Digital Rupiah Initiative

The Central Bank of Indonesia plans to launch a digital version of the Rupiah by 2030, with phased testing commencing in 2025. This initiative aims to integrate digital securities, streamline monetary operations, and explore advanced cryptocurrency features. The project positions Indonesia at the forefront of digital finance innovation, potentially reshaping the country's financial infrastructure through distributed ledger technology and tokenized government bonds.

Phased Rollout and Features

Bank Indonesia's plan for a digital Rupiah involves a phased roadmap. Extensive testing is scheduled between 2025 and 2028, focusing initially on digital securities issuance. By 2030, the project aims to incorporate advanced features, all while utilizing distributed ledger technology. Governor Perry Warjiyo is leading this initiative.

The phased rollout will begin with digital securities and subsequently expand to encompass broader financial transactions. The initiative's core objective is to integrate programmability and tokenization into the monetary framework, with the potential to significantly influence the operation and efficiency of the financial market.

"We will issue Bank Indonesia securities in digital form — the digital rupiah with underlying SBN, Indonesia’s national version of a stablecoin." — Perry Warjiyo, Governor, Bank Indonesia

Indonesia Joins the Asian CBDC Movement

Indonesia's decision to develop a digital Rupiah aligns with similar initiatives by other Asian nations, including China and Hong Kong, which have also been conducting Central Bank Digital Currency (CBDC) trials. These efforts aim to strengthen local currency infrastructure and potentially reduce reliance on USD-pegged assets.

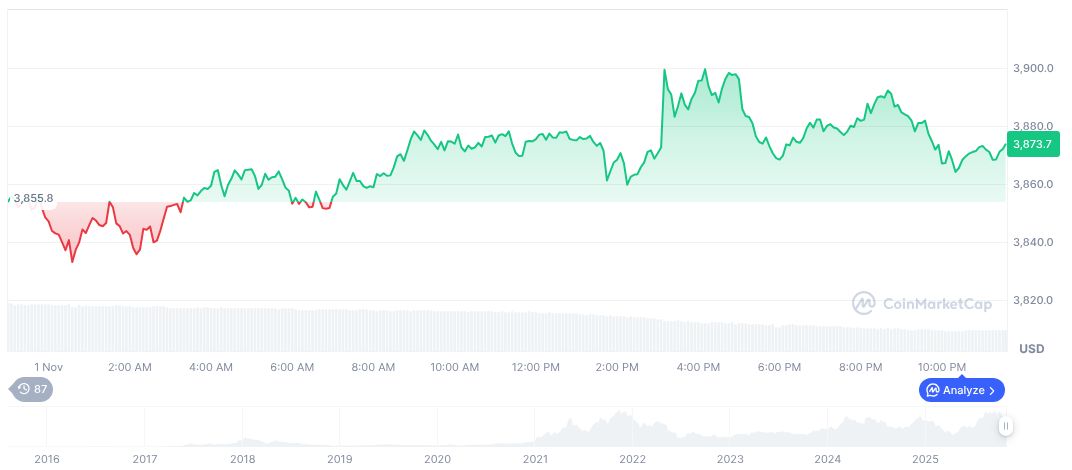

Ethereum (ETH) was trading at $3,879.52 with a market capitalization of $468.25 billion as of November 2, 2025. Recent data indicated a 0.74% increase over the past 24 hours, despite a 60-day downtrend of 10.54%.

Coincu's analysis suggests that the phased integration of the digital Rupiah is expected to drive blockchain adoption within Indonesia. This adoption is anticipated to enhance payment systems and improve financial transparency. This strategic approach is consistent with the global trend towards digital currencies for better financial governance.