Market Performance and Current Status

Kaspa (KAS) has emerged as one of the top-performing cryptocurrencies among the top 100 over the past week. It has demonstrated superior performance compared to many leading digital assets, including Ripple’s XRP, during this period. Multiple market observers suggest that KAS may continue to experience further price increases in the near future.

The token has seen a significant surge of 40% in the last seven days, with the majority of these gains occurring within the past 24 hours. Currently, KAS is trading at approximately $0.06, boasting a market capitalization of around $1.6 billion. This valuation positions KAS as the 72nd-largest cryptocurrency, outperforming popular altcoins such as Worldcoin (WLD), Algorand (ALGO), and Arbitrum (ARB).

Catalysts for the Recent Surge

The primary driver behind Kaspa's recent price increase appears to be the launch of its first decentralized bridge. The Dymension X account announced that KAS has been approved as a new base asset on their platform, a development that occurred just hours ago.

This upward movement has attracted the attention of numerous analysts who believe it could signal the beginning of a substantial rally. One X user, EuroSniper, has projected a potential price jump to $0.16 within the coming months. Crypto King has echoed a similar positive outlook, citing several factors that could support this bullish scenario, including the clearing of a multi-month downtrend and the sustained holding of the $0.05 zone as support.

Crypto Tony, a prominent X user with over 550,000 followers known for his analysis of various cryptocurrencies, also commented on the situation. The analyst expressed optimism for a further surge to $0.074, stating that their "longs need it."

Potential Bearish Factors

Despite Kaspa's recent positive momentum, its current price remains significantly below the peak levels it reached during the summer of 2024. At that time, the asset's valuation soared to $0.20, with its market capitalization approaching $5 billion.

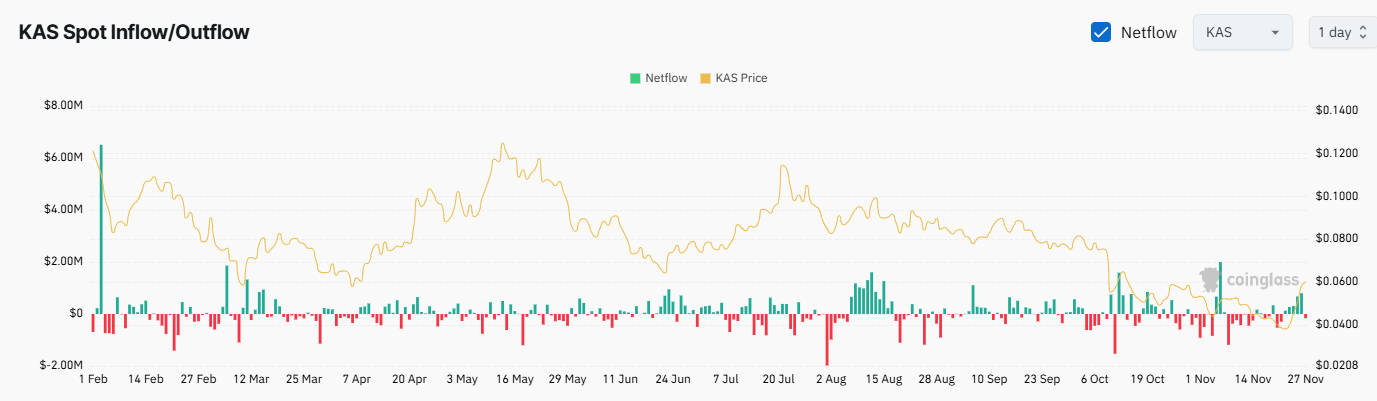

Certain technical indicators suggest that KAS may face challenges in reclaiming its former highs in the immediate future and could be subject to a pullback. One such indicator is the recent exchange netflow data.

According to data from CoinGlass, inflows have exceeded outflows over the past week. This trend indicates that investors may be moving their assets from self-custody solutions to centralized exchanges, a behavior that is often interpreted as a bearish signal, potentially preceding selling activity.