The cryptocurrency market has experienced a slight recovery today, with the Ethereum price outperforming the Bitcoin price over the past few weeks. At the time of writing, the BTC price was trading near its lowest point, while the Ethereum price had increased by more than 2%, suggesting a potential decrease in Bitcoin dominance in the upcoming days.

Furthermore, institutional interest appears to be shifting from Bitcoin towards the altcoin segment. This trend was further supported by the latest fund flow data into the US Spot Bitcoin ETF and other altcoin ETFs that have recently received approval.

The Solana ETF has recorded no outflows since its launch, in contrast to the BTC ETF, which has lost over $1 billion this week. This change in institutional money flow has intensified speculation that a new altcoin season may be forming.

However, analysts caution that one significant risk still looms over the market.

Altcoin Season Optimism Soars, Bitcoin Dominance in Focus

The broader cryptocurrency market has struggled recently, with Bitcoin price failing to break above the $98,000 mark and ETH price hovering around the $3.1k level. Nevertheless, the significant drop in BTC price and recent market trends have sparked discussions about whether altcoins are poised for a broader upward movement.

Institutional data lends support to this sentiment. Spot Bitcoin ETFs in the U.S. experienced over $1 billion in outflows this week, while newly approved altcoin ETFs, such as the Solana ETF, have reported no outflows since their inception.

On the other hand, the XRP ETF recorded the highest volume on its debut compared to other ETFs launched in 2025. Despite this, investors seem to be exploring alternative assets as Bitcoin's momentum slows.

Meanwhile, market participants are closely monitoring Bitcoin dominance for indications of potential future movements in altcoins. At the time of writing, Bitcoin dominance had surged to 58.8% today, while other cryptocurrencies, excluding Ethereum, were up over 1% to 29.4%.

Analysts Reveal Key Insights on Altcoin Season

Amidst the volatile market conditions, analyst Javon Marks highlighted this shift in a recent analysis. He stated that the altcoin sector has once again broken out against Bitcoin, mirroring the trend seen in early 2021.

According to Marks, the earlier breakout initiated one of the strongest phases of the previous altcoin season. He suggested that the current movement could pave the way for another significant rally.

However, not all analysts share the same level of optimism. Market commentator Ted argued that discussions about an imminent altcoin season are premature.

He warned that the broader altcoin market capitalization, excluding stablecoins, must reach a new all-time high before a true altcoin season can commence. Until then, he believes investors should maintain a cautious approach.

Bitcoin Vs. Alts: Analysts Shed Light on Historical Cycle

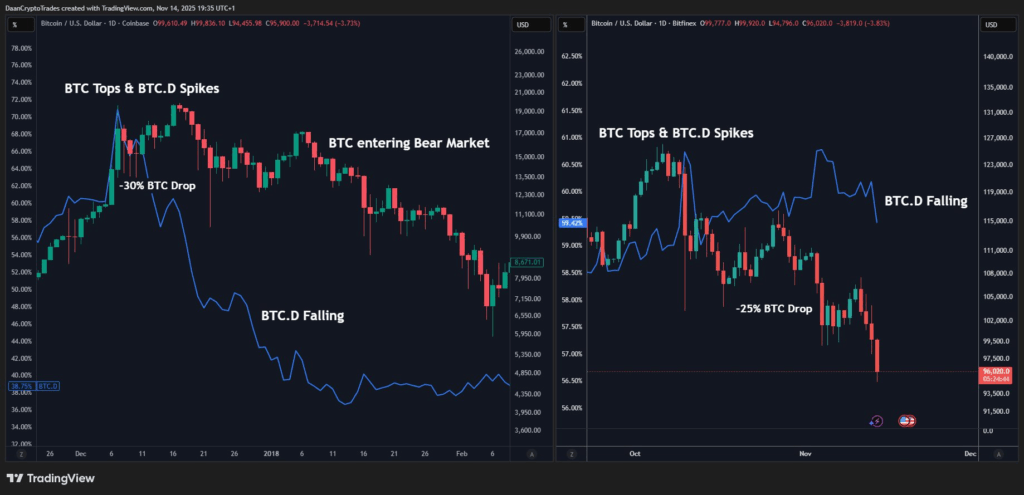

Analyst Daan Crypto Trades compared the current market to the 2017 cycle. He noted that Bitcoin's peak that year led to a sharp decline in Bitcoin dominance and a surge in altcoins for several weeks.

Traders who missed out on the Bitcoin price rally subsequently invested in smaller tokens, causing many of them to increase in value by 20-30% daily. However, he emphasized that today's market is significantly more crowded.

Instead of a few hundred tradable coins, the market now encompasses tens of thousands. In his opinion, this makes a widespread altcoin boom less probable.

Consequently, strength may only emerge in select altcoins. Daan noted that Bitcoin dominance experienced a sharp decline during the latest sell-off, primarily due to Ethereum's resilience.

He suggested that some traders might be cautiously moving into altcoins, anticipating that Bitcoin is nearing a local bottom. Nevertheless, he cautioned that this trend would not persist if Bitcoin loses support near the $94,000 level.