Wall Street banking giant JPMorgan Chase abruptly closed bank accounts belonging to Strike CEO Jack Mallers in September, triggering déjà vu over the crypto debanking era.

“J.P. Morgan Chase threw me out of the bank,” Mallers said in a Nov. 23 post on X. “Every time I asked them why, they said the same thing: ‘We aren’t allowed to tell you.’”

He added that his dad “has been a private client there for 30+ years.”

JPMorgan Identifies "Concerning Activity"

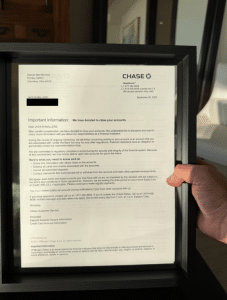

Mallers received a letter from the bank on Sept. 2 that stated, "during the course of ongoing monitoring we identified concerning activity on your account."

The letter further explained that under the Bank Secrecy Act and other regulations, the bank has an obligation to periodically review its customer relationships and is committed to "regulatory compliance and ensuring the security and integrity of the financial system."

Mallers stated that he has since framed the letter and is now banking with his own company, Strike, which is primarily a digital payments app that utilizes the Bitcoin Lightning Network for fast, low-cost transactions.

Crypto Industry 'Debanking' Unlikely Under Trump Administration

The banking industry has a history of restricting access to bank accounts for crypto firms, particularly in the United States.

During the Obama administration, the U.S. Department of Justice (DOJ) introduced an initiative called Operation Chokepoint, which discouraged banks from doing business with industries deemed high-risk.

More recently, during the Biden administration, the digital asset industry faced ongoing challenges with financial institutions, which were reportedly pressured by federal banking regulators to deny services to crypto companies and executives.

However, U.S. President Donald Trump has expressed a willingness to embrace crypto and is actively working on addressing the Operation Chokepoint initiatives from previous administrations.

Following Mallers’ post, Bo Hines, who previously headed Trump’s Council of Advisers on Digital Assets and now serves as a strategic advisor for Tether, questioned Chase, asking, "you guys know Operation Choke Point is over."

Hey @Chase… you guys know Operation Choke Point is over, right? Just checking. https://t.co/W6yVnoCbXk

— Bo Hines (@BoHines) November 24, 2025

In August, Trump signed an executive order titled “Guaranteeing Fair Banking For All Americans.”

This order aims to combat the practice of “politicized or unlawful debanking” and directs federal banking regulators to review banks’ past or current policies and practices that may have required, encouraged, or influenced “debanking.”

If any such policies are identified, remedial actions, including fines, consent decrees, or other disciplinary measures, can be taken against the involved institutions.

Trump and his family have publicly stated that they were “debanked” by financial institutions for political reasons. Eric Trump, one of the President’s sons, recounted that “some of the biggest banks in the world” canceled accounts for him and his family members at the end of Trump’s first term, which prompted them to embrace crypto.