Key Market Performance Indicators for 2025

Hyperliquid emerged as the leader in annual contract transaction volumes for 2025, recording a substantial $2.93 trillion. In parallel, Aster distinguished itself by topping web traffic, attracting 13.23 million visits during the same period. These metrics highlight the competitive landscape within the derivatives market, reflecting shifts in trading activity and user interest across different platforms.

Hyperliquid's Dominance in Transaction Volume

In the 2025 annual contract transaction volumes, Hyperliquid established a leading position with a total volume of $2.93 trillion. This significant figure surpasses its competitors, including Lighter and Aster, underscoring Hyperliquid's growing influence within the cryptocurrency trading sector. Despite Aster's leading position in web traffic with 13.23 million visits, Hyperliquid's substantial transaction volume indicates a robust market presence.

Aster's top rank in web traffic signifies a considerable user base. However, Hyperliquid's leadership in transaction volume demonstrates its strong market engagement. The differing levels of engagement across these platforms are indicative of crucial market shifts.

The dynamics of the cryptocurrency sector in 2025 demonstrate how rapidly evolving strategies can alter market hierarchies, observes a market analyst.

Factors Influencing the Crypto Trading Landscape

During the fourth quarter of 2025, Hyperliquid maintained its leadership in open interest, even amidst competitive trading volumes from Aster. This sustained performance suggests a strong underlying market position.

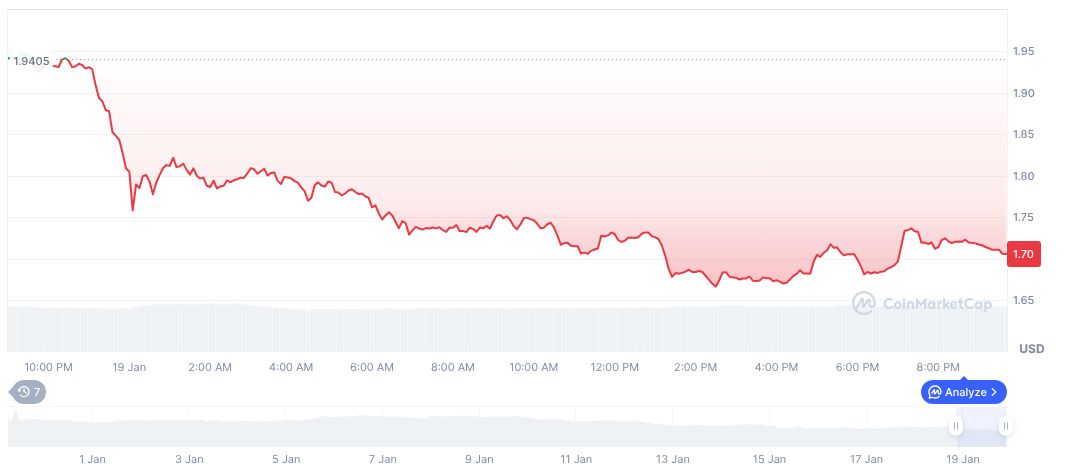

Lighter's native token, LIT, was valued at $1.71 with a market capitalization of $426.82 million. The token's 24-hour trading volume stood at $52.11 million, showing a 1.61% change. Data indicates that LIT has experienced a significant price decline over the past 90 days, dropping by 36.12%.

Research from Coincu suggests that regulatory developments and technological advancements are poised to redefine market structures. These changes could impact trading volumes and user engagement on platforms such as Hyperliquid. Insights from Stacy Muur highlight that data transparency and trading incentives are under increasing scrutiny, indicating that the market may undergo significant transformations.