JPMorgan Forecasts Dollar Index Drop to 91 by 2026

JPMorgan Chase anticipates a weakening U.S. dollar by mid-2026, largely due to expected Federal Reserve interest rate cuts. Analysts at the firm point to a convergence in U.S. economic conditions with those of other global markets and a reduced demand for safe-haven assets as key drivers for this projection. JPMorgan's experts forecast that the Dollar Index (DXY) will decline to a level of 91.00.

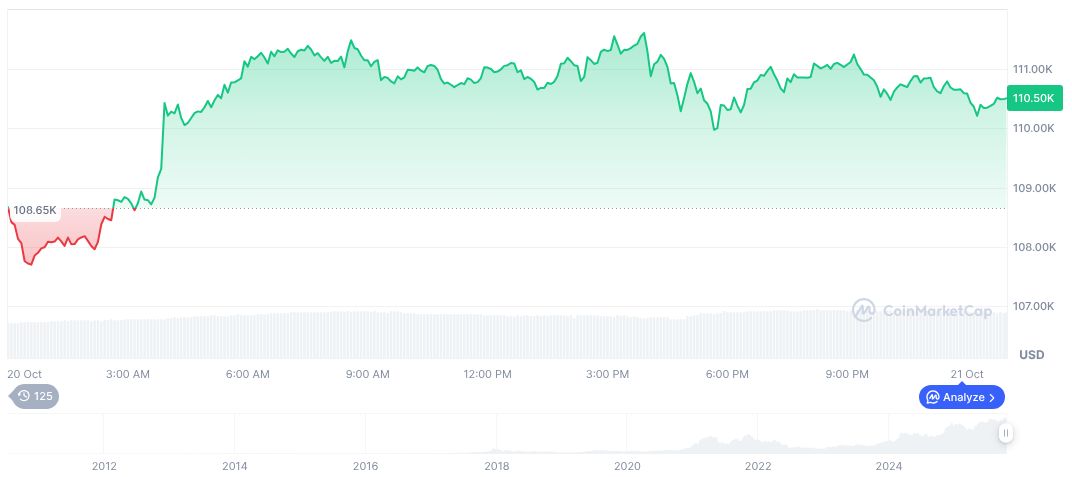

This projected decrease in the U.S. dollar's value could contribute to increased volatility across financial markets. JPMorgan's perspective aligns with a broader trend of predictions regarding the dollar's future performance. As the currency weakens, assets considered riskier, such as cryptocurrencies, may attract greater investor interest.

Financial analysts and market observers are closely monitoring the Federal Reserve for any indications of its future policy actions. While specific public statements from JPMorgan's leadership confirming the precise DXY target of 91.00 are not readily available, the sentiment for a weaker dollar is a recurring theme in market discussions.

Cryptocurrencies Expected to Benefit from a Weaker Dollar

Historical data suggests a positive correlation between periods of Federal Reserve rate reductions and significant growth in Bitcoin's value. For instance, during the Fed's rate-lowering cycle from 2017 to 2020, Bitcoin experienced substantial gains as investors shifted towards riskier assets, moving away from traditional safe havens like the U.S. dollar.

The Coincu research team's analysis indicates that a weakening U.S. dollar could stimulate capital inflows into the cryptocurrency market. Cryptocurrency markets have historically responded favorably to such macroeconomic conditions, suggesting potential growth opportunities for major digital assets like Bitcoin (BTC) and Ethereum (ETH) amidst anticipated shifts in regulatory and financial landscapes.

"We look for more USD weakness this year, predicated on the same combination of cyclical factors (including U.S. moderation and tariffs) and structural factors (such as valuations, fiscal, flow dynamics and policy uncertainty) that we have been discussing for several months now." — Meera Chandan, Co-head of Global FX Strategy, J.P. Morgan.