Lido’s token (LDO) climbed 7% to $1.30 on Thursday, extending a 20% rally over the past week. The surge comes after asset manager VanEck formally registered a Lido Staked Ethereum (stETH) exchange‑traded fund (ETF) in Delaware.

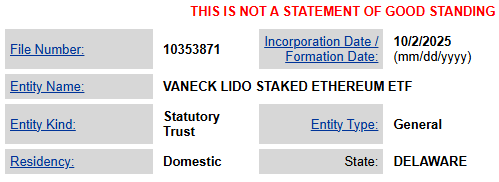

The October 2 filing signals VanEck’s intent to expand beyond spot Bitcoin and Ethereum ETFs into yield‑generating products. While registration does not guarantee approval, it has sparked renewed optimism for liquid staking.

According to CoinMarketCap data, Lido’s 24‑hour trading volume rose nearly 29% to $168.5 million and the derivatives volume increased by 45% to $426.9 million. The open interest rose by 6.6% to $222.60 million, which indicates that traders are opening positions in the hope of further gains.

The proposed ETF would enable investors to invest in Lido staked Ethereum and earn an estimated 4% annual reward without operating validators or asset locking. Lido is already the leading provider of ETH staking at more than 24%.

Buybacks and growth plans support LDO

Recently, Lido DAO passed a buyback program with treasury assets such as stETH and stablecoins, which may decrease the supply in circulation and promote the value of tokens. Its long‑term perspective is also reinforced by integrations with Layer‑2 networks and decentralization of the validators.

Analysts at CoinCodex project LDO could reach $1.34–$1.75 this month, potentially rising to $2–$3 by year‑end. However, regulatory delays or competition from rival protocols remain risks.

The ETF filing by VanEck brings out the increasing popularity of staking‑based products, which makes Lido the focal point of the liquid staking discussion, and investors consider both opportunity and risk.