Key Insights

- •Hyperliquid wallet moved $90M in HYPE, raising concern over possible large-scale sell activity.

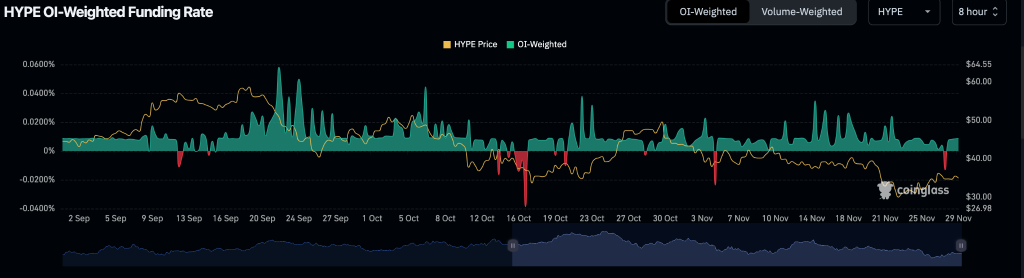

- •Funding rates flipped negative after wallet shift, suggesting growing trader caution in the market.

- •Spot wallet now holds millions in unlocked tokens, but no exchange movement has been spotted yet.

Hyperliquid transferred 2.6 million HYPE tokens, valued at approximately $90.18 million, from staking to a spot wallet on November 29 at 12:32 UTC+8. On-chain records from HypurrScan indicate this transaction originated from address 0x43e9abea1910387c4292bca4b94de81462f8a251, a wallet associated with HyperLabs. This transfer reduced the staked balance, but approximately 240 million HYPE tokens, estimated at over $8.33 billion, remain locked.

This movement has generated questions among market participants. Although no direct selling has been confirmed, transferring tokens to a spot wallet is frequently viewed as a preparatory action for liquidity management. The address currently holds no perpetual positions or vault assets. Its total wallet value surpasses $8.42 billion, with $90 million designated as spot holdings.

Wallet Activity Suggests Internal Shifts

In addition to the main HYPE token transfer, the wallet has received smaller inbound token transfers, including PICKL, YAP, and BIGBEN. Each of these tokens is valued under $50 and originated from a known address, suggesting low-value internal flows or testing activities rather than external transactions or new accumulation.

The primary focus remains on the HYPE tokens. It is currently unclear whether this shift indicates a planned sale or an internal reallocation of assets. One user commented, "No action yet, but this isn’t something you ignore."

Funding Rate Turns Negative as HYPE Enters Spot

Data from CoinGlass reveals that the funding rate for HYPE experienced a sharp decline below 0% following the token transfer. Prior to this event, funding rates had been predominantly positive from early September through mid-October, coinciding with HYPE's price surge towards $64. The shift in the funding rate occurred as prices cooled and short positions began to gain traction.

Traders commonly monitor funding rates to assess leverage sentiment in the market. A rate dropping below zero signifies that short position holders are paying to maintain their positions, which often correlates with an increasing bearish bias. The concurrent timing of the funding rate dip and the token movement amplifies market concerns.

Price Range Holds, but Traders Stay Cautious

HYPE's price is currently trading within the range of $37 to $40. This follows several weeks of price declines, with a minor rebound observed in the most recent trading sessions. Funding rates remain mixed, and price action has been relatively contained. No significant outflows from the wallet have been detected since the initial transfer, but market participants are closely observing the spot balance.

"Still watching. That $90 million doesn’t move for no reason," one market participant noted.