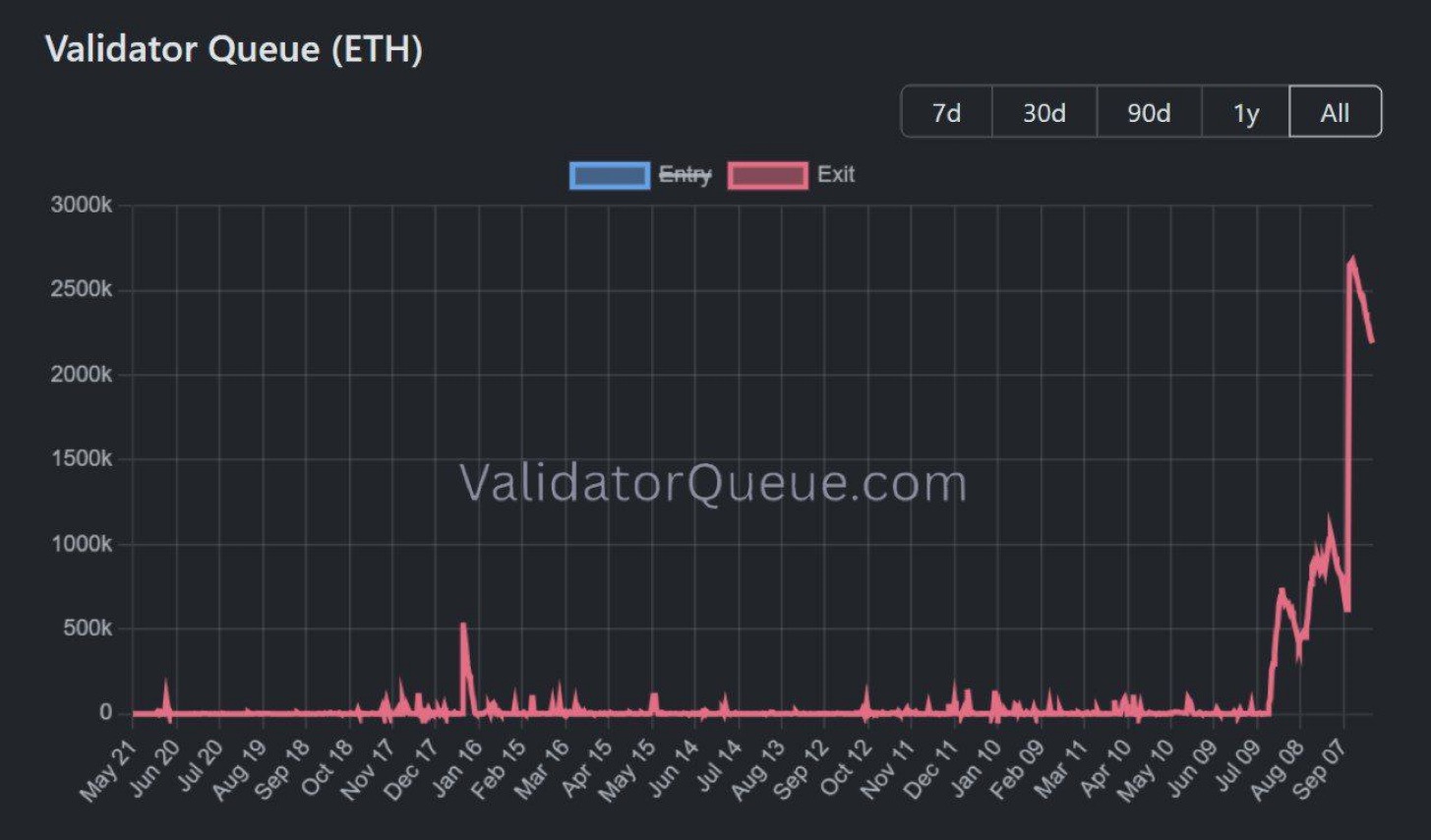

- •A scheduled $8.89 billion Ethereum unstaking event threatens to increase market selling pressure significantly.

- •Liquidation data shows a massive cluster of short positions, creating strong downward price pressure.

A scheduled release of 2.16 million Ethereum, worth $8.89 billion, from staking contracts may increase selling pressure. This unstaking process returns previously locked tokens to liquid circulation.

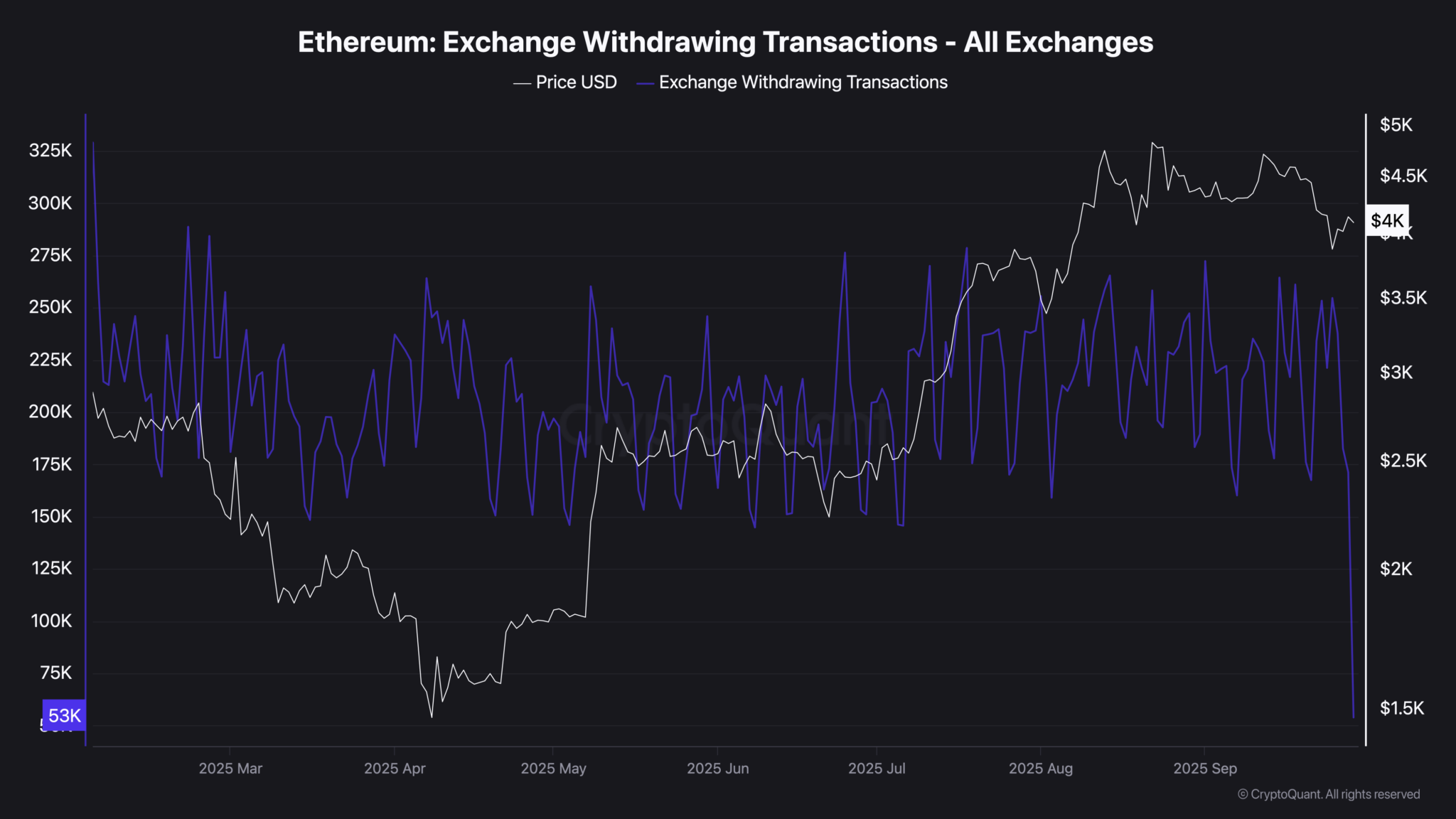

Ethereum’s price currently tests the $4,000 level. Investor activity on exchanges has diminished. Data shows only 37,000 withdrawal transactions occurred recently, marking the lowest count in six years.

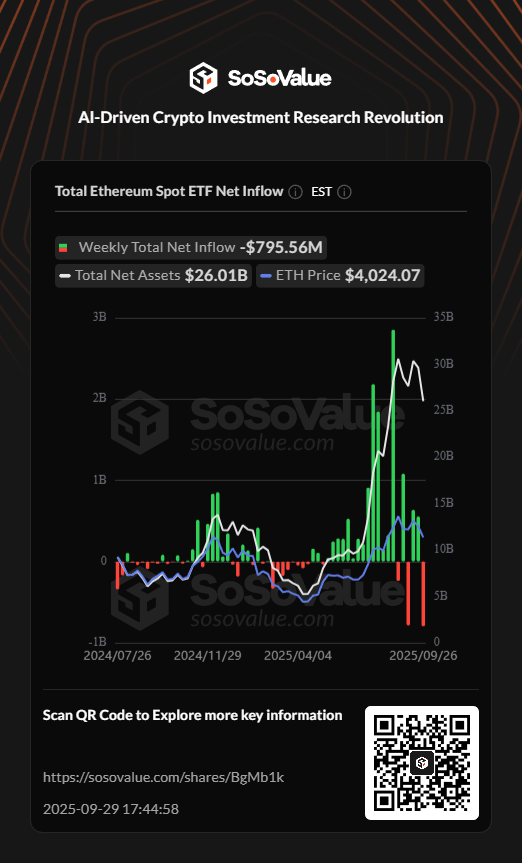

This low activity level often corresponds with cautious sentiment. Meanwhile, institutional funds moved $795.41 million out of Ethereum positions in the week ending September 22.

The full unstaking operation will not happen immediately. These tokens face an average waiting period of 37 days before they become freely tradable. This buffer separates the unlocking event from its potential market impact. However, the sheer number of tokens destined for release points to a possible supply overhang.

Liquidation data reveals heavily leveraged trades. Long positions have $49.5 million in liquidity concentrated at the $4,147 price. Short positions show a much larger cluster of $618.96 million at $3,906.

This substantial imbalance creates stronger gravitational pull toward lower prices. Consequently, Ethereum’s ability to maintain its $4,000 support depends on a shift in buyer sentiment to counter the building pressure.

Ethereum (ETH) is trading at $4,222, gaining +1.88% in the last 24 hours. The token has fallen 5% this week and 3.17% this month, but remains up 121% in six months and 57.7% year‑over‑year. Its market capitalization stands at $509.7 billion, with a 24‑hour trading volume of $41.08 billion.

Ethereum is currently testing resistance at $4,200 after bouncing from the $3,800–$3,900 support zone. Analysts are pointing to possible long‑term targets as high as $5,900 and even $21,000, although near‑term volatility remains a factor.

On September 26, spot Ethereum ETFs in the U.S. recorded $248 million in outflows, mostly from BlackRock’s ETHA fund, bringing total outflows for the week to $409 million. These ETF moves have contributed to short‑term selling pressure, despite broader institutional demand.