India is making a loud statement in the silver market, and investors around the world are starting to take notice.

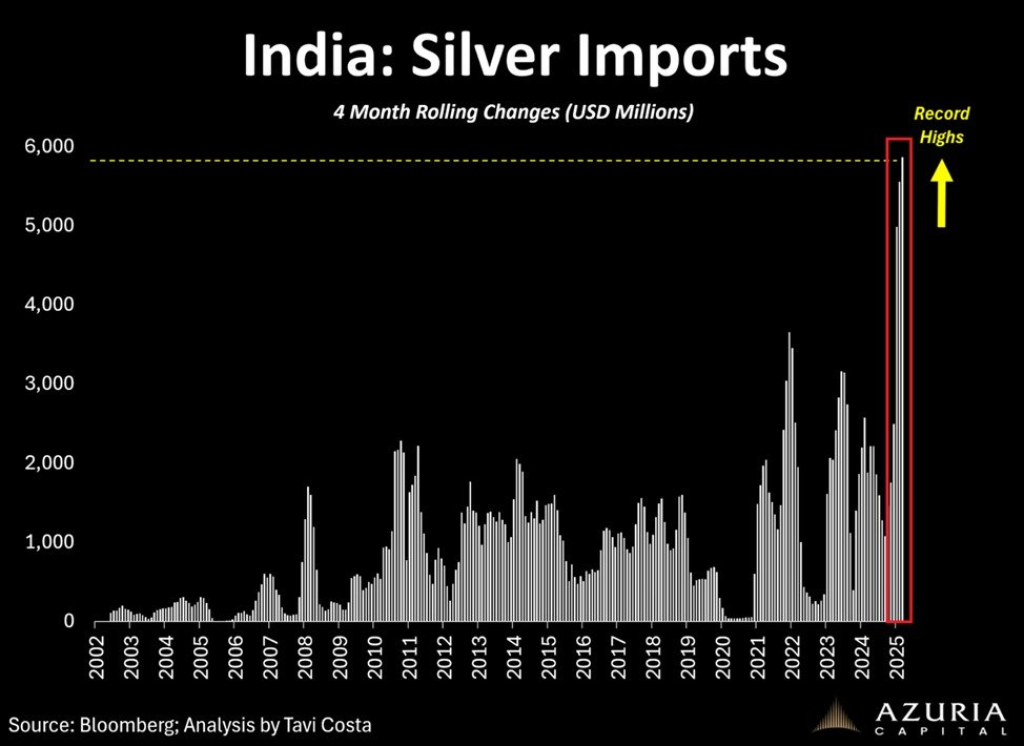

Over the last four months, India’s silver imports surged to a record $5.9 billion, marking one of the most aggressive accumulation phases in the country’s history. That figure means an incredible 400% increase since Q4 2024 and now sits 64% above the previous peak recorded in 2022.

To put that in perspective, between 2013 and 2019, India imported just around $1.5 billion worth of silver per year on average. Today, it is absorbing nearly four times that amount in just a few months.

This looks like a structural shift.

Why India Is Buying So Much Silver

India is already one of the world’s largest silver consumers, with demand spread across three major areas: jewelry fabrication, physical investment, and industrial use.

Jewelry remains culturally embedded in Indian society, but what’s changing is the industrial and energy side of the equation. Silver is a critical input for electronics, EV components, and solar energy, all sectors where India is expanding aggressively.

The country’s push toward renewable energy, particularly solar, is a key driver here. Silver is used heavily in photovoltaic cells, and as India ramps up domestic solar production, silver demand becomes less optional and more strategic.

At the same time, physical silver has been attracting strong interest from Indian investors as a hedge against currency debasement, inflation, and geopolitical uncertainty. With global trade fragmentation and persistent macro risk, silver is increasingly viewed as a hard asset rather than a speculative metal.

Metal Stocks Are Confirming the Trend

This silver rush is not happening in isolation.

India’s Nifty Metal Index, which tracks major metal and mining companies, is off to its best start to a year since 2018. Even more telling, the ratio between the Nifty Metal Index and the broader Nifty 50 is now sitting at its highest level in 11 years.

That means metal stocks are significantly outperforming the broader equity market.

Historically, this kind of divergence tends to show up early in commodity bull cycles, when capital begins rotating into hard assets and producers before the wider market fully catches on.

In other words, India’s equity market is already reflecting what the physical silver market is signaling.

What This Means for the Global Silver Market

India does not operate in a vacuum. When a country of this scale starts absorbing silver at record rates, it tightens global supply in a market that is already structurally constrained.

Global silver production has struggled to grow meaningfully in recent years, while industrial demand keeps rising. That combination leaves little room for sustained large-scale buying without price pressure eventually following.

This is why India’s silver imports matter beyond just domestic demand. They add fuel to an already tightening global silver market at a time when investment demand is also picking up elsewhere.

If India continues buying at anything close to current levels, it becomes increasingly difficult for silver prices to remain suppressed for long.

What Silver Proves Right Now

India’s aggressive silver accumulation, combined with metal stocks outperforming at an 11-year extreme, shows a clear picture: capital is moving back into real assets.

This is not just about jewelry or short-term speculation. It shows a deeper shift toward strategic resource accumulation and hard-asset exposure in a world facing inflationary pressures, energy transitions, and geopolitical fragmentation.

Silver, once again, is proving that it is both a monetary metal and an industrial backbone, and India is positioning itself accordingly.

Whether global markets are fully ready for that message is another question.

But India’s actions are already answering it.