HumidiFi (WET) token experienced a successful Token Generation Event (TGE) on December 9, achieving an all-time high (ATH) of over $0.33 and a market capitalization exceeding $77 million on December 10, despite prior challenges with its public sale.

HumidiFi is a decentralized exchange (DEX) built on the Solana blockchain. It functions as a proprietary Automated Market Maker (AMM), integrating on-chain execution with sophisticated market-making logic designed for institutional-grade performance.

As of December 10, HumidiFi has demonstrated significant trading volume, with nearly $923 million in 24-hour trading volume and over $7.7 billion in 7-day volume. This performance positions it as the 4th largest DEX by volume, surpassing prominent platforms like Pump and Aerodrome, according to data from DeFi Llama.

WET's December 9 Token Generation Event

The utility token for HumidiFi, WET, was successfully launched on December 9 across various exchanges, including Titan, Jupiter, and Binance. At the time of reporting, WET was trading above $0.29, with a market capitalization exceeding $67 million. Earlier in the day, it had reached an ATH of over $0.33.

In the preceding 24 hours, WET saw a price increase of more than 74%, accompanied by a trading volume of over $301 million.

The total supply of WET tokens is capped at 1 billion, with a current circulating supply of 230 million tokens.

The team behind HumidiFi shared a post from Jupiter DEX celebrating WET's performance on their platform, highlighting its success despite recent issues related to the token's public sale.

WET Public Sale Delay and Results

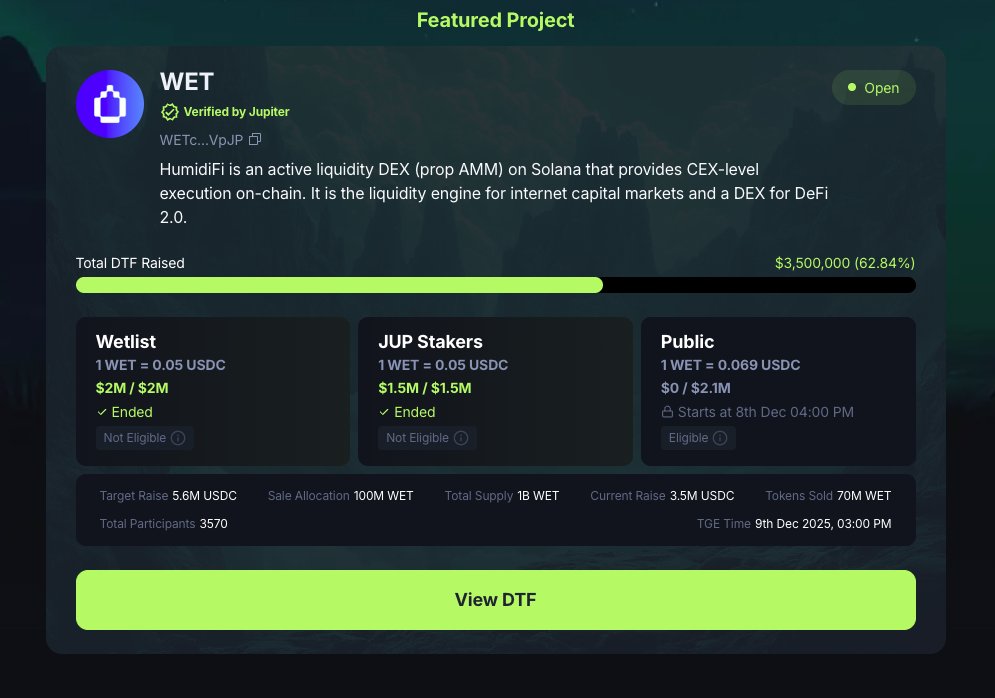

The relaunch of the WET public sale was initially slated for December 8 at 10 am EST. Despite an unexpected 40-minute delay, the public sale successfully commenced on Jupiter. Users were advised to utilize the auto-confirm function on the DEX’s wallet extension to enhance their chances of participating in the sale.

On December 8, Jupiter congratulated HumidiFi on the WET token public sale, which attracted over 60,000 participants. The majority of these participants were identified as genuine users, with only approximately 5% flagged as potentially suspicious addresses by Bubblemaps.

Jupiter reported that each of the over 4,000 successful WET purchasers accessed the sale through the DTF application's front-end. Jupiter's DTF platform is designed for public token sales, aiming to ensure fair launch distributions and implement anti-bot filtering measures.

Based on an initial wallet-age analysis conducted by the DEX, Jupiter expressed confidence that legitimate users were the primary beneficiaries of the sale.

Temporal, a crypto research and development firm and Meteora liquidity pool builder, collaborated with the HumidiFi team on the WET token sale, contributing to the development of a multi-layered anti-bot technology solution.

The Jupiter team also issued an apology for the public sale delay, which extended from 10 am to 10:40 am. They attributed the delay to heavy traffic that impacted the deployment of the anti-bot package.

The sale successfully raised $2.1 million from over 4,000 buyers, with each WET token priced at 0.069 USDC.