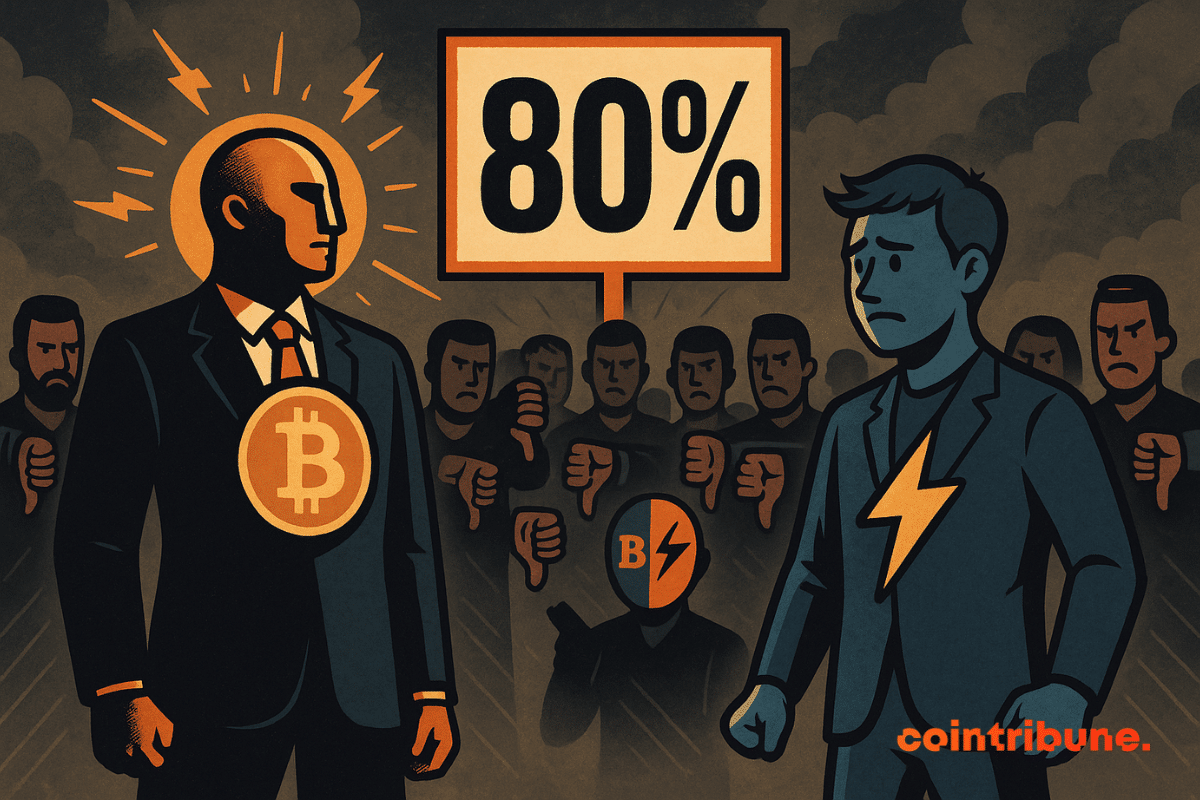

An online survey has ignited controversy, with a striking statistic revealing that over 80% of respondents believe the Lightning Network is not "real bitcoin." This significant figure highlights a clear divide between the technical promise of the network and its perception in the market. The debate has intensified on X (formerly Twitter), pitting proponents of the Lightning Network against its sharp critics. This article aims to summarize the arguments, decode the complexities, and project future implications.

In brief

- •A survey indicates that 80% of respondents do not consider the Lightning Network as real bitcoin.

- •The ongoing debate contrasts critics who cite complexity and liquidity dependence with defenders who emphasize real-world use and micropayments.

- •Current metrics show stagnation, while custodial products gain traction, underscoring the need for improved user experience and enhancements like splicing.

Shocking Survey Disrupts the Narrative

The survey's findings are stark: a large majority do not perceive the Lightning Network as an intrinsic part of bitcoin. This perception stems from a straightforward intuition: if users must transact on the main blockchain to enter and exit the network, Lightning appears as a separate environment, almost akin to a distinct token. This technical nuance, however, has not been enough to sway popular opinion.

In this climate, critics have amplified their points. Paul Sztorc describes it as a "cool system at first" that, over time, "does not work." He highlights specific constraints, including the necessity for nodes to be permanently connected, reliance on liquidity providers, and the need for watchtowers. According to Sztorc, the user experience quickly deteriorates towards custodial solutions, leading to a loss of trust.

On the opposing side, the response is unequivocal. Alex Gladstein defends the Lightning Network as a form of digital cash within the bitcoin ecosystem, operating without traditional banks.

Matt Corallo contributes a volume-based argument, suggesting that a significant double-digit percentage of BTC transactions are currently routed via Lightning. For proponents, the real-world utility is already established, and to deny these uses is to deny the reality of the network's adoption.

The Numbers Upset: Stagnation and Perceived Centralization

Examining the publicly available metrics reveals a concerning trend. The Lightning Network capacity hovers around a few thousand BTC, a level that has remained largely consistent since September 2022. This indicates a lack of substantial growth over the past three years, suggesting that traction has not materialized at the anticipated pace.

Another, more challenging indicator is the number of payment channels. This figure has nearly halved since 2022, decreasing from over 80,000 to approximately 45,000. Channel count is a crucial marker for network density, surface area, liquidity, and overall resilience. A decline in channels mechanically increases the perception of centralization, diminishing the credibility of claims that "everyone can route everything."

Despite these challenges, the Lightning Network retains a critical advantage: cost. Small payments routed off-chain can incur fees that are a fraction of a cent, a stark contrast to on-chain bitcoin fees, which can represent hundreds of basis points on small transactions. The technical advantage for micropayments persists, but the narrative advantage appears to be wavering.

Competition from Bitcoin ETFs and Revival Avenues

The broader market context does not aid the Lightning Network's perception. Volumes are surging in other areas, particularly through ETFs. In the third quarter, JPMorgan noted a renewed interest in spot bitcoin ETFs, while wrapped bitcoin (wBTC) and similar products continue to advance. Applications like Moonshot, Base, and Fomo offer user onboarding in just a few clicks, fast transactions, and a smooth user experience. The general public is highly sensitive to friction, and the bitcoin ecosystem suffers when steps appear overly technical.

This does not necessarily signal the end of the Lightning Network, but it necessitates an honest assessment. The network has not successfully navigated the post-2022 landscape as anticipated. It remains a powerful tool for specific use cases, such as low-value recurring payments, pay-per-use models, and targeted remittances. However, to achieve broader adoption, it requires a "default" experience that abstracts away the complexities of channels, liquidity management, penalties, and network connections. In terms of market context, bitcoin is trading around the $106,000 mark at the time of writing, a symbolic milestone that reflects a dynamic and evolving ecosystem.