According to analysis from CryptoQuant, the key reason institutional capital remains cautious on Bitcoin is no longer crypto-specific. The constraint is macro, and it runs directly through the Japanese Yen.

The Currency Domino Effect: Why the Dollar Stays Strong

The ongoing managed devaluation of the yen is acting as a structural prop for the U.S. dollar index (DXY). Even with a cautious Federal Reserve, the dollar remains resilient because the yen—one of its largest components, is in a controlled decline. This policy helps Japan manage the world’s largest sovereign debt burden and unwind decades of yen carry trades.

For global markets, the result is clear: a strong dollar is a headwind for risk assets, and Bitcoin remains tightly linked to dollar liquidity conditions.

The Price of Uncertainty: Why Gold Wins the Safety Trade

This setup creates a persistent macro dilemma. Any abrupt move in USD/JPY risks destabilizing global markets, making the yen a systemic tail risk. That uncertainty explains why institutions continue to favor Gold as a hedge.

The divergence is visible in performance: gold has surged more than +61%, while Bitcoin has largely oscillated, struggling to attract sustained macro-driven inflows.

The Withheld Trigger: Why Crypto Rotation Is Delayed

A broad crypto rally historically requires DXY weakness. But as long as the yen’s decline mechanically supports the dollar, that catalyst remains postponed. Institutional capital therefore has little urgency to rotate out of gold and back into Bitcoin.

The Macro Pressure Gauge

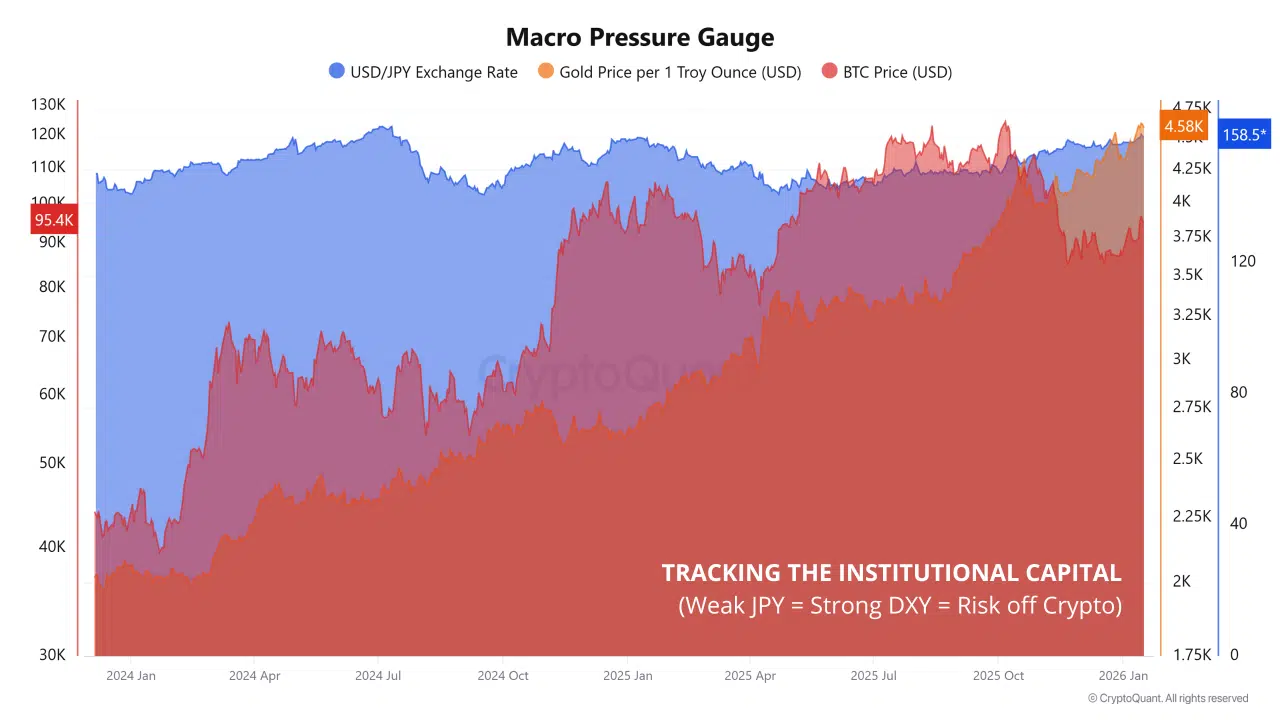

CryptoQuant’s “Macro Pressure Gauge” tracks three variables:

- •Bitcoin price (USD)

- •Gold price per troy ounce (USD)

- •USD/JPY exchange rate (higher = weaker yen)

At the time of analysis:

- •Bitcoin: ~$95,000

- •Gold: ~$4,580

- •USD/JPY: ~158.5

The alignment reinforces the same message: macro stress favors safety.

Final Takeaway

The ongoing “Deviation to Gold” is not a rejection of Bitcoin, but a hedge against planned currency disorder. The macro clarity institutions are waiting for is not regulatory or ETF-related; it is the resolution of the yen crisis. Until that pressure eases and the dollar weakens, strategic patience remains the dominant institutional stance in 2026.