The International Monetary Fund issued a warning on December 5th, stating that U.S. dollar-backed stablecoins possess the potential to undermine monetary sovereignty in weaker economies. This is primarily achieved by facilitating currency substitution, where individuals and businesses opt for stablecoins over their local currencies.

Such stablecoins could reinforce the dominance of the U.S. dollar, thereby challenging the control central banks have over capital flows. This shift could lead to destabilizing effects within local monetary systems, particularly in regions that are already vulnerable.

IMF Concerns Over Stablecoin Impact on Monetary Sovereignty

The International Monetary Fund has highlighted that U.S. dollar-backed stablecoins, especially when used in cross-border transactions, could lead to the erosion of local currencies. Economies that already possess weak monetary controls might experience an increased preference for these digital assets over their traditional fiat money. Economists affiliated with the monetary authority emphasize that significant transformations in currency usage patterns can indeed undermine local sovereignty. The IMF's assessment states, "U.S. dollar‑backed stablecoins could accelerate currency substitution in countries with weak currencies, thereby undermining local monetary sovereignty and central banks’ control over capital flows."

Severe economic effects are anticipated as a consequence of this trend. Stablecoins may diminish the effectiveness of traditional banking systems, as users are increasingly drawn to the lower friction associated with digital transactions. The IMF underscores that the proliferation of dominant dollar-backed stablecoins could trigger complex and far-reaching shifts in capital flows, necessitating careful international cooperation and robust regulation. According to IMF documents, minimizing these risks involves the implementation of effective safeguards designed to protect against potential threats to financial stability.

The implications of these economic shifts could be profound, potentially leading to increased instability in local economies that depend heavily on the stability and control of their own currencies.

Tether's Market Position and Financial Stability Risks

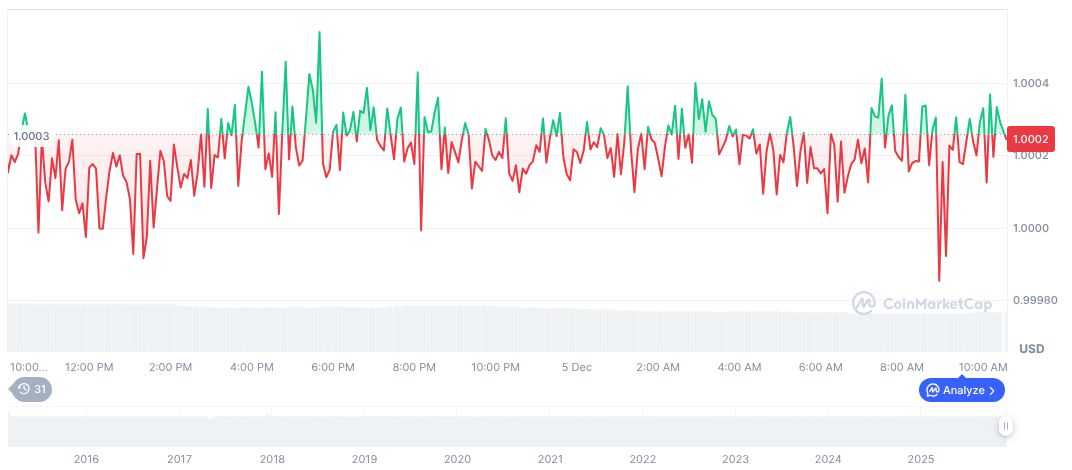

Data indicates that Tether USDt (USDT) has maintained a stable price of $1.00. Its market capitalization stands at 185.57 billion, representing 5.97% of the total cryptocurrency market. The 24-hour trading volume reached $88.97 billion, signifying high usage, despite an observed 18.72% decrease. Over the past three months, the coin's price stability reflects its fixed valuation mechanism.

Coincu analysts have pointed out that enhanced financial stability risks may emerge as the use of stablecoins continues to grow. Significant regulatory challenges persist, as the conventional scope of financial oversight appears to be declining in the face of decentralized trends. This situation is sparking extensive discourse regarding the future structures of the global economy.

Historical Context: During previous waves of dollarization, countries experiencing high inflation often turned to the U.S. dollar for savings. Currently, stablecoins offer a digital parallel to this phenomenon, likely accelerating the adoption of this shift.