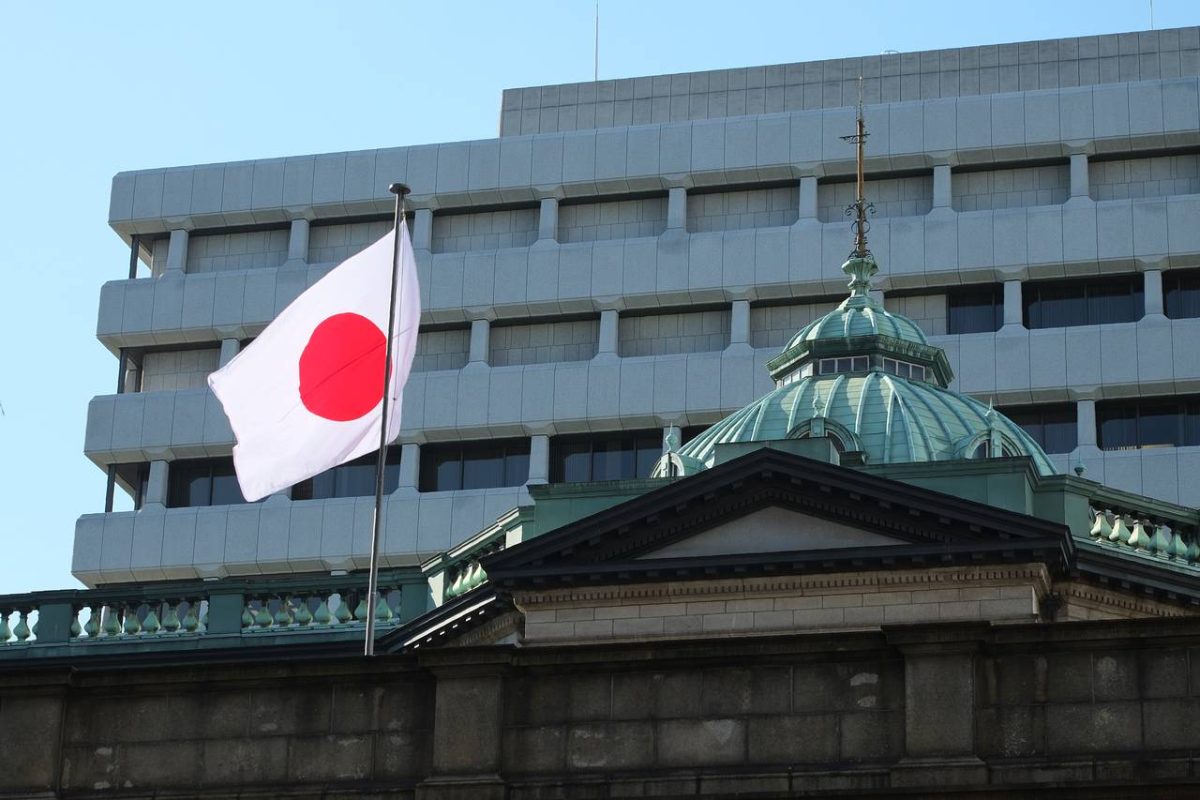

Japan is rolling out one of its most consequential crypto regulations in years, requiring exchanges to hold liability reserves or obtain insurance to guarantee customer reimbursement in the event of a hack.

The new mandate marks a major tightening of oversight and could reshape how digital asset platforms operate in the country.

A Direct Response to Security Risks

Under the rule, crypto exchanges must maintain dedicated reserves or insured coverage large enough to fully compensate users if digital assets are stolen or compromised. This ensures that the financial burden of an exploit falls on the exchange, not on customers.

🇯🇵 JUST IN: Japan will require crypto exchanges to hold liability reserves or insurance to guarantee customer compensation after hacks, a major regulatory shift that could reshape the industry. pic.twitter.com/bh8OzSZXgo

— Cointelegraph (@Cointelegraph) December 9, 2025

Japan has historically taken a strict regulatory approach toward digital assets, especially following the Mt. Gox collapse, which remains one of the largest exchange failures in crypto history. The updated requirement reflects regulators’ stance that consumer protection must remain at the center of the ecosystem.

What This Means for the Industry

For exchanges, the policy introduces new operational responsibilities. Liability reserves and insurance coverage will likely increase costs, but they also establish a higher standard of trust and accountability.

For customers, the change offers a clearer safety net. Instead of relying on voluntary reimbursement policies or uncertain recovery processes, compensation becomes legally protected.

A Move That Could Influence Global Standards

Japan’s approach often serves as a template for other jurisdictions evaluating crypto oversight. By making customer protection mandatory rather than optional, the country may set a precedent for more regulated markets to follow.

As the industry continues to evolve, this rule positions Japan at the forefront of consumer-focused crypto governance, raising expectations for exchanges while strengthening user confidence in the long run.