Market Dynamics and ENA Price Action

Ethena (ENA) is entering a new phase characterized by the emergence of larger market participants, the introduction of new products, and evolving regulations, all of which are beginning to reshape the project's trajectory. Traders are observing closely as the ENA price exhibits early signs of strengthening following weeks of market volatility.

A significant transaction involving a large wallet associated with Ethena Labs saw the withdrawal of $7.1 million worth of ENA from Bybit. Such movements often indicate a reduction in selling pressure or preparations for upcoming incentives, suggesting potential future price appreciation.

Concurrently, Ethena is expanding its presence within the regulated stablecoin market through its partnership with Anchorage. This collaboration now facilitates a GENIUS-compliant version of USDtb, enhancing its accessibility and legitimacy for institutional adoption.

The ENA token also received a notable boost from developments in traditional financial markets with the launch of a regulated ENA Exchange Traded Product (ETP) by 21Shares. These combined factors are setting a positive tone for ENA's positioning as it heads into 2026.

Technical Analysis of the Ethena Chart

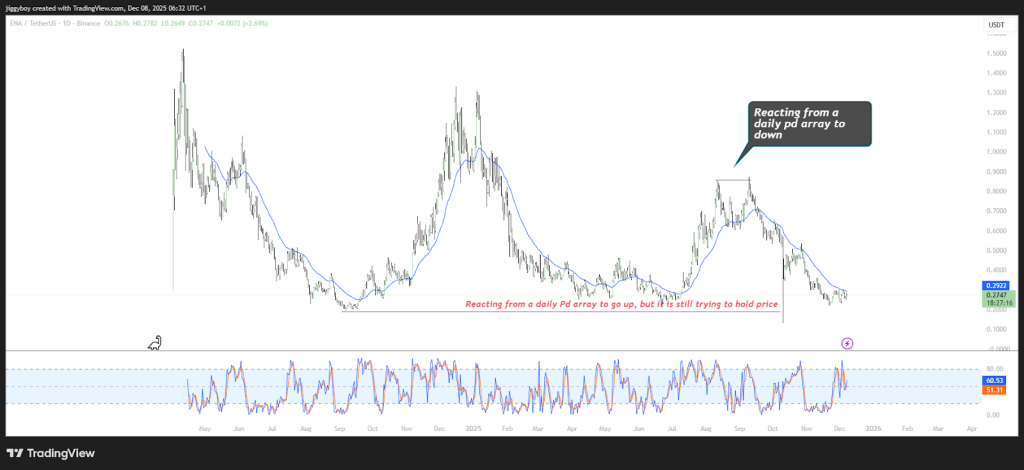

A broad view of the ENA chart reveals a prolonged downtrend from its earlier peak values, with recurring instances of resistance encountered around the moving average. Each attempted recovery has been short-lived, keeping ENA confined within a wide downtrend channel.

The recent positive reaction from the lower daily price zone suggests that buyers are actively defending key support levels. However, overall market momentum remains subdued. The ENA price is currently trading around $0.2745, situated between a significant support zone and a cluster of resistance areas that have repeatedly capped its upward movement over recent months.

The current market structure remains fragile. For ENA to break its pattern of lower highs, it needs to successfully reclaim the mid-range levels, approximately around $0.35. A failure to hold the current support could lead to a retest of deeper price zones observed in early 2025. Conversely, if buyers maintain their hold on this area and positive news flow persists, ENA has the potential to establish a more robust foundation for a gradual recovery.

Key Factors Influencing Ethena's Price Trajectory Towards 2026

Ethena's increasing emphasis on regulated adoption is emerging as a significant competitive advantage. The partnership with Anchorage and the availability of a GENIUS-compliant USDtb are paving the way for institutional use cases, including settlements and treasury management. This development could stimulate demand for ENA through its governance and revenue-sharing mechanisms.

The sustained growth of USDe remains a primary driver of long-term value for the Ethena ecosystem. The rapid expansion of its supply, coupled with consistently increasing fees, and the forthcoming fee switch mechanism, which will allocate a portion of protocol revenue to ENA stakers, are all critical factors. If this fee switch is implemented early in 2026, ENA could transition into a true yield-generating asset, mirroring the trajectory of BNB during its early fee-sharing phase.

Restaking and cross-chain security represent another pivotal element in Ethena's narrative. Integrations with Symbiotic and LayerZero have resulted in over 450 million ENA being locked into staking and governance protocols. This action effectively reduces the circulating supply and has historically provided price support during periods of expansion.

However, ENA is also subject to token unlocks throughout 2026. These unlocks could exert downward pressure on the price if market demand does not keep pace with the increased supply.

The Ethena team's strategic plan for 2026 centers on enhancing utility through the fee switch, expanding the reach and adoption of USDe, and laying the foundational groundwork for a future Ethena Chain. This chain is envisioned to host its own financial applications powered by USDe.

Should these core initiatives be successfully executed, 2026 could represent a significant turning point for the Ethena ecosystem.

Projected Value of 100 ENA Tokens by 2026

The future price of ENA in 2026 will be contingent upon several factors, including the pace of USDe adoption, the effectiveness of the fee switch mechanism, and the level of demand generated from restaking initiatives, institutional investment, and new trading products.

In a scenario where the broader market remains subdued, 100 ENA tokens might retain a value close to their current valuation, approximately between $25 and $40. If market conditions stabilize and USDe continues its growth trajectory, this range could potentially expand to between $60 and $120.

With increased adoption, substantial revenue growth, and a smooth activation of the fee switch, 100 ENA tokens could reach a value between $180 and $300, driven by a larger number of stakers locking tokens to earn yield.

In the most optimistic outlook, where Ethena solidifies its position as a central liquidity hub, USDe becomes a primary competitor to DAI, and the Ethena Chain achieves significant real-world usage, the value of 100 ENA tokens could surpass $500.

Ethena is approaching a critical year in its development. The ecosystem is undergoing expansion, new institutional pathways are being established, and the protocol continues to demonstrate growth even within a challenging market environment.

The current chart analysis indicates that the ENA price is attempting to find stable support levels. Simultaneously, the underlying fundamentals point to a project that is actively building and focused on long-term growth. If this positive momentum is sustained, ENA's market performance by 2026 could see a significant transformation.