November Sees Unprecedented Activity on Prediction Market Platforms

Kalshi and Polymarket have both set new monthly trading volume records in November, with their combined activity approaching $10 billion. This significant surge in trading reflects a growing user interest and engagement with their respective prediction market platforms.

The substantial growth observed in November signals a consolidation of leadership within the prediction market sector. This trend is attributed to increased user participation and the strategic expansion of these platforms within the United States, which in turn has intensified global competitive dynamics.

Impacts of CFTC Licenses on U.S. Market Growth

Kalshi, under the leadership of CEO Tarek Mansour, continues to prioritize transparency and regulatory compliance in its global operations. Concurrently, Polymarket, founded by Shayne Coplan, has experienced rapid expansion following its recent approval to operate within the U.S. market.

The combined trading volumes for Kalshi and Polymarket in November, nearing the $10 billion mark, underscore their significant presence in the market. The Commodity Futures Trading Commission (CFTC) has provided these exchanges with a more robust regulatory framework, enabling them to reach a wider audience and strengthen their operational foundation.

“We’re proud to see Kalshi’s trading volume continue to grow as more people discover the power of prediction markets. Our focus remains on building a regulated, transparent platform for event contracts.” — Tarek Mansour, CEO, Kalshi

Market Data and Insights

The regulatory approval granted by the CFTC has demonstrably influenced the growth trajectory of prediction markets within the United States.

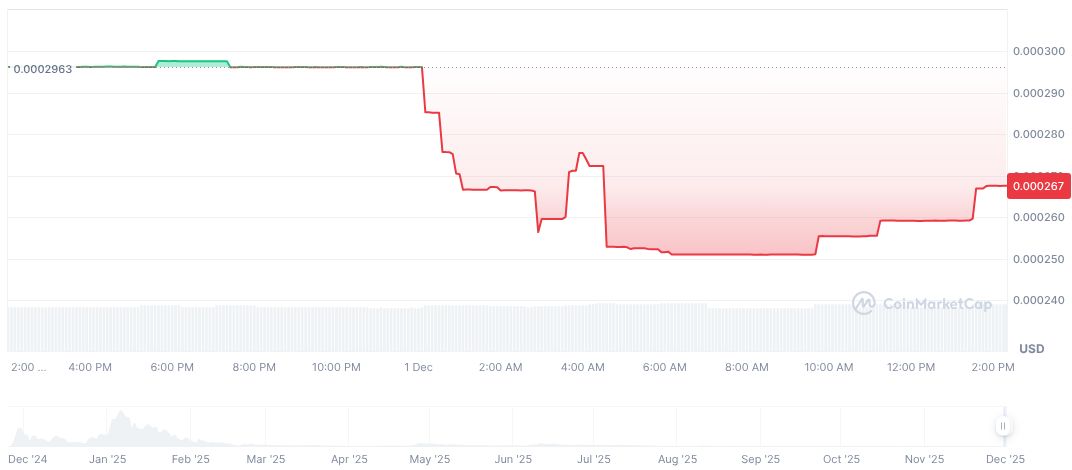

In recent market activity, Polytrader by Virtuals (POLY) has seen a 9.69% decrease in value over the past 24 hours, trading at approximately $0.00. Its fully diluted market capitalization stands at $267,036.75. Data regarding the circulating supply is not currently available, and the 24-hour trading volume was $87,974.76, indicating a slight daily decline.

These market reactions suggest a strengthening of the duopoly between Kalshi and Polymarket, coupled with increased engagement from U.S. users. This positioning indicates a positive outlook for future growth for both platforms.