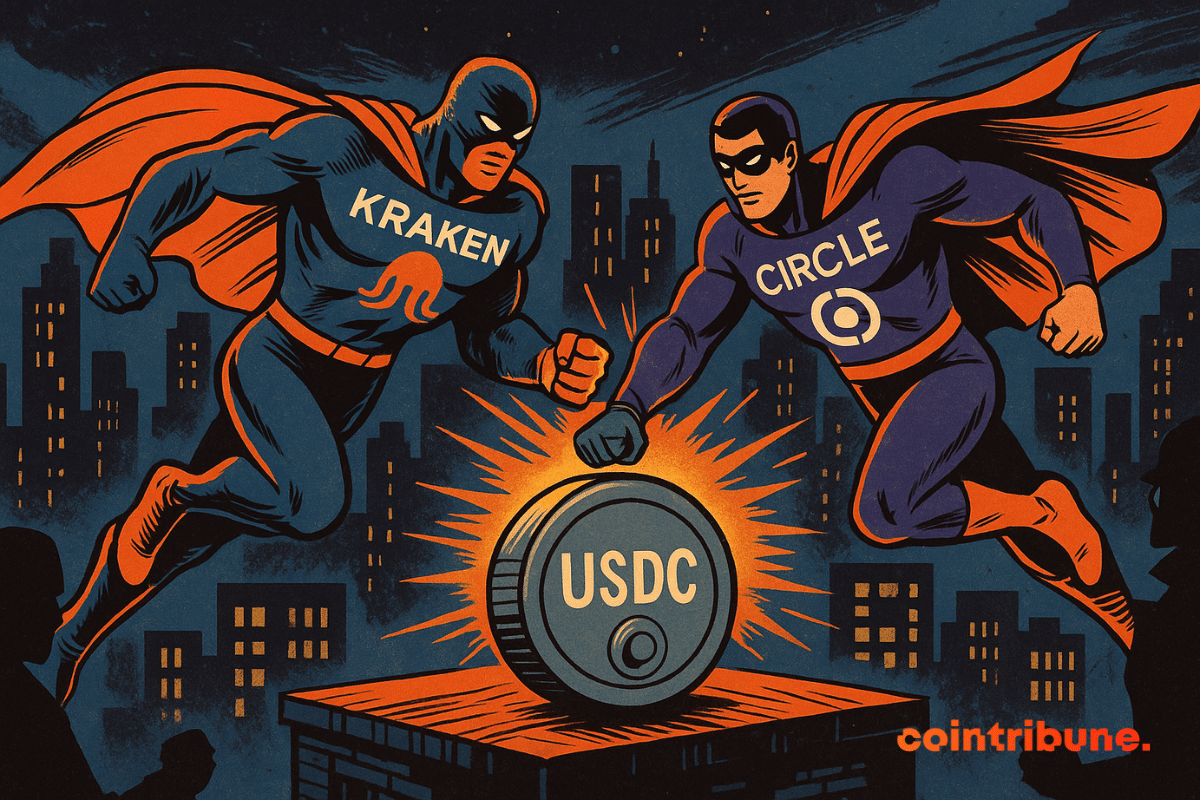

The cryptocurrency ecosystem has experienced a significant development with the announcement of a strategic partnership between Kraken, a globally recognized exchange platform, and Circle, a leading entity in stablecoins. This alliance, formalized in September 2024, is set to transform the user experience for USDC (USD Coin) and EURC (Euro Coin) stablecoins within the Kraken ecosystem.

Key Highlights of the Partnership

- •Kraken and Circle have established a significant agreement to bolster the integration of USDC and EURC stablecoins on the Kraken platform.

- •The partnership aims to increase stablecoin liquidity, reduce conversion fees, and introduce new opportunities through Kraken's applications.

- •Kraken, with over seven years of experience, and Circle, a stablecoin leader with a market capitalization of 31.2 billion euros, are prominent players in the market.

- •This collaboration facilitates lower conversion fees and an improved user experience on Kraken, encompassing DeFi applications and cross-border payment services.

The Scope of an Ambitious Partnership

Founded in 2011, Kraken serves over 15 million institutions, professional traders, and consumers, facilitating transactions across more than 500 digital assets, traditional assets, and six national currencies.

Collaboration with Defined Objectives

The partnership between Kraken and Circle primarily seeks to broaden access and enhance the utility of USDC and EURC stablecoins on the Kraken platform. This collaboration is structured around three core objectives:

- •Increased liquidity for Kraken customers.

- •Reduced conversion fees on USDC transactions.

- •New avenues for stablecoin deployment across Kraken's applications.

Mark Greenberg, Global Head of Consumer Business at Kraken, articulated the underlying philosophy of this partnership: “Expanding support for Circle products isn’t about checking boxes. It’s about integrating new opportunities to benefit from Circle-issued stablecoins in products our customers already use and trust.”

Introduction of EURC: A New Offering for Kraken

A notable innovation stemming from this partnership is the introduction of EURC onto the Kraken platform. This euro-pegged stablecoin, fully collateralized by Circle, presents new possibilities for European users and those interested in engaging with the European currency.

| Stablecoin | Reference Currency | Approximate Market Cap | Status on Kraken |

| USDC | US Dollar | ~$73.5 billion | Enhanced |

| EURC | Euro | ~€60 million | New introduction |

A Favorable Market Climate for Stablecoins

Kraken: A Long-Standing Participant in the Stablecoin Market

Kraken has a history of involvement in the stablecoin space, having offered stablecoins since 2017, and has observed consistent growth in demand. Official company data indicates an acceleration in its stablecoin market share over the past year, increasing from 43% to 68% of stable-fiat spot volumes in Q2 2024.

This performance can be attributed to several factors:

- •Improved global regulatory clarity.

- •Growing user confidence in the stablecoin category.

- •Increased utilization of the platform for trading and payments.

Circle: Established Market Leadership

Circle, with its market capitalization of €31.2 billion, has solidified its position as the leading entity in the stablecoin market. USDC, its primary product, is the second-largest US dollar-pegged stablecoin globally.

Circle has demonstrated remarkable recent performance:

- •A 62% stock growth over the preceding six months.

- •Q2 2025 quarterly results that surpassed expectations.

- •Revenue from subscriptions and services exceeding initial estimates.

Technical and Operational Implications of the Partnership

Integration Across the Kraken Ecosystem

This partnership extends beyond the mere addition of new tokens; it involves a comprehensive integration of Circle stablecoins throughout the entire Kraken ecosystem. This includes:

- •Advanced trading services offered via Kraken Pro.

- •Kraken Pay payment solutions.

- •Investment and yield farming products.

- •Institutional services tailored for professional clients.

This integrated approach enables Kraken's 15 million users—comprising institutions, professional traders, and consumers—to fully leverage the advantages offered by Circle stablecoins.

Fee Reduction: A Significant Competitive Advantage

A direct benefit of this collaboration is the reduction in conversion fees for USDC users. This cost optimization provides a substantial competitive edge in a market where fees can often act as a deterrent to adoption.

Strategic Analysis and Market Ramifications

Enhanced Competitive Stance

This partnership emerges within a landscape of intensifying competition in the stablecoin market. Recent developments, such as Hyperliquid's announcement of its own USDH stablecoin, have raised concerns among analysts regarding USDC's market dominance.

The Kraken-Circle alliance strategically addresses this competitive pressure by:

- •Reinforcing the USDC ecosystem through deeper integration.

- •Diversifying offerings with EURC to target European markets.

- •Improving the user experience by reducing associated fees.

Prospects for Evolution and Future Opportunities

DeFi Applications and On-Chain Finance

The partnership aligns with a broader objective of advancing on-chain finance. Kash Razzaghi, Chief Commercial Officer at Circle, highlighted this ambition: “Expanding access to Circle products across Kraken’s established ecosystem can help extend the benefits of stablecoins to their millions of users.”

Potential future developments may include:

- •Integration with major decentralized finance (DeFi) protocols.

- •Optimized solutions for yield farming.

- •Derivative products based on stablecoins.

- •Enhanced cross-border payment services.

Geographic and Regulatory Expansion

The introduction of EURC signifies a deliberate strategy for geographic expansion. This multi-currency approach allows Kraken to better serve its international user base while adhering to diverse local regulatory frameworks.