IBM has unveiled the IBM Digital Asset Haven, a new platform designed to enhance the secure management capabilities for digital assets. This platform is intended for financial institutions, governments, and enterprises. The launch occurred in October 2023, as reported by BlockBeats News.

The IBM Digital Asset Haven facilitates the secure management of the digital asset lifecycle. This development is expected to impact financial infrastructures and operations. However, there are no immediate shifts in token markets or on-chain analytics that are forthcoming as a direct result of this launch.

IBM's 40+ Blockchain Solution Targets Financial Institutions

IBM's Digital Asset Haven is specifically engineered to empower enterprises and government entities to manage the entire lifecycle of digital assets, from custody to settlement. This initiative was developed through a collaborative effort, including a technical partnership with Dfns, which focuses on cryptographic security.

The platform is anticipated to significantly influence the financial sector by offering a unified solution that supports over 40 blockchains. It is designed to improve operational efficiencies in handling digital assets, enabling institutions to navigate complex regulatory landscapes with greater ease. Developments like these highlight the increasing integration between traditional financial institutions and blockchain technology.

Initial market reactions suggest a cautious sense of optimism among financial institutions regarding this new platform. While industry experts recognize its considerable potential, there have been no immediate large-scale institutional fund flows or on-chain analytics that reflect a direct impact on the broader market at this time.

Bitcoin Price Movement Amidst IBM's Entry into Digital Assets

IBM's foray into digital asset management echoes its earlier blockchain initiatives, signaling a sustained commitment to enterprise-grade solutions amidst evolving regulatory environments.

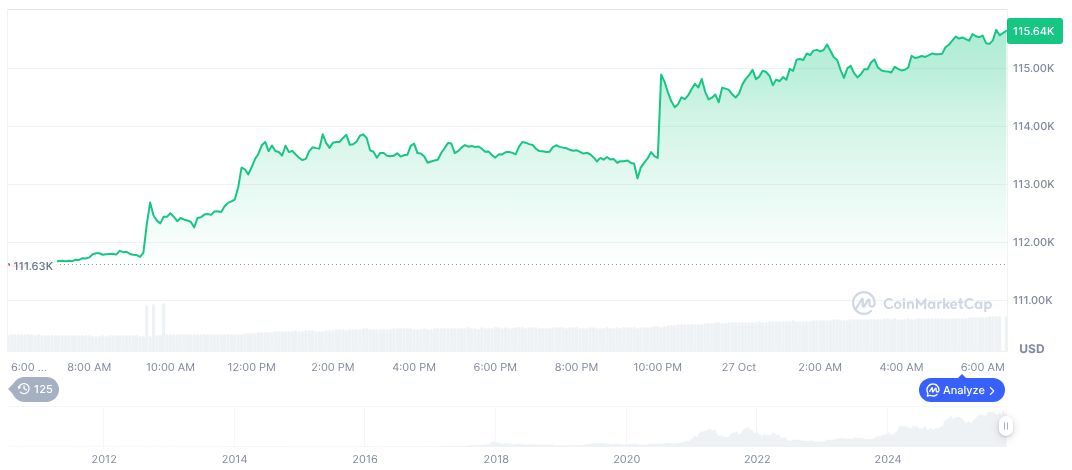

As of October 27, 2025, Bitcoin (BTC) holds a market capitalization of $2.30 trillion and a trading volume of $60.35 billion. This represents an 80.32% increase. The price of Bitcoin has seen a recent uptick of 1.70% in the last 24 hours. This data was sourced from CoinMarketCap.

Experts from the Coincu research team propose that the IBM Digital Asset Haven could catalyze significant advancements in regulatory compliance frameworks. The platform's emphasis on quantum-safe solutions aligns with industry demands for robust digital asset infrastructure, potentially shaping future financial and technological landscapes.