Bitcoin's recent price action indicates a potential shift in its long-term trend. The cryptocurrency has fallen below significant support levels, raising concerns about a broader correction. As Bitcoin risks losing the momentum that has driven its bullish run since 2021, traders and investors are closely monitoring key technical indicators and market sentiment to anticipate the next move.

After defending the 50-week simple moving average (SMA) last week with a robust weekend rebound, Bitcoin is now approaching a critical juncture. Unless the price recovers above $101,000 by Sunday, it may close below this key indicator, further jeopardizing its two-year upward trajectory.

This support level, active since September 2023, has been pivotal in maintaining Bitcoin’s broader bullish outlook. A weekly close beneath it would invalidate the long-standing trend and suggest weakening bullish momentum, possibly leading to a deeper correction.

Technical Breakdown and Shifting Market Dynamics

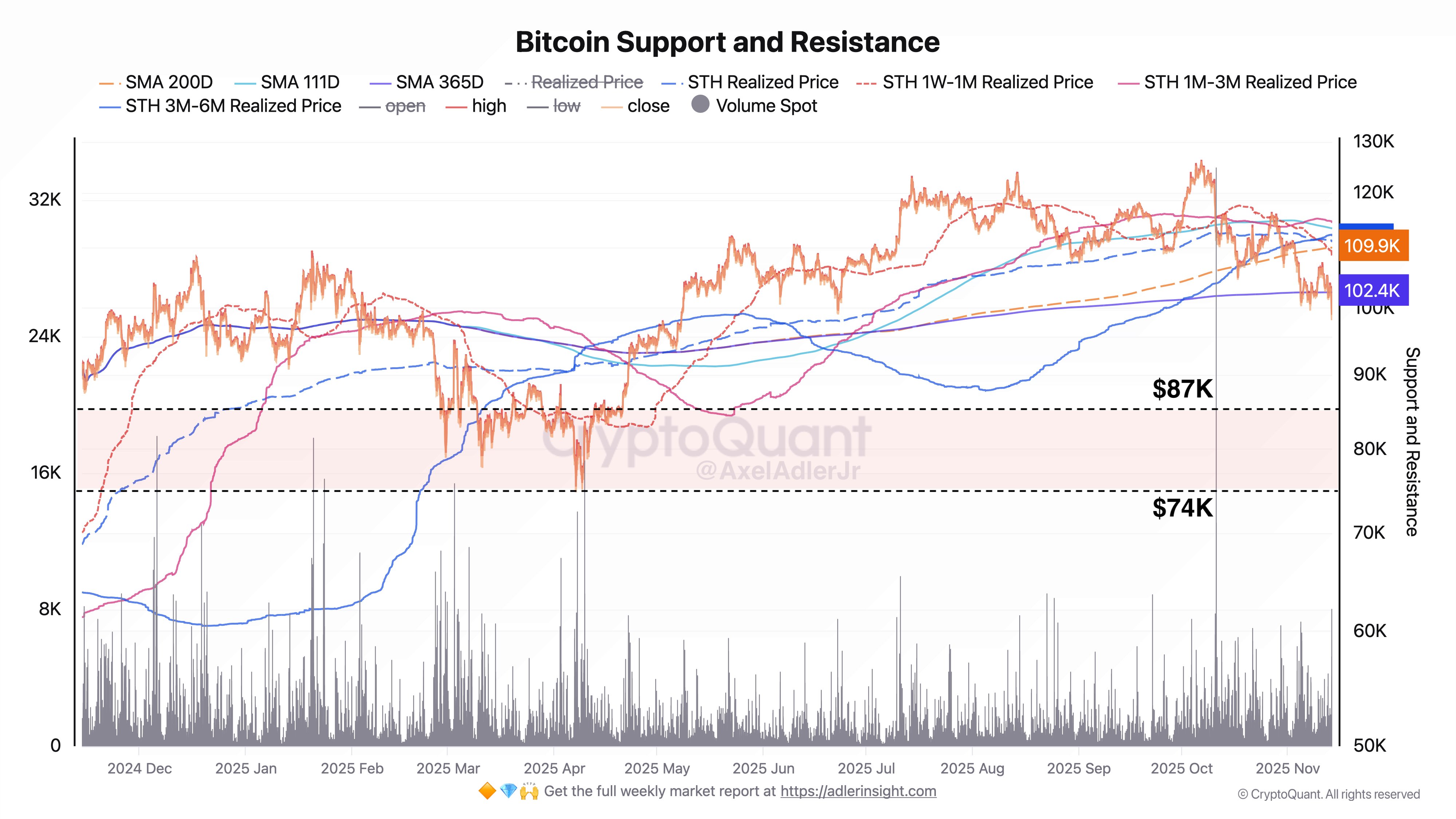

Bitcoin researcher Axel Adler Jr. emphasized the gravity of the breakdown, stating, “there is no support left in the market, all key metrics have flipped into resistance,” after the asset lost $100,000 on November 14. The breakdown reflects widespread technical erosion and shifting market dynamics.

Data on short-term realized price bands reveal deteriorating support zones. Notably, the 1-week to 1-month realized price at around $102,400 and the 1-month to 3-month band near $98,000 have become overhead hurdles. This follows over $1.1 billion in liquidations, indicating heightened selling pressure.

Potential Stabilizing Support and Investor Capitulation

However, some analysts suggest that a stabilizing support could be near $94,000, aligned with the cost basis of six-to-12-month holders. A bounce from this zone might offer technical relief, but a sustained drop below it could accelerate losses and reinforce a bear market trend.

Market stress indicators show that the recent decline has heightened panic among new and short-term investors. Data highlights that investors who bought Bitcoin in the past six months are now facing an average loss of 12.79%, a typical sign of capitulation. This phase often signals the final flush of weak hands before a potential recovery begins.

Despite the recent turbulence, some analysts maintain a cautiously optimistic view, suggesting that this capitulation could clear the way for long-term holders and eventual stabilization. Yet, caution remains warranted, as technical and on-chain signals point toward increased downside risk in the short run.

This evolving market environment underscores the importance of monitoring key support levels and technical indicators as traders assess whether Bitcoin can sustain its recent losses or if further downside is imminent.