- •AVAX holds a critical $10‑$14 support zone tested since 2021 despite recent losses.

- •Descending triangle pattern suggests breakout potential toward $100‑$140 if resistance is broken.

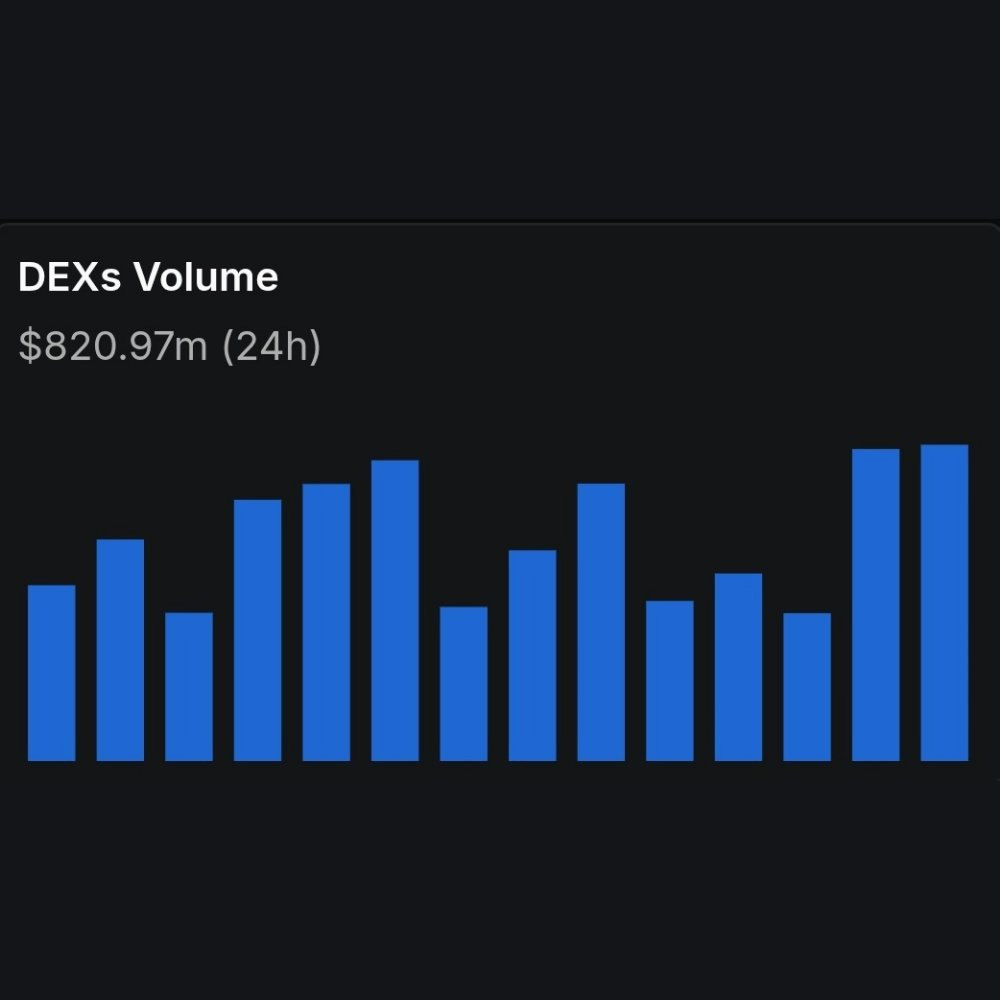

- •Rising DEX and futures volumes show increased trading interest amid price swings.

Avalanche (AVAX) faces a critical moment as it tests a strong support zone near $23. After weeks of decline, traders watch closely for a breakout from the descending triangle that could spark a major price move.

Avalanche (AVAX) is testing a key support level after a tough week. The price is around $22.97, down more than 23% for the week. Even with this drop, AVAX is holding above a strong demand zone between $10 and $14. This zone has acted as a reliable floor since 2021, helping the price bounce back several times, including the recent sharp recovery after a dip.

On the weekly Binance chart, AVAX is facing a long‑term downward trendline from its all‑time high in late 2021. This line has kept the price from moving higher, with several lower highs forming. Each time AVAX tried to break above it, the price has pulled back. If AVAX could push up toward the $100 to $140 range.

The support zone between $10 and $14 is critical to keep the bullish case alive. A clear move above would suggest a reversal after years of sideways action. On the other hand, if price falls below this support, further losses could follow.

Trading volume adds an interesting angle. Decentralized exchanges (DEXs) are showing a spike in activity and have recorded $820 million in 24‑hour volume. High volume like this often leads to sharper price moves.

At the same time, futures markets on Binance and Bybit have seen huge volume increases — over 300% and 500%, respectively — as traders position for volatility.

While selling pressure has pushed the price down, futures open interest has dropped by 30‑50%, indicating many traders are closing their positions. Funding rates remain negative, with short positions slightly outnumbering longs, adding downward pressure to the price.

Avalanche’s market cap is around $9.56 billion, with about 422 million tokens circulating. The coin is facing a tough market but remains a focus for traders because of the strong support and increased volume.

If AVAX breaks above the descending trendline it could mark the start of a new upward trend. For now, keeping above the $10‑$14 support zone is key for the bulls.