Introducing the Krak Card: Seamless Crypto and Fiat Spending

Kraken, a prominent cryptocurrency exchange, has officially launched its new debit product, the Krak Card, in the United Kingdom and the European Economic Area (EEA). This innovative card allows holders to seamlessly spend using over 400 fiat and digital assets across numerous denominations.

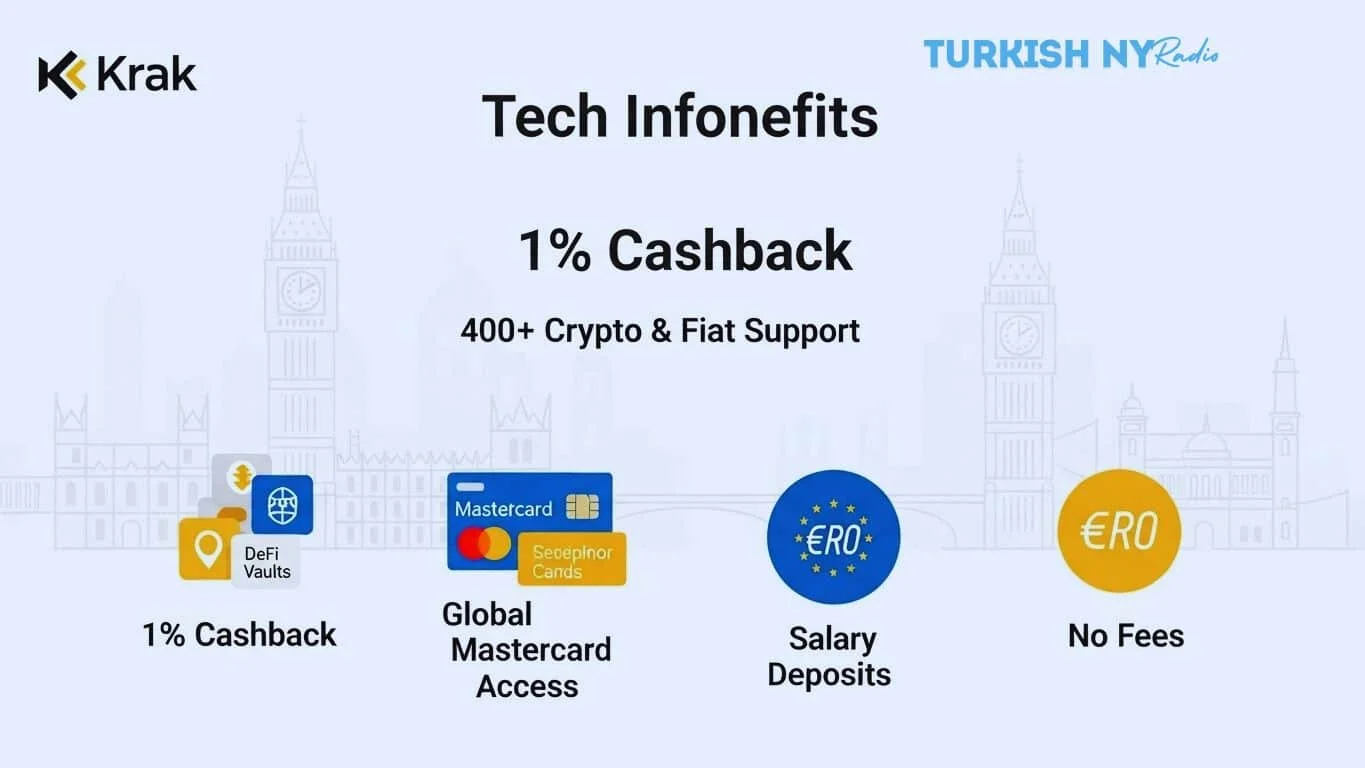

Operating on Mastercard's network, the Krak Card facilitates immediate multi-asset conversion at the point of sale. It boasts no monthly fees, no foreign-exchange surcharges, and offers 1% cashback, which can be received in either local fiat currency or Bitcoin.

The Krak Card enables users to mix funds from traditional cash balances and any chosen cryptocurrency for a single purchase. For instance, a €120 transaction could be split, with €60 deducted from a fiat balance and the remaining €60 from a cryptocurrency like Bitcoin or Ethereum. Kraken's integrated app handles these real-time asset conversions automatically at checkout.

Users also have the flexibility to manage how their balances are utilized for payments, with the option to exclude certain assets from being used. This dynamic spending mechanism transforms what was previously a manual conversion process into an automated experience.

In addition to physical cards, Krak provides virtual card options for mobile wallets, enhancing convenience for both in-store and online purchases.

Key Benefits: No Fees, Generous Cashback, and Global Acceptance

Every transaction made with the Krak Card earns users 1% cashback, redeemable in either fiat currency or Bitcoin. The card is designed with user-friendly economics, featuring no transaction fees, no monthly maintenance fees, and no foreign exchange surcharges for international spending.

The Krak Card is accepted universally wherever Mastercard is present, granting access to over 110 million merchants worldwide. It also supports ATM withdrawals in more than 190 countries.

Cardholders can further enhance their cashback rewards through a boosted rate, currently reaching up to 4%, on travel purchases made via Kraken's Concierge service.

Regulatory Compliance: Operating Under MiCAR and FCA Oversight

The rollout of the Krak Card is underpinned by strong regulatory compliance. Kraken has secured a MiCAR license from the Central Bank of Ireland, empowering it to offer crypto-asset services across all 30 member nations of the EEA.

Kraken has maintained a presence in the UK since 2013, continuing its operations through its FCA-registered business.

Card issuance is managed by licensed electronic-money institutions: Monavate in the UK and a corresponding entity in Lithuania for all EEA users. This ensures operations are conducted in accordance with local e-money regulations.

Beyond a Card: A Comprehensive Financial Hub

The Krak Card is a key component of Kraken's broader strategy to evolve into a full-service financial platform. The accompanying Krak app allows users to send money internationally to over 160 countries, offering a modern alternative to traditional wire transfers.

Expanding its offerings beyond spending and sending, Kraken has introduced "Vaults." These features, integrated with DeFi protocols, are designed to offer competitive Annual Percentage Yields (APYs) of up to 10% on user balances.

The platform is also set to launch salary deposit support for UK and EU customers soon, aiming to provide a holistic solution for earning, managing, and spending funds from a single account.

Revolutionizing Everyday Finance with the Krak Card

The Krak Card aims to bridge the gap between traditional banking products and crypto-based financial solutions. It seeks to consolidate key spending functionalities, including multi-asset wallets, fee-free spending, global payment flexibility, and regulatory adherence, into a single offering.

The 1% cashback reward and the potential for multi-asset investment exits make the card particularly appealing to users with diversified portfolios in both fiat and digital assets.

For individuals seeking a unified financial account to earn, spend, and save, the Krak Card presents a compelling proposition.

With its extensive global reach via Mastercard, regulatory backing from MiCAR and FCA jurisdiction, and integration with DeFi-based yield opportunities, Kraken is positioning the Krak Card as a strong contender against traditional banks and neobanks.

If widely adopted across Europe and beyond, the Krak Card could emerge as a significant next-generation banking solution, facilitating a world where crypto and fiat coexist seamlessly, thereby enhancing financial freedom for a broader audience.

Summary

Kraken has launched its Krak Card in the UK and Europe, enabling users to spend in real-time from over 400 crypto and fiat assets. The card offers a user-friendly experience with no monthly or foreign exchange fees.

Key features include 1% cashback in fiat or Bitcoin and worldwide acceptance through the Mastercard network.

The Krak Card operates under MiCAR and FCA regulations, integrating with the Krak app for flexible payments and advance salary deposits. It also provides access to yield-generating DeFi Vaults.

Glossary of Key Terms

MiCAR (Markets in Crypto-Assets Regulation): The European Union's regulatory framework for crypto-asset services, promoting consumer protection, transparency, and licensed operations throughout the EEA.

FCA Registration: Authorization from the UK's Financial Conduct Authority, allowing Kraken to offer specific regulated financial services and uphold standards of compliance, security, and performance.

Cashback in Bitcoin: A rewards program where a percentage of each Krak Card purchase is returned to the user as Bitcoin or fiat currency, enhancing purchasing power and potential wealth growth.

Vaults (DeFi Yield): Upcoming features for the Krak app that will connect user assets to Decentralized Finance (DeFi) protocols, enabling interest earnings based on risk levels and asset types.

Proof-of-Reserves: A cryptographic auditing technique employed by Kraken to verifiably demonstrate the exchange's reserves without relying on account balances.

EMI (Electronic Money Institution): A licensed financial service provider that issues e-money, manages insured client funds, and offers payment services within its card ecosystem, ensuring the protection of fiat balances.

FAQs About Krak Card

What is the Krak Card?

For users in the UK and EU, the Krak Card is a Mastercard-linked debit card that provides access to global spending capabilities using over 400 crypto and fiat assets in real time.

Are there any monthly or forex fees on the Krak Card?

The Krak Card does not have any monthly fees or foreign exchange fees. It offers 1% cashback in Bitcoin or fiat on every purchase, both online and in-store, globally.

How secure are the Krak Card and app?

The Krak Card operates under strict MiCAR and FCA guidelines, ensuring safeguarded funds, secure transactions, KYC/AML compliance, and proof-of-reserves reporting for customer balance protection across all regions.

What’s next in store for Krak Card users?

Upcoming features include DeFi Vaulting with yield compounding options, salary contributions, and expanded support for assets, cashback, and merchant rewards across the European market.