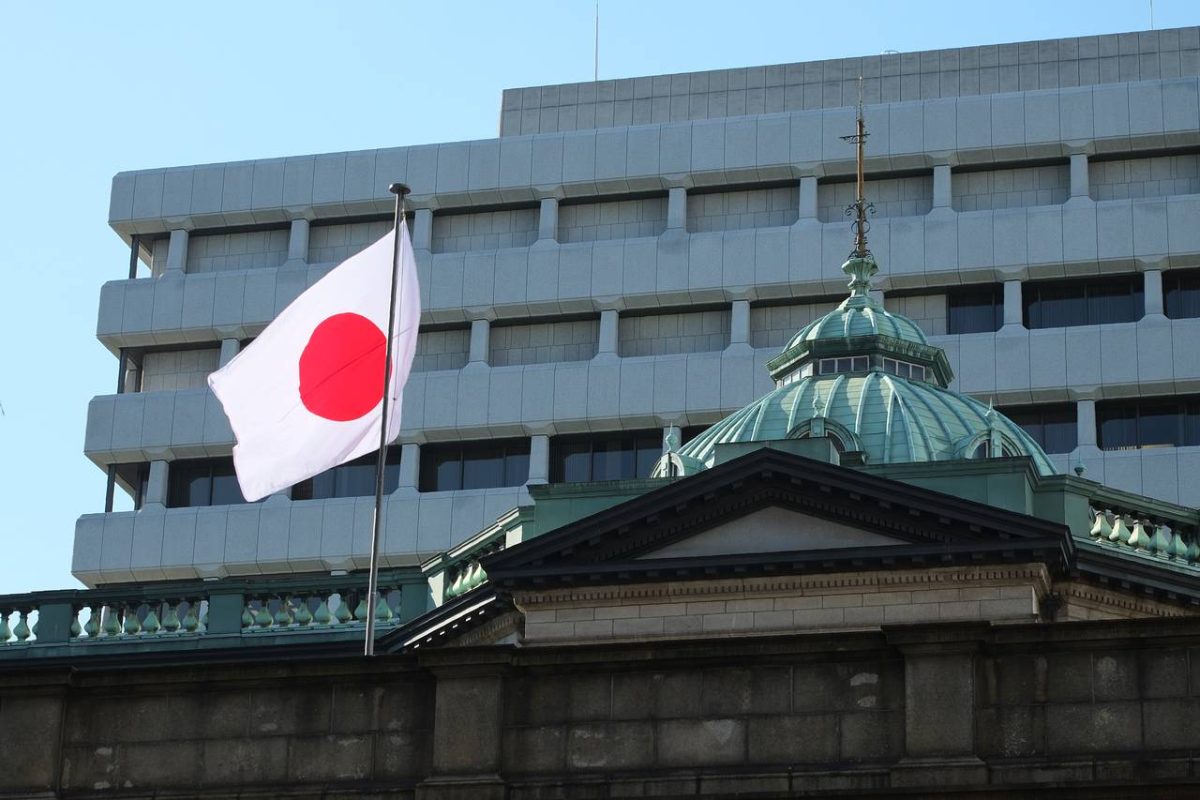

The Bank of Japan (BOJ) is drawing attention to the ongoing transformation in global payments infrastructure. Deputy Governor Ryozo Himino has stated that stablecoins may soon begin to "partially replace the role of bank deposits."

During his address at the 2025 GZERO Summit in Tokyo, Himino emphasized that with non-bank financial institutions now holding nearly half of global financial assets, regulators must update their oversight frameworks to align with these evolving dynamics. He specifically highlighted stablecoins as an area where regulation is currently lagging behind innovation.

Stablecoins offer advantages over legacy systems like SWIFT or ACH, including faster settlement times, lower fees, and the ability to conduct transactions around the clock. Himino noted that these characteristics position stablecoins to become integral components of payment ecosystems, thereby challenging traditional deposit-based banking models.

Japan's Embrace of Digital Currency Infrastructure

These remarks coincide with a significant push within Japan to adopt digital currency infrastructure. Major financial institutions such as Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group are reportedly collaborating to issue stablecoins pegged to the Japanese yen and the US dollar, utilizing a shared technical standard.

By indicating its readiness to embrace a future where tokenized money plays a central role, the BOJ is positioning Japan to be competitive in the rapidly expanding "stablecoin settlement" era. Furthermore, the central bank is urging global regulators to accelerate their efforts in adapting to these changes. As Himino stated, "we need to continue to modernise international prudential standards to keep up with the new and emerging realities."