Key Signals for Market Recovery

A new CryptoQuant analysis outlines how traders can identify when Bitcoin’s recent deleveraging cycle may be nearing its end. The report observes a -12.48% decline in Open Interest, indicating that leverage in derivatives markets has been flushed out, a process often described as a market “reset.”

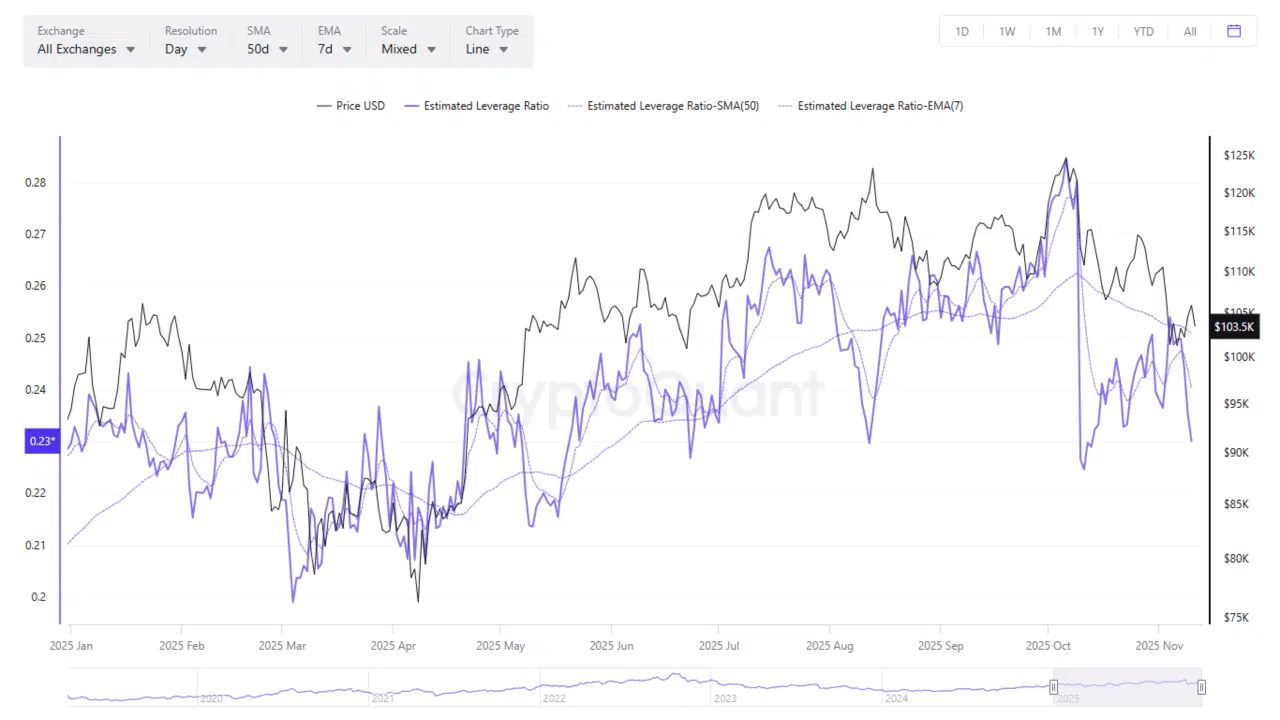

According to CryptoQuant, combining the Estimated Leverage Ratio (ELR), a real-time measure of leveraged sentiment, with two key Moving Averages (MAs) offers a powerful lens for detecting reversals. The study highlights the interaction between the 7-day Exponential Moving Average (EMA) and the 50-day Simple Moving Average (SMA) as a reliable framework for interpreting the end of deleveraging periods.

Three Signals That Mark the End of Deleveraging

Bullish Crossover (Reversal Signal)

When the 7-day EMA crosses above the 50-day SMA, short-term momentum overtakes the broader trend, a classic signal that OI has stopped falling and leverage is returning.

7-Day EMA Above 50-Day SMA (Trend Confirmation)

Sustained positioning of the short-term average above the medium-term average confirms that the market is regaining strength and leverage is rising steadily.

Price Above 50-Day SMA (Confidence Recovery)

When Bitcoin’s price trades consistently above the 50-day SMA, it reinforces medium-term bullish sentiment and typically coincides with renewed market confidence following deleveraging.

Restoring Confidence After a Reset

CryptoQuant concludes that the convergence of sentiment (via ELR) and trend strength (via MAs) provides a holistic method for identifying when corrections are over. As OI stabilizes and these technical patterns emerge, the probability of a leverage-driven recovery increases, signaling that the worst of the correction may be behind.

This blended approach, the report notes, helps traders move beyond surface-level volatility metrics and instead read the deeper rhythm of Bitcoin’s leverage cycles, offering valuable foresight into when risk appetite is quietly returning to the market.