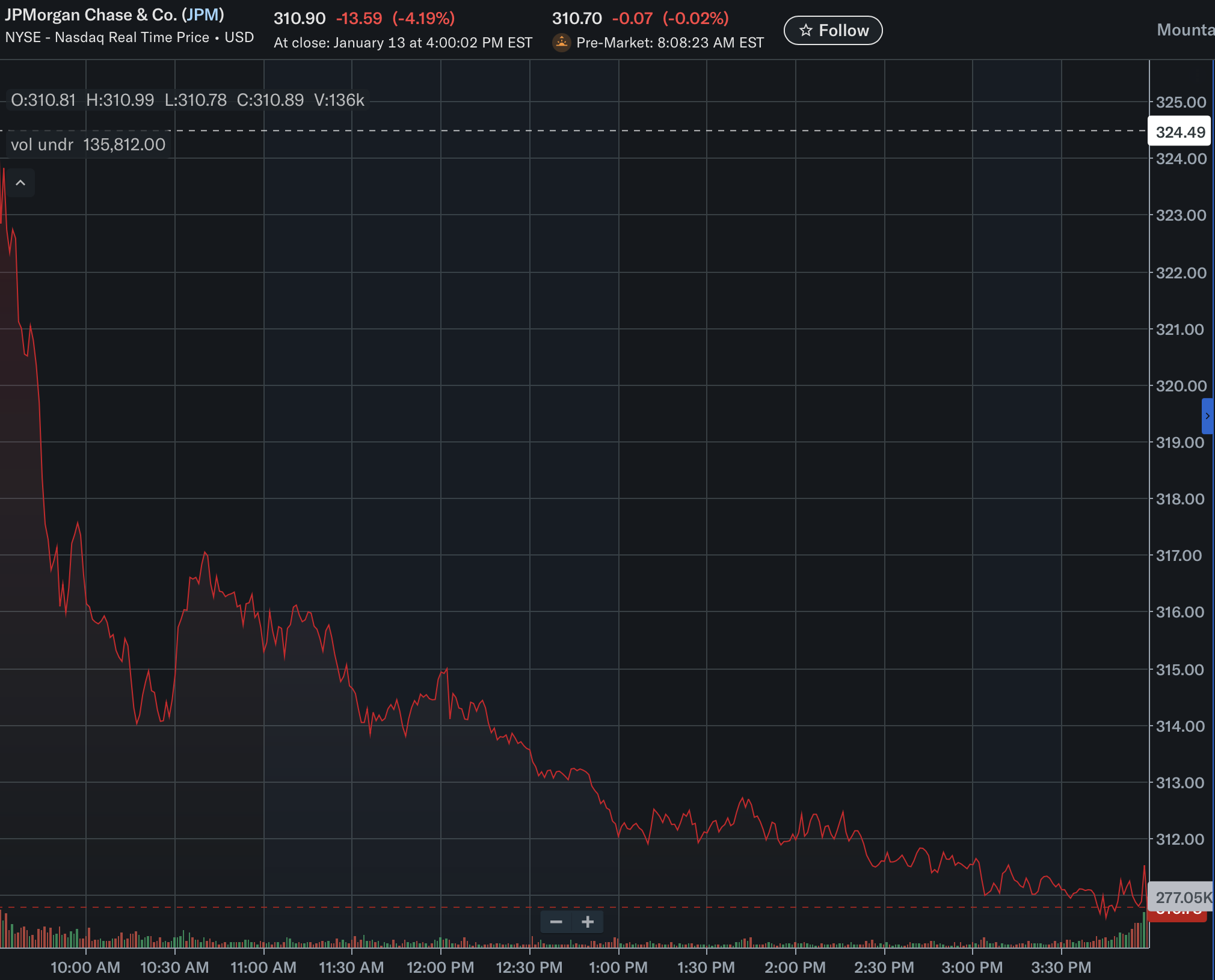

Shares of JPMorgan Chase & Co. fell roughly 4.2% on January 13, 2026, even after the bank reported adjusted fourth-quarter earnings that exceeded analyst expectations.

The sell-off reflected investor focus on weaker investment banking revenue, a sizable credit reserve tied to the Apple Card portfolio, and rising regulatory risks surrounding consumer lending.

The stock closed near $310.9, extending intraday losses as selling pressure persisted throughout the session.

Investment Banking Miss Overshadows Earnings Beat

While headline profit numbers came in strong, investors zeroed in on a shortfall in investment banking fees. JPMorgan reported $2.35 billion in investment banking revenue for Q4 2025, representing a 5% year-over-year decline and falling short of analyst estimates in the $2.5–$2.6 billion range.

The miss raised concerns that deal activity and underwriting momentum remain uneven heading into 2026, despite broader strength in other business lines.

$2.2 Billion Credit Reserve Weighs on Sentiment

Another major drag was the establishment of a $2.2 billion pretax credit reserve related to the upcoming Apple Card portfolio acquisition. The reserve reduced GAAP earnings per share by approximately $0.60, tempering enthusiasm around the earnings beat and reinforcing caution around consumer credit exposure.

Regulatory Risk Adds to Investor Anxiety

Shares were further pressured by comments from CEO Jamie Dimon and CFO Jeremy Barnum regarding a proposed 10% cap on credit card interest rates. Management warned that such a move could severely disrupt the credit card industry and restrict consumer lending, introducing a new layer of policy uncertainty for large banks.

Expenses and Valuation Concerns Surface

JPMorgan also formalized an adjusted expense outlook of $105 billion for 2026, reflecting continued heavy investment in technology and franchise expansion. While strategically important, the guidance struck some investors as aggressive, particularly after the stock’s strong performance in 2025.

Analysts noted that JPMorgan shares had climbed roughly 35% over the prior year, leaving little margin for disappointment and setting the stage for profit-taking on any perceived weakness.

Q4 2025 Financial Snapshot

- •Adjusted EPS: $5.23 (beat vs. $4.86 expected)

- •Managed Revenue: $46.8 billion (above expectations)

- •Net Income: $13.0 billion, down 7% year-over-year due to reserves

- •Net Interest Income: $25.1 billion, up 7% year-over-year

- •CET1 Ratio: 14.5%, down 30 basis points from Q3

Looking ahead, JPMorgan projected 2026 Net Interest Income of approximately $103 billion, slightly above consensus estimates. Despite that outlook, the stock remained under pressure into January 14 as investors continued to reassess regulatory risks and credit exposure.