Key Takeaways

- •The crypto market has transitioned from retail-driven speculation to institutional-led growth, with major firms managing billions through Bitcoin and Ethereum products.

- •Secure custody solutions and robust compliance frameworks have enhanced the safety and attractiveness of crypto for institutional investors.

- •Institutional participation now contributes to market stability, deeper liquidity, and long-term growth, while retail investors face increased competition and reduced market influence.

The cryptocurrency market has undergone a significant transformation over the past decade, evolving from a domain primarily influenced by retail traders to one increasingly shaped by institutional investors. Large investment firms, hedge funds, and family offices are now actively participating in both spot and derivatives markets, injecting substantial capital and employing sophisticated trading strategies.

This influx of institutional capital has led to increased market liquidity, enabled larger capital inflows, and fostered more structured market behavior. Consequently, the way prices react and the overall ecosystem develops have been fundamentally altered.

Role of ETFs, Wealth Managers, and Large Investors

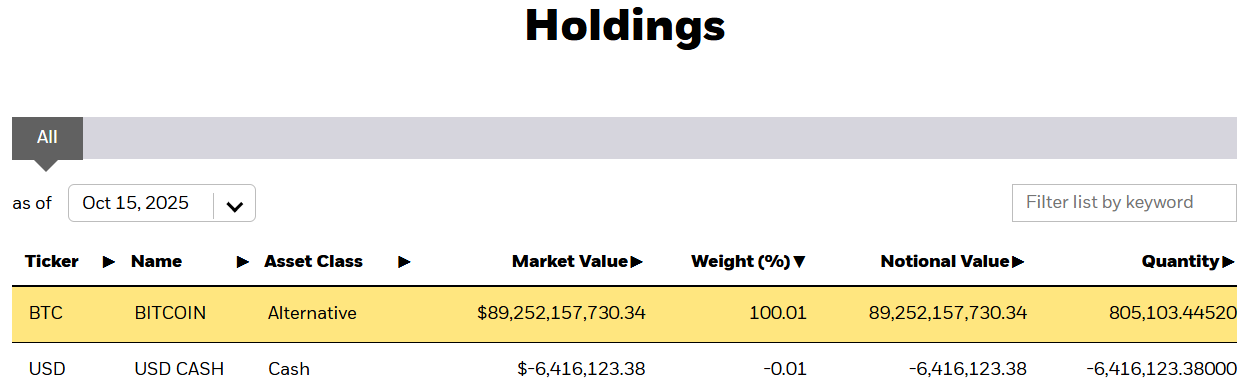

Institutional crypto investors have substantially increased their holdings in Bitcoin and Ethereum, causing marked changes in crypto market dynamics. For instance, BlackRock’s iShares Bitcoin Trust (IBIT) has become the world’s largest Bitcoin ETF, with assets under management surpassing $89 billion.

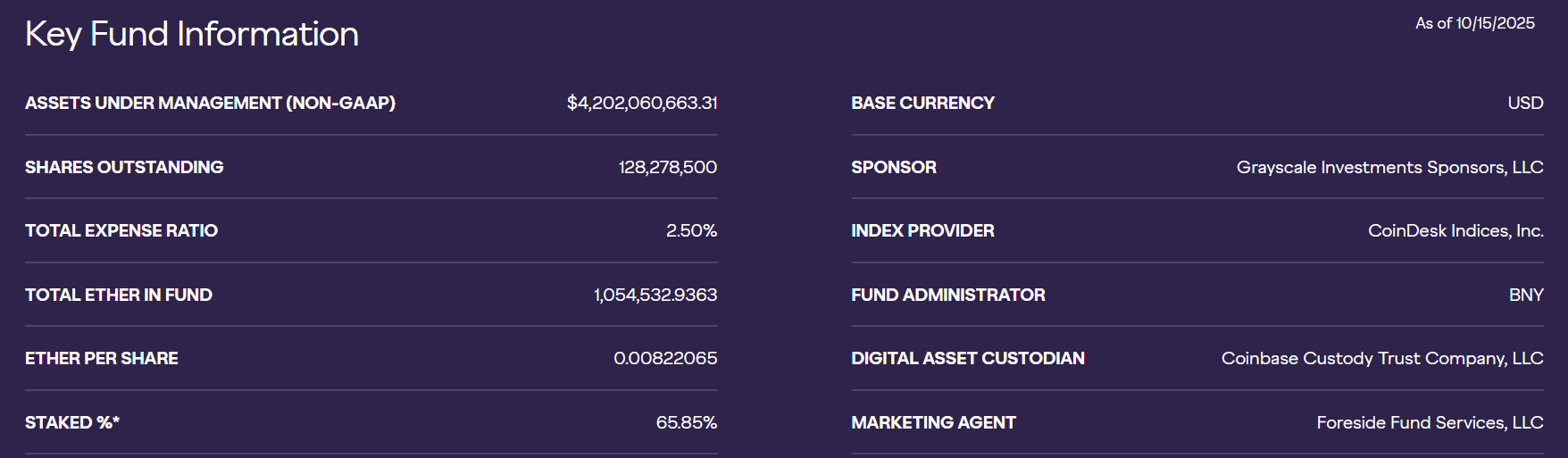

Grayscale’s Ethereum Trust (ETHE) is a prominent institutional crypto vehicle for Ethereum exposure. As of October 2025, ETHE assets under management surpassed $4 billion. This makes it one of the largest Ethereum investment products, widely used by institutional crypto investors seeking indirect exposure to Ethereum’s price movements.

Similarly, family offices are increasingly allocating capital to digital assets. A Goldman Sachs report indicates that 33% of family offices now invest in cryptocurrencies, up from 26% in 2023. Notably, Jim Pallotta’s Raptor Group has committed to a $200 million blockchain-focused fund, underscoring the growing interest among ultra-wealthy investors.

Institutional crypto investors require secure custody solutions to hold crypto safely. Firms like Coinbase Custody, BitGo, and Fidelity Digital Assets offer insured wallets, multi-signature security, and cold storage, enabling large-scale investors to hold Bitcoin and Ethereum safely.

Regulatory compliance also plays a key role. Institutions rely on frameworks that meet SEC, FINRA, and other global standards. ETFs, for example, require custodians and auditors to follow strict rules, thereby reducing risk and building confidence among professional investors. These safeguards have been critical in encouraging large capital inflows from pension funds, endowments, and asset managers.

How Institutional Influence Stabilizes or Alters Markets

Institutional crypto investors, such as hedge funds, asset managers, and large trusts, tend to hold massive positions for longer periods. Their participation can smooth out price swings, providing steadier liquidity compared with highly speculative retail trading. Large-scale buy or sell actions by institutions can still move markets, but their strategies often prioritize risk management and long-term returns, reducing sudden volatility spikes.

Potential Reduction in Retail-Driven Pump-and-Dump Cycles

Retail traders often drive short-term hype and sharp price swings through swift buying and selling. Institutional involvement can counteract these cycles because their trades are typically larger, more measured, and less reactive to social media-driven sentiment. By providing stability, institutions reduce the likelihood of extreme, short-lived price surges and crashes caused by speculative retail activity.

Impact on Correlation with Traditional Markets and Macroeconomic Events

As more institutional money enters digital assets, cryptocurrencies may increasingly reflect broader financial market trends. For example, large ETH or BTC holdings by investment funds can tie crypto performance more closely to equities, interest rates, and macroeconomic announcements.

RELATED:Bitcoin on Corporate Balance Sheets: What are the Risks and Rewards?

This doesn’t necessarily diminish crypto’s independent behavior, but it does create a new layer of sensitivity to global financial events, influencing how both retail and institutional crypto participants respond.

Institutional influence can stabilize crypto markets by enhancing liquidity, reducing speculative swings, and aligning crypto more closely with macroeconomic trends. While this may reduce some of crypto’s traditional volatility, it also introduces new dynamics that both retail and institutional investors must consider.

Implications for Retail Investors and Smaller Players

As institutions take a larger role in crypto markets, retail investors face both opportunities and challenges from increased liquidity, professional trading strategies, and a more mature market.

Opportunities

- •Access to regulated products: ETFs, custody services, and professionally managed funds give retail investors exposure to crypto with less risk of fraud or mismanagement.

- •Greater market stability: Institutional liquidity can reduce extreme price swings, making it easier to plan trades.

- •Improved transparency: Institutions require reporting, audits, and regulatory compliance, which helps make markets clearer for smaller investors.

- •More investment options: Products like crypto funds, structured notes, and staking services allow retail investors to diversify beyond simple spot trading.

- •Long-term growth potential: Institutional participation helps legitimize the market, which can boost mainstream adoption and asset value.

- •Access to research: Many institutions publish market analyses and insights that retail investors can use to make informed decisions.

Challenges

- •Higher competition: Large trades by institutions can move the market, making it harder for retail orders to execute at favorable prices.

- •Price sensitivity: Retail positions can be affected by institutional flows, causing rapid price changes.

- •Market concentration: Institutions often focus on major assets like BTC and ETH, leaving smaller coins less liquid and riskier.

- •Limited access to advanced tools: Algorithms, derivatives, and high-frequency trading are typically out of reach for most retail investors.

- •Reduced influence: Retail trading no longer drives rallies or corrections as institutional capital dominates.

- •Potential price manipulation: Coordinated moves by big players can distort prices, which can trap smaller investors without strong risk strategies.

Retail investors should track institutional activity, adjust strategies to broader market trends, diversify holdings, and use risk management tools. Staying aware of ETF flows, staking trends, and custody developments helps smaller investors navigate a market increasingly shaped by professional participants.

Will Institutions Dominate the Market Long-Term?

Institutions have already brought liquidity, stability, and regulated products to the crypto market, reducing extreme volatility and professionalizing trading. ETFs, custodial solutions, and large-scale investments show how institutional capital can shape market behavior.

Over the next 5–10 years, retail investors will still play a role, but major assets like Bitcoin and Ethereum are likely to be influenced more by institutions. The market will probably see a balance, with institutions providing stability and retail traders driving innovation and niche opportunities.