Lista DAO Vault Faces Forced Liquidation

The Lista DAO vault, managed by MEV Capital and Re7 Labs, experienced a forced liquidation on November 6, 2025, after its fund utilization rate reached 99%. This event underscores the potential for instability within Decentralized Finance (DeFi) protocols, particularly when utilization rates approach or exceed 90% across various platforms.

High borrowing rates, coupled with a lack of repayments, motivated the liquidation action. This situation directly impacted stablecoins such as $USDX and $sUSDX. In response, Re7 Labs proposed emergency governance measures through Discord to manage the affected assets.

Immediate implications of this event include the implementation of measures to control borrowing rates, such as setting allocation caps to zero and updating interest rate models. The broader DeFi ecosystem may experience indirect impacts due to this exposure, necessitating increased vigilance from users across platforms that are experiencing high utilization rates.

Market participants, including teams like PancakeSwap, have been actively monitoring the situation and advising users to reassess their positions in relation to the affected vaults. Lista DAO has initiated governance votes designed to prevent further destabilization, emphasizing the importance of community involvement in finding resolutions.

Historical Precedents and Regulatory Concerns in DeFi

Did you know? The forced liquidation of Stables Labs' USDX stablecoin is reminiscent of past crises, such as the Stream Finance incident involving $93 million in collateral. These historical events highlight the persistent risks present in DeFi, especially during periods of volatile utilization.

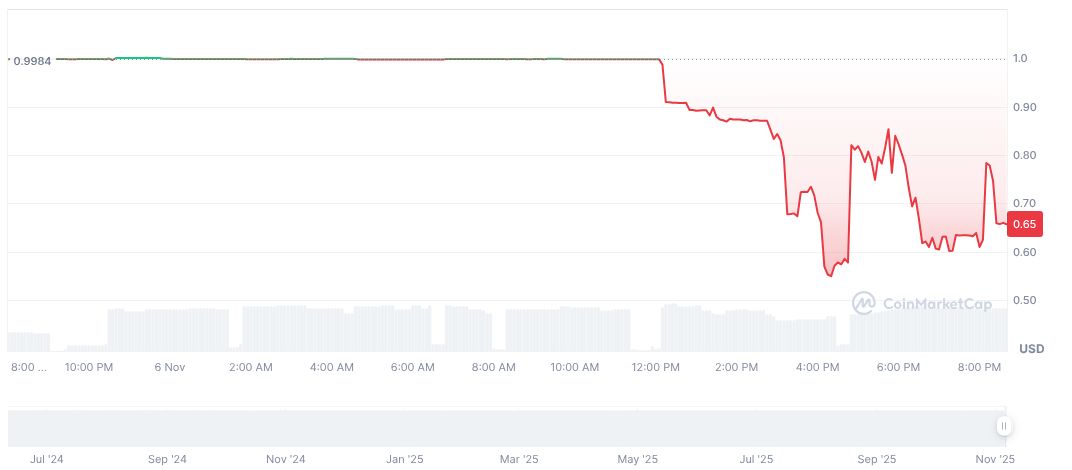

Data from CoinMarketCap indicates that the price of Stables Labs' USDX plummeted to $0.66, representing a 34.22% decrease within a 24-hour period. Despite a fully diluted market cap of $118.82 million, the circulating supply remains at zero. In the same timeframe, trading volume saw a significant spike of 124.51%.

Research from the Coincu team suggests that repeated collapses in stablecoin-backed protocols could lead to increased regulatory scrutiny. Future stability in DeFi may depend on technological advancements and improved risk management strategies. The recurring nature of these liquidation events, viewed in the context of historical trends, emphasizes the critical need for robust governance frameworks.