Key Highlights

- •Solana’s DApps generated over $22 million in revenue last week, led by Pump.fun, Jupiter, and Axiom, demonstrating strong user engagement despite a slowdown in meme‑coin launchpad liquidity.

- •Meanwhile, SOL trades around $206, holding key support levels, with rising TVL and DEX activity signaling continued ecosystem growth and bullish potential.

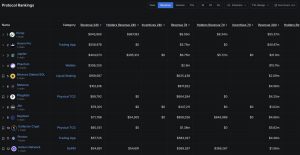

Revenue Breakdown

Solana’s decentralized application (DApp) ecosystem continues to demonstrate remarkable resilience, generating over $22 million in revenue last week despite a noticeable slowdown in meme‑coin launchpad liquidity.

According to DefiLlama data, Pump.fun led the pack with $9.65 million in revenue, marking its eighth consecutive week at the top. Emerging trading platform Axiom followed with $5.20 million, while Solana’s largest decentralized‑exchange aggregator, Jupiter, recorded $6.75 million.

Phantom wallet contributed $2.9 million, further cementing its role as a gateway for users into Solana’s DeFi ecosystem.

Other notable contributors included Raydium ($858,000), Meteora ($817,000), and Collector Crypt ($1.38 million), surpassing staking platforms such as Binance Staked SOL, which earned $625,000.

The collective performance highlights that, even amid a cooling meme‑coin market, Solana’s DApps continue to attract significant user activity and capital.

Growth in TVL and Trading Volume

The growth in protocol revenues coincides with broader gains in Solana’s decentralized finance sector. The network’s total value locked (TVL) has climbed above $12 billion for the first time since the 2021 bull run, reaching $12.18 billion on September 10.

Current TVL sits at $11.3 billion, up nearly 2 % in the past 24 hours, while daily trading volumes on Solana DEXs surged to $4.44 billion, well above the $2.77 billion baseline. User fees have remained robust, totaling $12.38 million in a single 24‑hour period across various protocols.

Meme‑Coin Launchpad Cooling

Despite these gains, the meme‑coin launchpad sector has cooled. Bonding‑curve volumes, a key liquidity indicator for meme‑focused platforms, fell below $1 billion last week for the first time in six months. Pump.fun still accounted for the majority of this liquidity with $669.2 million, while BonkFun followed with $95 million.

Smaller platforms, including Sugar, Moonshot, Launchlab, and Bags, contributed modestly, signaling a shift away from speculative activity toward more sustainable DeFi engagement.

SOL Price Outlook

Solana’s native token, SOL, trades at $206.78, up 4.2 % over the past 24 hours but down 7.1 % over the past week. Price action remains within a parallel ascending channel established since spring 2025, with support at $200 and resistance near $220 and $260.

Analysts note that a decisive break below $180 could lead to deeper losses, while a bounce from lower support zones could push SOL toward $260–$280 and even $300 in the months ahead.

Conclusion

Overall, Solana’s fundamentals remain strong. Rising TVL, record protocol revenues, and active DEX trading suggest that the blockchain is maintaining robust growth momentum, even as certain speculative segments cool. Platforms like Pump.fun, Jupiter, and Axiom are spearheading the ecosystem’s expansion, highlighting Solana’s continued relevance as a top‑performing blockchain in 2025.