Injective's IIP-617 proposal, known as the "Supply Squeeze," is on the verge of passing with an overwhelming 99.89% of voters supporting the measure. The governance vote is scheduled to conclude today, January 19, 2026, at 16:17 UTC, signifying the most substantial tokenomics update in the protocol's history. If approved, the proposal will double INJ's deflation rate, positioning the token as one of the most deflationary assets within the cryptocurrency space.

Key Changes Introduced by IIP-617

The proposal addresses both aspects of the supply equation. Firstly, it significantly reduces the current annual inflation rate, which stands at approximately 8.88% and results in the minting of around 10 million INJ tokens each year. Secondly, it enhances the burn rate by increasing the percentage of network fees collected from auctions that are destroyed to 8%.

This adjustment is designed to create a fundamental shift in the protocol's mechanics. Instead of relying on discretionary burn events, deflation will become an intrinsic part of the protocol's design. As network activity escalates, the burn rate is expected to surpass the minting rate, leading to a net contraction of the token's supply.

Injective has already demonstrated a commitment to supply reduction, having burned approximately 6.85 million INJ to date through its Community BuyBack program and application fees, accounting for about 6% of the circulating supply. IIP-617 aims to accelerate this process by making deflation an automatic outcome rather than dependent on ad-hoc decisions.

Current Voting Status

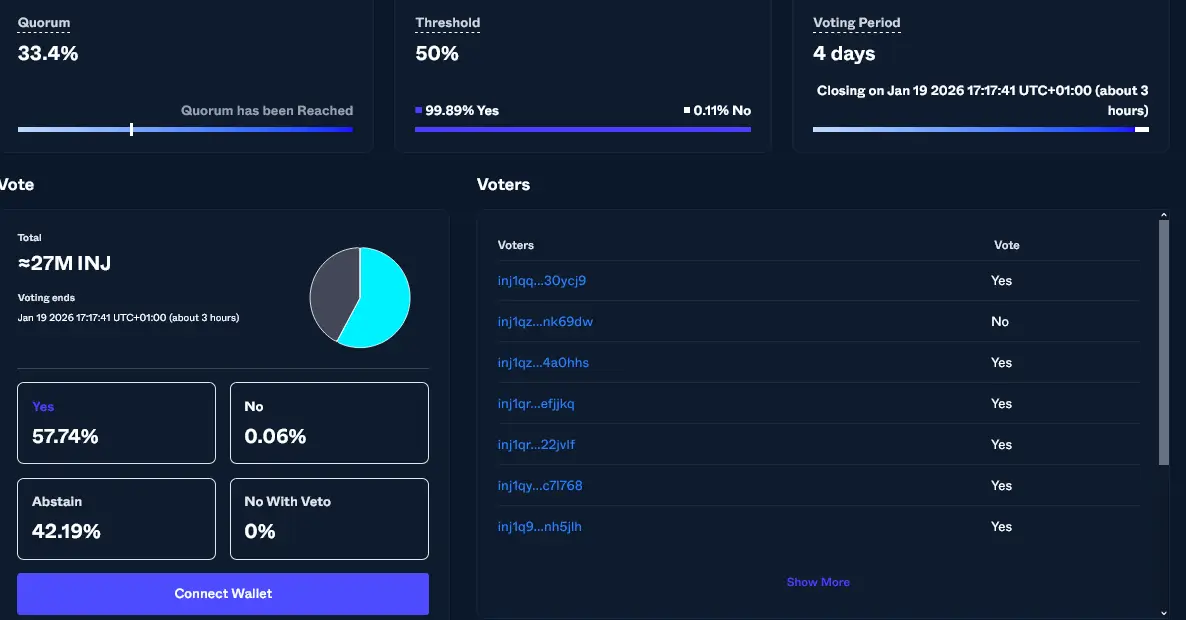

The voting results indicate a strong consensus in favor of the proposal. Approximately 27 million staked INJ tokens have participated in the vote. Among the voters who cast a definitive Yes or No, support is nearly unanimous: 99.89% voted in favor, while only 0.11% voted against.

When considering the total voting power, 57.74% of the votes were cast as Yes, 0.06% as No, and a significant 42.19% chose to Abstain. No votes were registered for the "No With Veto" option.

The proposal successfully reached its quorum requirement on January 16, just one day after Injective Labs submitted it. Governance rules mandate a minimum participation of 33.4% of staked INJ for a proposal to be considered valid, and the proposal has comfortably surpassed the 50% approval threshold. If the proposal is approved as anticipated, the implementation process could commence as early as January 20.

Community Reactions and Perspectives

The sentiment expressed across social media platforms is predominantly bullish. Supporters emphasize the long-term benefits of aligning network growth with token scarcity. Discussions related to Injective have been dominated by posts encouraging a "Vote Yes," with many users drawing parallels between the proposed deflationary model and Bitcoin's fixed supply mechanism.

However, some critics raise a valid concern. At the current levels of network activity, INJ remains net inflationary, with the 8.88% annual minting rate exceeding the amount burned from circulation. Without increased adoption that drives higher network fees, the protocol may not achieve net deflation.

"Even if passed, INJ will remain net inflationary," one trader noted on X. "Only wider adoption can make burns dominate the mint rate." This highlights the ongoing debate between the structural improvements offered by the proposal and the necessity of real-world adoption for its success. While the proposal establishes the framework for deflation, its ultimate effectiveness hinges on Injective's ability to attract more users and boost transaction volume across its decentralized finance applications.

Implications for INJ Holders

For stakers, this proposal reinforces the value of long-term commitment to the network. A reduced issuance rate translates to less dilution, while the enhanced burn mechanism, funded by network revenue, creates a direct correlation between the ecosystem's growth and the token's value.

The timing of this tokenomics upgrade is also significant. Tokenomics adjustments have become a prevalent strategy among major protocols, mirroring trends seen in Ethereum's fee burns and Solana's supply mechanics. By positioning itself as a leading deflationary asset, Injective aligns with the broader industry trend of networks competing on their economic design.

Despite the potential benefits, risks remain. If user adoption falters, the inflationary baseline will persist. The proposal focuses on parameter changes rather than core code modifications, thus avoiding technical risks associated with new smart contract deployments. However, the underlying economic thesis is entirely dependent on Injective's capacity to expand its user base.

Final vote counts can be monitored on the Injective Hub. Results are expected to be confirmed shortly after the closing time of 16:17 UTC today.