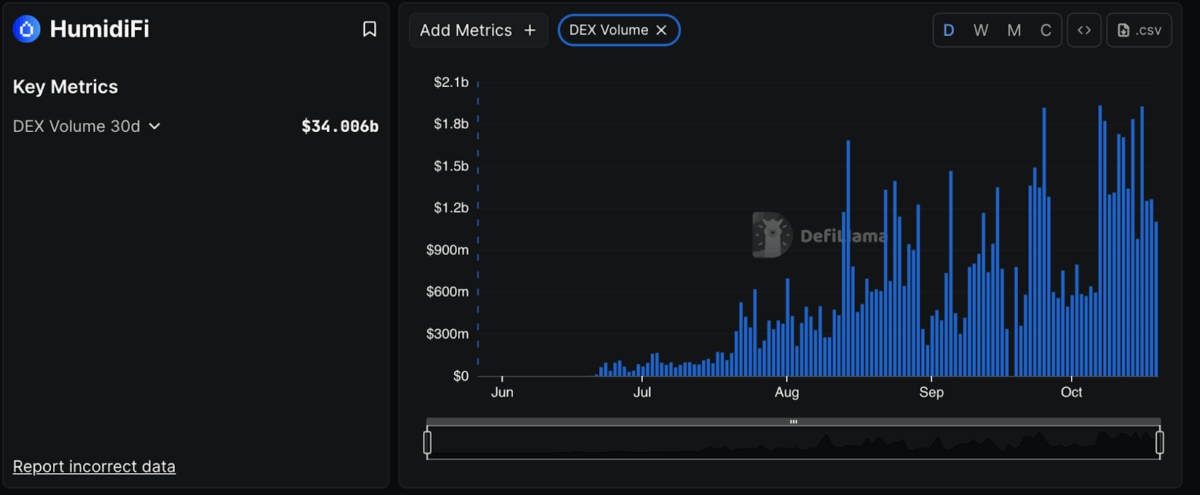

HumidiFi has emerged as the largest decentralized exchange (DEX) on the Solana network, surpassing other prominent platforms. According to data from DeFiLlama, HumidiFi facilitated $1.1 billion in trades within a single day, $9.7 billion over a week, and a substantial $34 billion in trading volume over the past month.

Unlike many decentralized exchanges, HumidiFi operates as a dark pool. This means that trade details are kept confidential. The platform utilizes a private system that conceals order information, enabling traders to bypass price fluctuations and prevent others from gaining an unfair advantage. Consequently, large investors frequently opt for HumidiFi to execute substantial trades discreetly without impacting market prices.

Private Liquidity and Institutional Growth

HumidiFi does not feature a public trading page, which is common for most exchanges. Instead, trades are processed through aggregators. This mechanism ensures that prices remain private, allowing traders to keep their strategies hidden while also avoiding significant market shifts.

Protocols like HumidiFi can sometimes achieve better-than-expected prices, enhancing trading efficiency, according to Sandwiched.me. Due to its discreet trading environment and less volatile price action, HumidiFi has become the preferred choice for many significant traders. This shift has also led to liquidity moving away from more open exchanges such as Raydium and Orca.

HumidiFi attracted professional traders by providing fast and private trading capabilities. In June, the platform handled only a few million dollars daily. However, by August, daily trades had surged past $1 billion. Since then, its trading activity has remained robust, averaging between $1.2 billion and $2 billion each day.

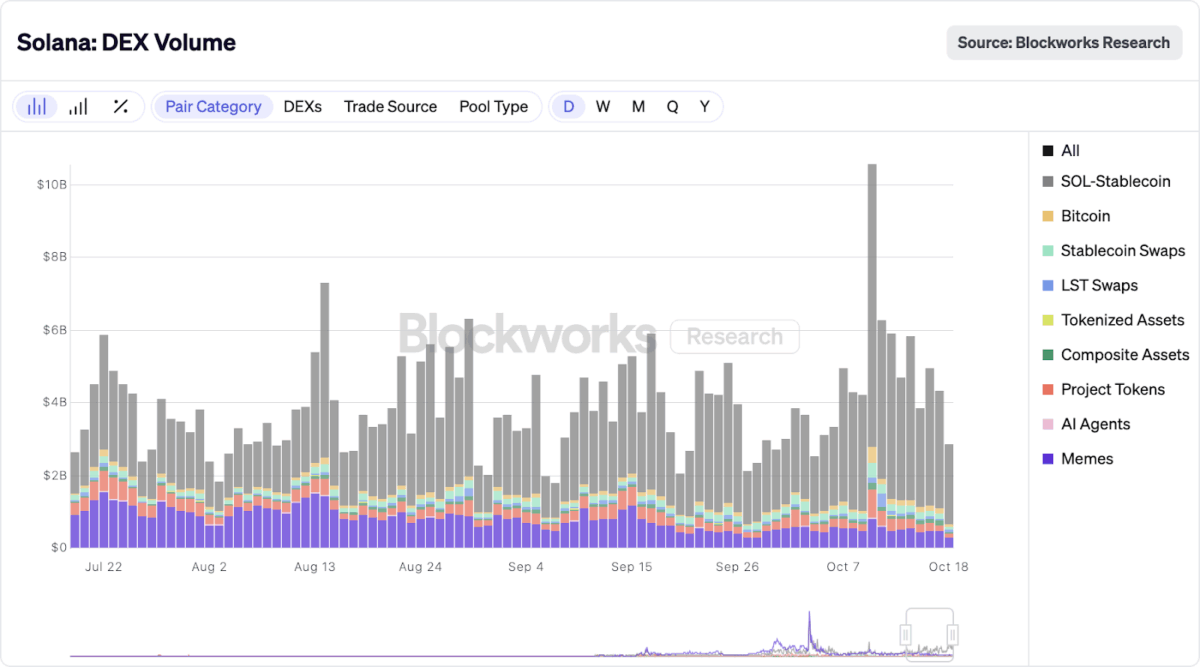

Data from Blockworks indicates that daily trading volume on Solana has ranged between $3 billion and $6 billion, with occasional peaks reaching as high as $10 billion. The majority of this trading activity involves swapping SOL for stablecoins like USDC and USDT, with smaller portions attributed to meme coins, Bitcoin, and liquid staking tokens.

The growth of HumidiFi signifies an increasing number of traders opting for private and efficient methods to trade cryptocurrencies on Solana's network.

Crypto Execs to Meet Senate Democrats Following Leaked DeFi Proposal