Early-Stage Wealth: Essential Assets and Limited Savings

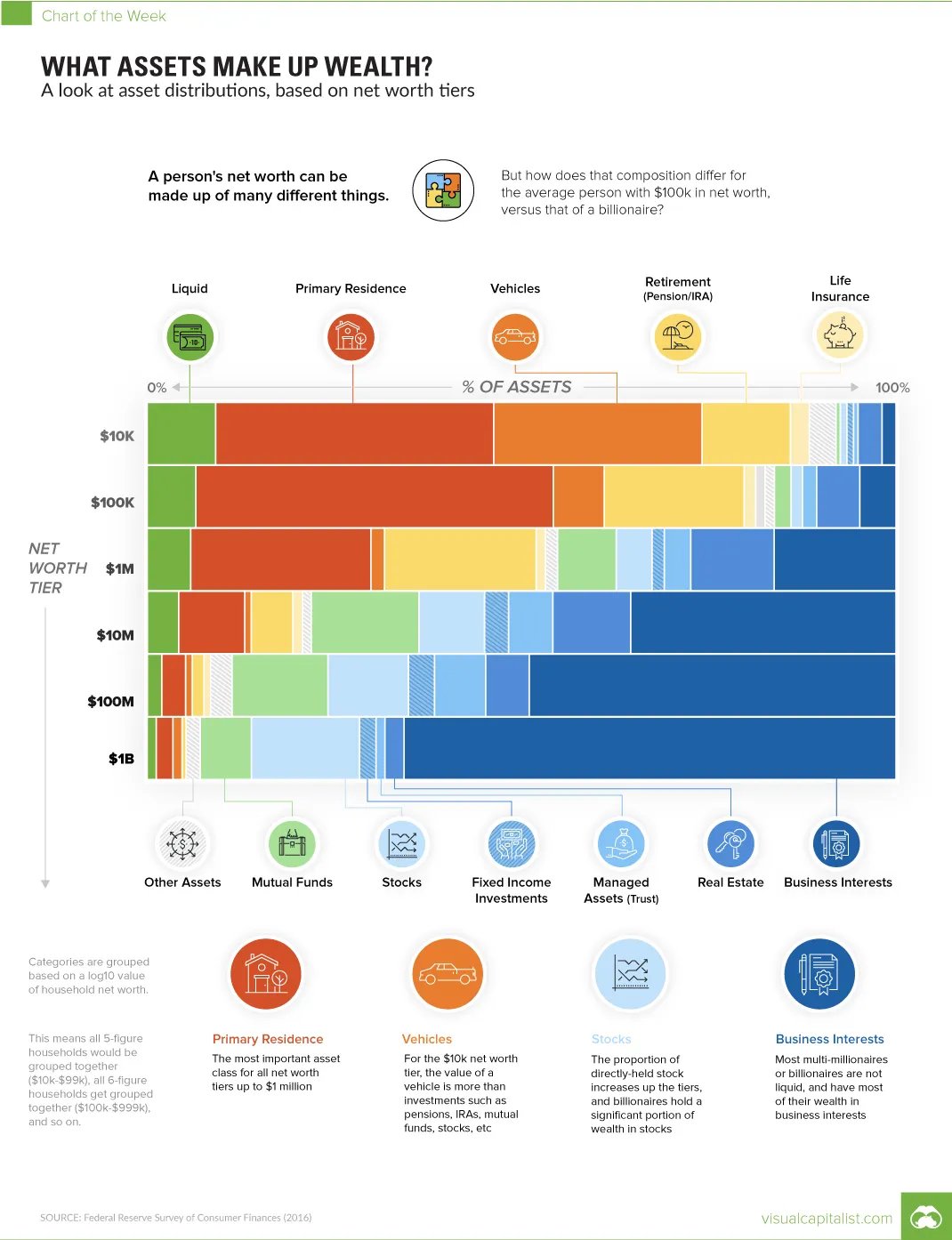

For households with less than $100,000 in net worth, the composition of assets is heavily weighted toward primary residences and vehicles. According to the Federal Reserve’s Survey of Consumer Finances, these physical assets make up the majority of wealth for this group. The home represents stability, while vehicles often carry more financial value than investments or pensions at this tier.

Liquid savings remain limited, emphasizing how early-stage wealth is tied up in necessary, depreciating assets. At this level, ownership reflects consumption more than investment, as most families focus on home equity rather than financial growth instruments.

The Middle Class: Real Estate Meets Retirement

As net worth rises toward the $100,000–$1 million range, the balance begins to shift. The home still dominates, but retirement savings, mutual funds, and fixed-income investments gain traction. These households are building long-term security, using pension plans and 401(k)s as stepping stones toward capital accumulation.

By the $1 million tier, asset diversification becomes more sophisticated. Wealthy households begin reducing dependency on real estate and vehicles, reallocating into stocks, managed funds, and business ventures. The shift reflects a key psychological change: moving from asset ownership for personal use to asset ownership for income generation.

Affluent Wealth: Financial Assets Take the Lead

At the $10 million to $100 million mark, wealth composition changes drastically. Stocks, managed assets, and trusts dominate the portfolio, while personal residences account for only a small fraction of total wealth. These individuals have largely transitioned from property-based to financial-based wealth.

Fixed-income investments and mutual funds are used for diversification and stability, while real estate becomes more of a strategic or passive investment rather than a primary store of value. The liquidity of assets decreases, but the capacity for capital growth increases, signaling the rise of professionalized wealth management.

The Billionaire Blueprint: Business Ownership and Control

For individuals with over $1 billion in net worth, the asset structure transforms completely. According to the chart, business interests make up the largest share of total wealth, eclipsing real estate, vehicles, or even stocks. Billionaires own and operate enterprises that produce recurring income and scalable value, from private corporations to equity in global firms.

Liquid assets are minimal, and managed assets and trusts play a significant role, helping optimize taxation, succession planning, and risk exposure. These portfolios are illiquid but powerful, with wealth concentrated in productive entities rather than passive holdings.

From Stability to Scale: The Wealth Evolution Path

The chart makes one concept clear: the composition of wealth evolves with financial literacy and scale. Lower tiers focus on ownership of essential goods; middle tiers accumulate diversified, income-yielding assets; and the ultra-wealthy channel capital into enterprise growth.

This journey represents the transformation from consumption-based wealth (homes, cars, pensions) to production-based wealth (businesses, investments, equity). It underscores a timeless financial truth, the wealthiest individuals don’t just store value; they create it.