Aster’s never‑ending DEX blow‑up has splashed across crypto tracking sites, but Hyperliquid maintains critical architectural advantages that could separate the long‑term winners from the inevitable losers.

Capital and attention now flow in DeFi derivatives between these two Perp DEX platforms.

HYPE Hyperliquid price Hype (Hyperliquid) is currently trading at $49.39 USD, decreasing by 1.73% today.

The price of ASTER at the moment is around $1.87 USD; low market cap life, low velocity, but high potential!

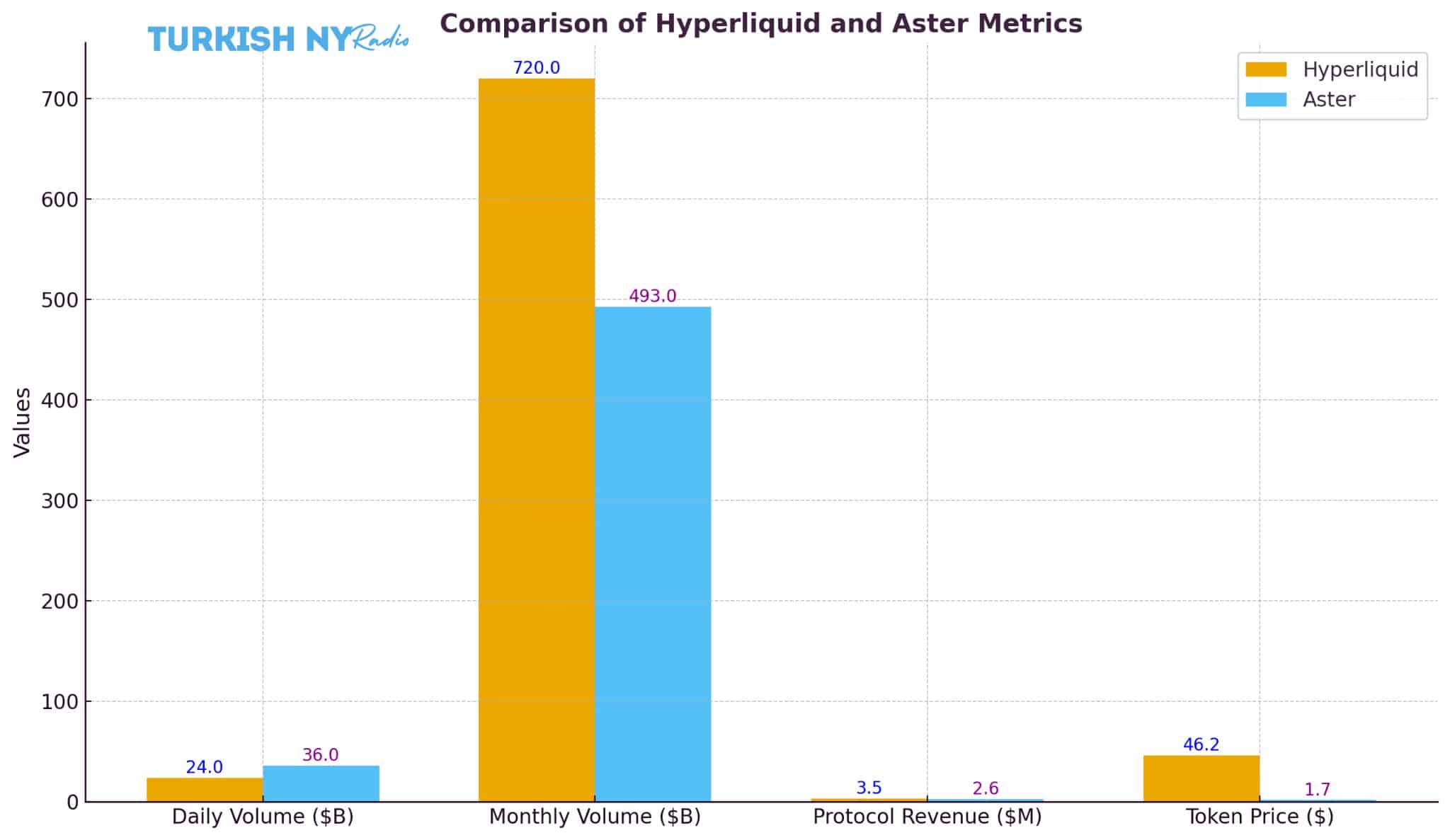

On‑chain and protocol data: 30‑day perp volume for Aster is $493.6 B.

Hyperliquid continues to post a strong fee generation and open interest base for comparison purposes, though published like‑for‑like revenue numbers are rather opaque.

The gap is indicative of those price levels. Hyperliquid has a much higher per‑token value, whereas Aster surfs the volume‑driven megahype wave in Perp DEXs.

Aster’s Volume Spike Raises Alarm and Opportunity

Aster now tops a growing number of daily volume leaderboards. One recent day, the Perp DEX ecosystem hit $70 B in trading volume, of which $36 B could be attributed to Aster, more than half of daily global activity.

That run‑up was largely a product of aggressive incentive programs, like token airdrops, point farming, and yield rewards for volume takers.

A big whale swap has been confirmed with blockchain data, showing $8.9 m worth of HYPE sold and moved into Aster in a momentum‑inducing move, suggesting a rotation out of Hyperliquid as whales sense the gravity of the situation.

“But these are not necessarily sustainably protocol‑driven revenue or user retention, as rewards are dropped.”

Revenue, Liquidity and Tokenomics

Hyperliquid is still capitalizing on that structural advantage. HYPE token is supported by a fee‑to‑buyback model, where a large percentage of the trading fees are dedicated to buying back Hype from the market. It serves as a long‑term support structure that many of the newer DEXs don’t have.

This makes Hyperliquid resilient thanks to deep liquidity, multiple integrations across chains, and a solid ecosystem of derivative products. Whereas the raw volumes behind Aster draw attention, Hyperliquid’s underpinnings may provide more defense in downturns.

One muses that Aster’s fees revenue (7‑day average) is 2.6× that of Hyperliquid under the peak window, a red sign when it comes to valuation comparisons between the respective fortunes.

Additional risk for both networks lies in token unlock and supply concentration, particularly in the case of Aster, where it has been said that a handful of wallets hold significant shares of circulating ASTER supply.

Price Outlook Scenarios (Not Investment Advice)

| Time Horizon | Bear Scenario | Base Scenario | Bull Scenario |

|---|---|---|---|

| Q4 2025 | HYPE: $35–$42; ASTER: $0.90–$1.20 | HYPE: $45–$55; ASTER: $1.50–$2.20 | HYPE: $60–$75; ASTER: $2.50–$3.50 |

| Q1 2026 | HYPE: $30–$45; ASTER: $0.70–$1.50 | HYPE: $55–$70; ASTER: $2.00–$3.00 | HYPE: $80–$100; ASTER: $3.50–$5.00 |

Assumptions: sustained Perp DEX growth, controlled unlocks, neutral macro environment, no major exploits.

What Protocol Leads the Way?

Aster’s assertive arrival will not have gone unnoticed, particularly because of the speed with which volume has shot up. Still, the Perp DEX sector is poised to mature in a way that revenue, durability, and tokenomics separate hype from platform shelf life.

Hyperliquid is also a lighthouse; the HYPE price already factors further utility in, anchored by fee recycling and token backing. Aster will have to turn volume into revenue, retention, and governance strength in a sustainable way.

Summary

Aster hits DEX volumes of $493 billion with new DeFi records, beating Hyperliquid by insane percentages. Despite the hype, Hyperliquid has better fundamentals that are backed not only by its buyback fee model but also a thicker pool of liquidity.

HYPE price is trading at around $46, with ASTER near the level of $1.69. Aster’s momentum‑driven growth is called into question by analysts while Hyperliquid takes the lead in evolving Perp DEX competition.

Glossary of Key Terms

Perp DEX (Perpetual Decentralized Exchange)

A separate platform where people trade contracts linked to coin prices that don’t expire; think of betting on a team without requiring the game to end.

Hyperliquid (HYPE)

A decentralized DEX trading platform offering deep liquidity and high fee‑based rewards. Part of the value goes to its native token, HYPE, which sees the price increase through regular buybacks.

Aster (ASTER)

A recently launched perpetual exchange also growing rapidly with benefits such as rewards and airdrops. Think of it as a new store offering discounts to lure shoppers.

HYPE Price

The dollar value of Hyperliquid’s token on the market. It varies from day to day based on trading volume demand, fees collected, and general market conditions for crypto.

Trading Volume

The aggregate value of trades that have occurred on an exchange at a given time, similar to how busy a market is in terms of items bought and sold.

Protocol Revenue

The trading fees collected by the platform. It’s like seeing a shop’s daily income after sales, and it’s how customers gauge just how sustainable the business model is.

Tokenomics

The rules and design of a token: how many there are, how they are released, and what they are used for. Consider it a coin’s playbook.

Incentives

Incentives for traders to trade on a platform, which includes tokens or discounts. Like supermarkets giving out loyalty points or free samples to get people buying.

Frequently Asked Questions About Hyperliquid vs Aster

What sets Hyperliquid and Aster apart in the Perp DEX market?

Hyperliquid pursues sustainable earnings through the fee‑to‑buyback model, whereas Aster targets trading volume growth via a stimulus package including incentives, airdrops and token farming mechanics.

What’s the current HYPE price in comparison to ASTER?

HYPE trades at about $46.2 and is underpinned by further liquidity depth, while ASTER is closer to $1.69 and favored by incentive‑driven trading volumes.

What are the benefits of using Hyperliquid artists compared to Aster for permanent users?

Hyperliquid offers better fee capture, deeper liquidity, and token buybacks that help HYPE maintain its value more sustainably than Aster’s spike in short‑term incentives.

Are there any downside risks in Aster’s robust growth?

Aster’s extensive use of incentives has raised questions about its long‑term sustainability. These include high thresholds to adoption for general users, concentrated token distribution, high‑leverage products and uncertain revenue models that could affect user trust over the long run.