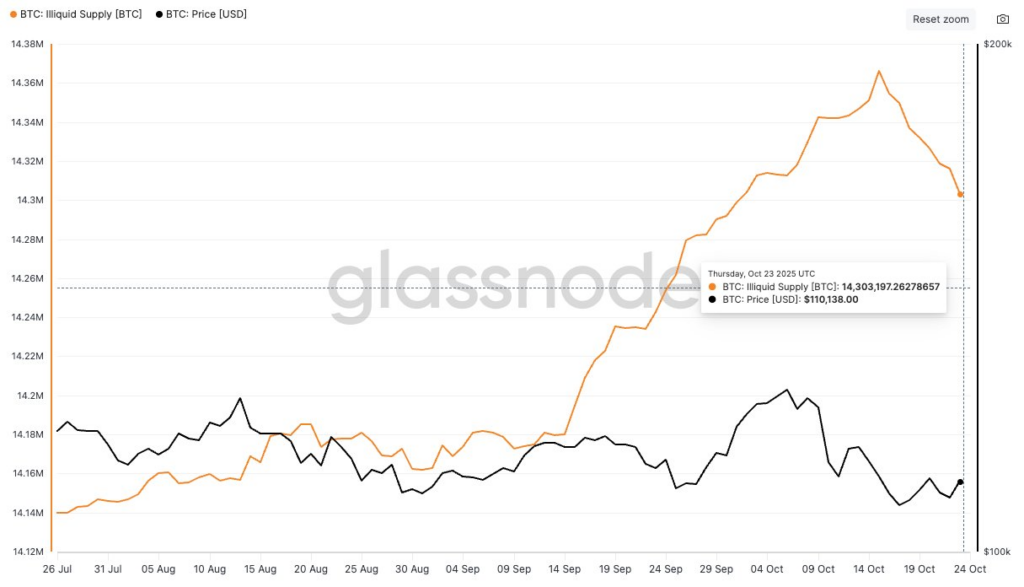

Bitcoin’s market structure is showing signs of strain as long-term holders begin moving their coins, leading to a decline in illiquid supply. New data from Glassnode reveal that around 62,000 BTC—worth nearly $7 billion—have left long-term, inactive wallets since mid-October, marking the first major drawdown in the second half of 2025.

This shift suggests that long-standing investors are taking profits or redistributing their holdings—a move that could slow Bitcoin’s recovery momentum. The outflow coincided with a price drop from an all-time high of over $125,000 in early October to around $115,000.

Whales Quietly Buy the Dip While Long-Term Holders Cash Out

Despite the pullback, whale wallets—those holding large amounts of BTC—appear to be accumulating during the correction phase.

Glassnode reported that whale wallets have increased their Bitcoin holdings over the past month and largely maintained their positions since October 15, showing limited selling activity during this period. This suggests that while some long-term holders are exiting, larger investors may be positioning for potential mid-term gains.

Bitcoin Holds Above Key Support, but Weak Spot Demand Limits Upside

Wallets holding between $10,000 and $1,000,000 worth of BTC have shown consistent outflows since late 2024. The firm attributes these outflows mainly to weak market demand.

Many short-term traders who bought during the rally have now exited, while new buyers have yet to enter the market with enough volume to offset the selling pressure. This imbalance has weighed on prices and weakened short-term recovery prospects.

Momentum buyers have largely exited, while dip-buyers failed to step in with enough demand to absorb that supply. With first-time buyers flat, this imbalance is pressuring prices until stronger spot demand returns.

Glassnode

As of now, Bitcoin trades around $116,000, hovering above a key support level near $113,000. Analysts view holding this zone as critical to maintaining market stability.

Key Market Observations:

- •Bullish Market Outlook: Bitcoin’s current price sentiment remains bullish, signaling strong investor confidence and positive market momentum.

- •Technical Strength: The asset continues to trade above the 200-day simple moving average, reinforcing its long-term uptrend structure.

- •Consistent Performance: Bitcoin has recorded 18 green days out of the last 30—a solid 60% win rate indicating sustained buying pressure.

- •Dominance Retained: With a market dominance of 57.86%, Bitcoin continues to assert its leadership over the broader cryptocurrency market.

However, weak inflows and a cautious trading environment may hinder Bitcoin’s ability to retest the $120,000 mark. Without renewed liquidity, price action could remain range-bound in the short term.

Fidelity Sees 42% of Bitcoin Going Illiquid by 2032 as Holders Lock In Supply

Glassnode’s findings align with broader market trends showing a decline in the percentage of BTC in profit. Currently, about 82.3% of the circulating supply remains profitable, down from its October peak.

A separate report by Fidelity Digital Assets projects that by Q2 2032, roughly 42% of all Bitcoin—about 8.3 million BTC—could become illiquid if current trends persist. The report adds that increased nation-state adoption and evolving regulations could accelerate this trend, reinforcing Bitcoin’s long-term scarcity narrative even amid short-term volatility.