Traders are closely observing whether Litecoin can regain its position as "digital silver" following a challenging October, which saw a broad market reset led by Bitcoin.

Concurrently, a payments project named Remittix (RTX) continues to attract attention for its real-world utility, extending beyond typical trading cycles. The central question remains: can Litecoin maintain its key price levels as Bitcoin stabilizes and trading volume returns to spot exchanges?

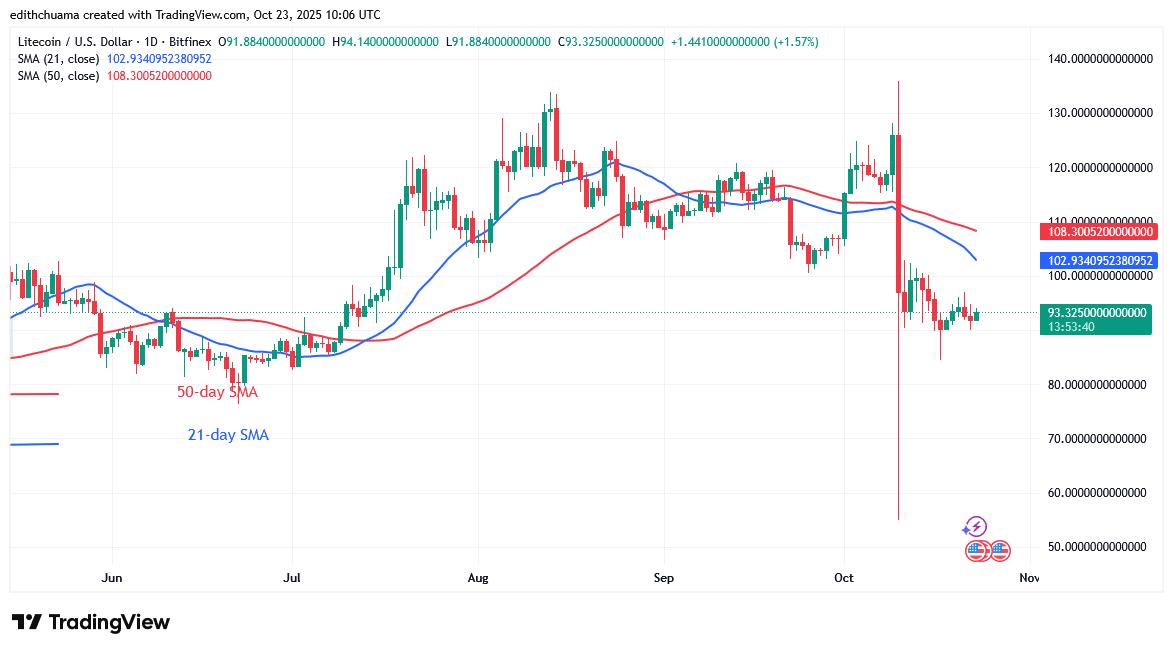

Litecoin Price Action: Key Support and Resistance Levels to Watch

Litecoin experienced a decline mid-month, trading below the $90 mark. This drop occurred after a surge that began in October, with the cryptocurrency closing around $94 on October 23. Analysts suggest that Litecoin's market value could potentially rebound with an increase in market liquidity, particularly influenced by Bitcoin's performance.

Santiment had previously flagged Litecoin as overheated in early October. However, as market sentiment weakened, caution set in. Traders are now intently monitoring the $100–$110 zone, which is identified as the first critical level to confirm strength. Should this range be surpassed, attention is likely to shift towards targets between $120–$135 as November approaches.

Bitcoin Trends Shape Litecoin’s November Outlook

Bitcoin's recent pullback towards the $100,000–$110,000 range has diminished investor interest in other altcoins, including Litecoin. Nevertheless, if Bitcoin's price stabilizes around its 50-week moving average, Litecoin could experience a faster recovery. For a short-term outlook on Litecoin's price, traders are observing miner performance and Exchange-Traded Fund (ETF) activity for relevant signals. A recent update from VanEck indicated stress among Bitcoin miners, suggesting a potential limitation on new supply and a greater influence from capital flows.

Remittix Offers Real Payment Utility Over Market Cycles

While Litecoin often moves in correlation with Bitcoin, its primary use case is not payments. In contrast, Remittix is specifically designed for payment solutions. The project's team is verified on CertiK and holds the number one ranking for Pre-Launch Tokens on the CertiK leaderboard, indicating a high level of trust and security. The ongoing live wallet beta demonstrates clear product development progress.

The project's traction is evident in its sales figures: over 681 million tokens have been sold at $0.1166 each, raising more than $27.7 million to date. Confirmed listings on BitMart and LBank are in place, with a third exchange pending. The RTX50 bonus incentive remains active as the fundraising campaign nears its $30 million target.

For investors aiming to balance their portfolio between established assets like Litecoin and projects with demonstrable real-world utility, Remittix presents a compelling option. It combines verified security, live product testing, and attractive user incentives.

November Forecast: Can LTC Hold Its “Digital Silver” Status?

Litecoin has the potential to maintain its "digital silver" status provided that Bitcoin stabilizes and market flows improve. If buyers regain dominance, the next price targets are projected to be between $120–$135 by mid-November. A stronger upward trend in Bitcoin could further support Litecoin's recovery through the remainder of the year.

For investors seeking exposure to the payments sector without being solely reliant on daily price fluctuations, Remittix offers an alternative investment avenue. Its foundation in verified security and live product testing positions it as a practical complement to holding Litecoin, especially while Bitcoin continues to significantly influence overall market sentiment.