Bittensor Enters Key Stage with First Halving Event

Bittensor (TAO) is entering a significant phase as its first halving event is scheduled for December 12. This event, which cuts the new supply of TAO in half, has already contributed to a price recovery, pushing the token back towards the $283 area after a period of weakness. Despite ongoing market volatility, the TAO price continues to fluctuate between modest rallies and sharp declines. Concurrently, the Bittensor network is experiencing consistent growth through the introduction of new subnets, increasing revenue streams, and the development of new investment products, all of which are crucial factors shaping TAO's trajectory towards 2026.

Current Market Analysis of Bittensor (TAO)

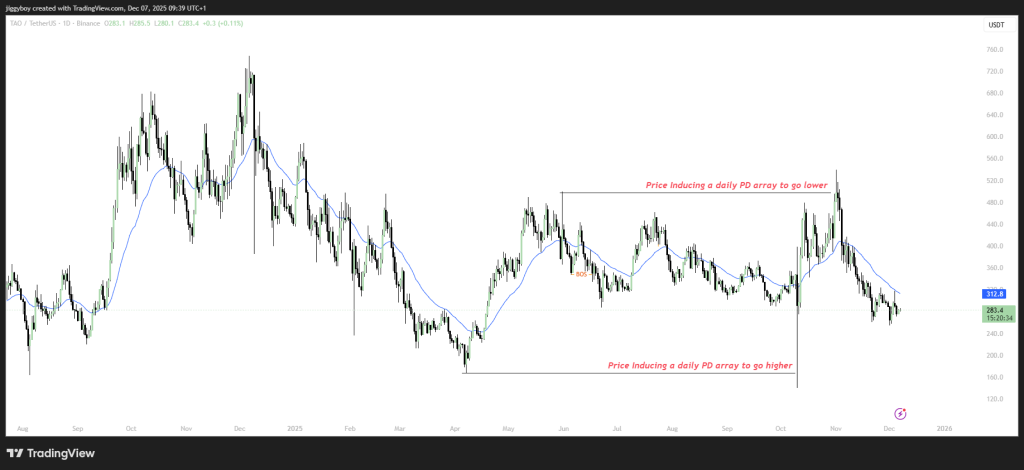

The broader chart analysis for TAO reveals significant price fluctuations since its peak earlier in 2024. Following an extended downturn, the price has established wide trading ranges that have consistently acted as resistance levels during attempted upward movements. The recent rebound from the $260–$280 zone indicates sustained buyer interest in defending critical support areas, although TAO remains below the major resistance levels encountered earlier in the year.

Currently trading around $282.34, TAO is positioned between a substantial support zone and multiple resistance clusters. The price chart clearly depicts a market structure characterized by strong selling pressure near $350 and a significant demand zone around $250. If TAO can maintain its position above this support level post-halving, a potential upward movement towards the mid-$300s could occur. However, a breach below $250 would likely lead to a more substantial pullback into deeper retracement zones observed in mid-2025. The upcoming halving event is now a pivotal factor in determining TAO's short-term price direction.

Key Factors Influencing Bittensor's Price Outlook for 2026

The upcoming halving event represents the first major supply shock for TAO. Following this event, the rate at which new tokens enter circulation will be halved. This reduction in supply, coupled with sustained or increasing subnet demand, could lead to a rapid tightening of TAO's circulating supply. The network's annual inflation rate is projected to drop to approximately 1.3%, which is even lower than Bitcoin's current inflation rate.

Bittensor is also progressing towards greater integration within the broader cryptocurrency ecosystem. The ongoing development and rollout of EVM compatibility are expected to enhance TAO's accessibility for a wider range of developers, applications, and decentralized finance (DeFi) platforms. This strategic shift holds the potential to unlock opportunities such as liquid staking, expanded lending markets, and increased cross-chain interoperability throughout 2026.

Furthermore, the growth of Bittensor's subnets is a critical driver. The network's updated rewards framework directly links token emissions to demonstrable utility. This means that subnets providing tangible output will attract greater stake and earn higher rewards. In 2026, the most successful subnets, particularly those focused on artificial intelligence (AI) inference, prediction markets, and synthetic data generation, are expected to propel the network's advancement and attract a larger developer community.

The network's strategic roadmap for 2026 emphasizes scaling decentralized AI capabilities, broadening cross-chain integrations, and further refining the rewards framework to prioritize genuine utility. The halving event is set to influence the first half of 2026, while the expansion of EVM compatibility and the maturation of subnets will be key themes in the latter half of the year. If user adoption progresses at the pace anticipated by the Bittensor team, 2026 could emerge as a landmark year in the history of TAO.

Projected Value of 100 TAO Tokens by 2026

The future price of Bittensor in 2026 will be a confluence of several factors, including the impact of the halving event, the pace of subnet growth, and the level of demand generated from developers, institutional investors, and AI-focused markets.

In a scenario of slow network growth, TAO's price might hover around current levels. Conversely, accelerated adoption could trigger a significant price breakout as supply constraints become more pronounced. In a robust AI-driven market, TAO's value could surge considerably, establishing it as a primary digital asset linked to decentralized AI technologies.

Under a weak market scenario, 100 TAO tokens could be valued between $18,000 and $22,000. If market conditions remain stable, the value might range from $32,000 to $42,000.

Should demand increase following the halving and broader adoption of TAO for AI applications, the value of 100 tokens could potentially reach between $60,000 and $90,000.

In the most optimistic projection, if TAO solidifies its position as the leading decentralized AI network, the value of 100 TAO tokens could exceed $120,000.

Bittensor is entering a pivotal year, with the halving event, the EVM rollout, and subnet expansion all playing significant roles in shaping its development throughout 2026. The TAO price is showing signs of establishing a base, while the underlying fundamentals indicate a network that continues to expand despite prevailing market uncertainties. If these positive developments continue, TAO is well-positioned to enter a new growth phase that could significantly differ from its performance in 2025.