- •Traders question how such a potentially confusing ticker passed regulatory review, while others view the branding as a strategic win.

- •The debut comes amid a broader wave of XRP ETF launches, signaling growing institutional interest and competition in the segment.

New XRP ETF Enters the Market

Bitwise Asset Management launched its new spot XRP ETF on November 20, 2025, listing on the NYSE Arca under the ticker XRP. The fund began trading on November 20 with a management fee of 0.34%, which will be waived on the first $500 million of assets for one month. This launch follows the debut of Canary Capital Group's first U.S. spot XRP ETF (ticker XRPC) on November 13, 2025, which attracted over $250 million in inflows on its first day.

Bitwise's release highlighted XRP's 13-year history and its $125 billion market cap, noting that XRP powers the XRP Ledger, a blockchain focused on efficient exchange, tokenization, and settlement. The new ETF extends the wave of crypto products beyond Bitcoin, but traders immediately focused on the choice of ticker.

Ticker Choice Ignites Controversy

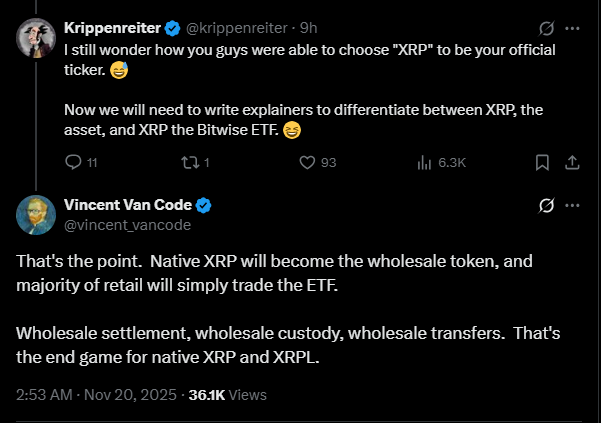

Within hours of the launch, discussions on X (formerly Twitter) erupted regarding the ticker XRP. Users pointed out that no prior U.S. crypto ETF had used the exact symbol of the underlying token. One trader questioned the regulatory approval of such a confusing ticker, asking if there was an ETF with the ticker BTC. Another user, a DeFi educator known as "Krippenreiter," inquired how Bitwise obtained the ticker XRP, suggesting the firm would need to issue explanations to differentiate between XRP the asset and XRP the Bitwise ETF.

These comments referenced the fact that other crypto ETFs, such as Fidelity's Bitcoin ETF, use tickers like FBTC, and many funds avoid using the direct token symbol. However, not all reactions were negative. Some users praised the choice as a strategic move. Software developer Vincent Van Code suggested that the native XRP would become the wholesale token, with most retail investors trading the ETF, aligning with the long-term vision for native XRP and the XRPL.

Some observers interpret the ETF's branding as reinforcing XRP's institutional role. Bitwise executives have echoed this sentiment. CIO Matt Hougan stated that XRP is an intriguing asset with a long history of successful operation at low costs and a strong community. He also commented that under the current regulatory environment, XRP stands on an equal footing with other digital assets, reflecting the company's belief in the value of large-cap utility tokens like XRP in investor portfolios.

Market Reaction and Future Outlook for XRP ETFs

The trading debut saw modest price movement for XRP, which was trading around $2.11 on November 20, approximately 4.8% below its previous day's close of $2.214. Over the past year, XRP has seen a significant increase of about 91%. Inflows into XRP ETFs have been robust, with Canary's XRPC fund attracting roughly $250 million on November 13. Industry analysts anticipate similar demand for the Bitwise ETF.

Bloomberg ETF analyst James Seyffart predicted on November 19 that "lots [are] happening next week," with spot XRP ETFs from Grayscale and Franklin Templeton expected to begin trading around November 24. With the Washington funding shutdown resolved, Bitwise's Matt Hougan advised clients to prepare for an "ETF-palooza," forecasting over 100 new fund launches in the coming weeks.

The corporate messaging emphasizes the long-term potential of XRP. Bitwise's press release describes XRP as the world's third-largest crypto asset, with a market cap exceeding $125 billion. It highlighted the XRP Ledger's 13-year track record, processing over 4 billion transactions with approximately $1.9 billion in daily volume, and its focus on fast, low-cost cross-border payments. CEO Hunter Horsley stated that investors are gaining exposure to an asset with the potential to fundamentally reshape global money movement.

Similarly, Canary Capital's CEO Steven McClurg referred to XRP as one of the most established and widely used digital assets, asserting that ETF access would enable the next wave of adoption and growth in a critical blockchain system.

In summary, Bitwise's XRP ETF debut has generated significant attention in the crypto news sphere and among traders. The distinctive use of the XRP ticker, while unusual, underscores the enthusiasm for the token's utility. The launch confirms XRP's arrival on Wall Street, and market observers will closely monitor fund inflows and their impact on XRP's trading price. Crypto news outlets are expected to continue focusing on this ETF and the numerous others scheduled for launch, as traders and analysts assess their potential to shift industry dynamics.